With the immortal phrases of W. Edwards Deming echoing in our ears, ‘In God we belief; all others should carry knowledge,’ we current right here sure statistical measures that will help you perceive the risk-return evaluation of shares.

Arithmetic Imply

Following every firm’s earnings launch, analysts are likely to revise their estimates, incorporating the most recent efficiency ratios and ahead steering. ‘Consensus estimates’, a time period that bl.portfolio readers would have come throughout in our analyses, is solely the arithmetic imply (generally known as the common) of all of the estimates.

Consensus estimates symbolize a collective forecast of an organization’s earnings, aggregating the insights from all fairness analysts masking that firm. Consequently, when an organization’s outcomes align with or surpass these consensus figures, they are usually interpreted positively by the market. Conversely, falling wanting these estimates can elicit a adverse market response. Although it may be calculated manually, it’s often referred from a monetary database corresponding to Bloomberg, which computes by taking a easy common of dealer estimates up to date within the final 12 months.

Usually, the arithmetic imply can be utilized each in elementary and technical evaluation of shares. It gives a snapshot of the central tendency of a set of values, say, valuation metrics corresponding to inventory PE. For example, one would usually anticipate a inventory’s PE to typically revert towards its historic common over time, as per the imply reversion principle.

Limitations: Nonetheless, train prudence when decoding such averages. Whereas the arithmetic imply serves its goal, it has inherent limitations. Firstly, it treats all knowledge factors equally, disregarding potential outliers or skewed observations. For example, remoted situations of huge worth spikes can disproportionately affect the common return, distorting the general notion.

Secondly, whereas historic efficiency affords priceless insights, it’s not the only real indicator of future returns. Exterior market dynamics and intrinsic firm fundamentals wield vital affect over future trajectories. Alternate options embody the geometric imply, which is commonly used for funding returns because it accounts for compounding results higher than the arithmetic imply. Let’s say your inventory worth doubled (100 per cent returns) within the first 12 months however misplaced 50 per cent within the second 12 months. The arithmetic imply of the returns over the 2 years provides you with 25 per cent. In distinction, the geometric imply of the returns (also referred to as the CAGR) will simply be zero!

Commonplace Deviation

Typically, you’ll have heard market commentary that the shares buying and selling above 2 sigma ranges are doubtlessly overvalued. However what precisely is that sigma? It’s a Greek image representing commonplace deviation (SD) which is an important software to evaluate the volatility and relative stability of a inventory’s worth actions. It quantifies the extent to which a inventory’s worth tends to deviate from its common closing worth. A excessive SD implies heightened volatility, characterised by frequent fluctuations in inventory worth, whereas a low SD indicators extra steady worth behaviour.

By combining the ideas of imply and SD, one can set up thresholds past which deviations from the common are deemed vital. Usually, these thresholds are calculated as imply plus (or minus) one SD and imply plus (or minus) two SD.

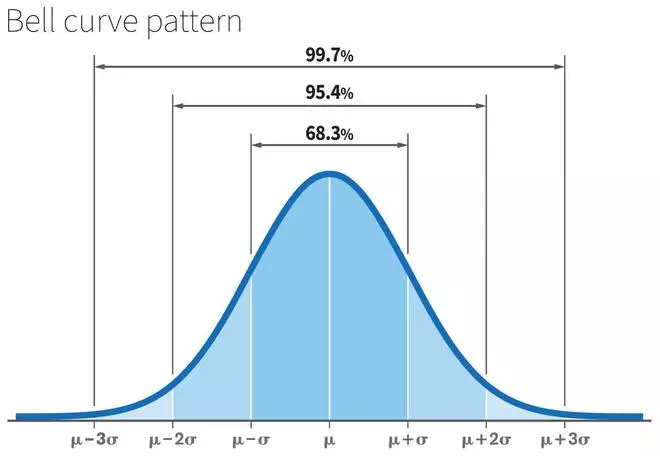

Over an extended interval, it’s assumed that the distribution of any knowledge, corresponding to inventory PE, tends to method a traditional distribution, in line with a statistical idea referred to as the Central Restrict Theorem. Merely put, the inventory PE knowledge will carefully resemble a bell curve sample. For example, in the event you have been to gather the heights of a big random pattern of grownup males or females from a given inhabitants and plot them on a graph, you’ll doubtless observe a bell-shaped curve, with nearly all of people clustered across the imply top, and progressively fewer people of very tall or very brief heights as you progress away from the imply in the direction of the extremes.

As soon as that is settled, the three-sigma rule (additionally referred to as 68-95-99.7 rule) then states that 68 per cent of the information will fall throughout the first SD from the imply, 95 per cent will fall inside two SD, and 99.7 per cent will fall inside SD.

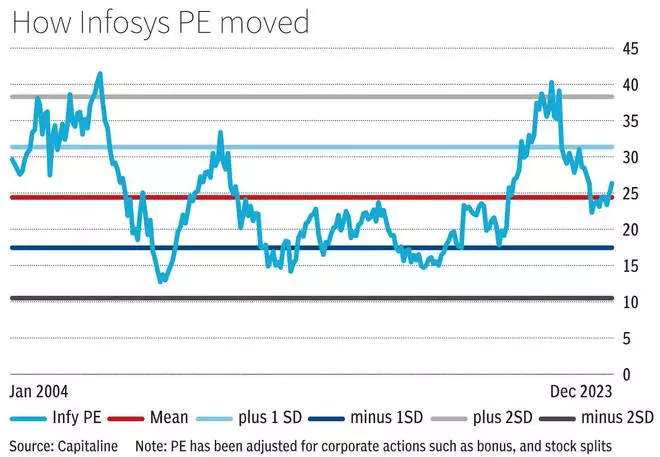

Let’s break it down with an instance. Contemplate Infosys’ Value-to-earnings (PE) ratio over the previous 20 years. By calculating the imply and SD of this metric and plotting it alongside the edge bands, we get fascinating insights. Notably, situations the place Infosys’ PE ratio exceeded the imply plus 2SD, corresponding to in 2006-end and March 2022 as seen within the chart, hinted at potential overvaluation relative to historic norms. Going by the three-sigma rule, we are able to say that there’s a 95 per cent chance that the inventory PE will revert under the imply plus 2SD band. Certainly, as evidenced within the case of Infosys, corrections within the inventory’s PE ratio have traditionally materialised following breaches of the imply plus 2SD threshold (see chart).

The inventory provided a shopping for alternative at any time when it breached the imply minus 1SD band — in October 2008 and April 2020. Between 2012 and 2020, the inventory PE was hovering across the imply and imply minus 1SD band, implying a consolidation part.

Limitations: Nonetheless, whereas the imply plus 2SD threshold band serves as a priceless benchmark to evaluate inventory valuation, it’s crucial to think about a myriad different components — corresponding to the corporate’s progress trajectory, the standard of its earnings, business dynamics, macroeconomic variables, and broader market sentiment. Additionally, a excessive P/E ratio alone doesn’t essentially signify overvaluation. As a substitute, it is best to consider whether or not a premium within the inventory’s valuation aligns with the corporate’s future progress prospects and intrinsic worth.

Beta

Although SD helps you perceive the dispersion of a inventory’s returns round its imply return, it lacks a comparative facet in opposition to the broader market, which is the place the beta metric is available in. Beta permits traders to evaluate the systematic threat inherent in a inventory. A beta worth higher than 1 means that the inventory tends to be extra unstable than the market, implying bigger worth fluctuations. Conversely, a beta under 1 signifies decrease volatility in comparison with the market/benchmark.

Usually, shares with larger betas current potential for amplified returns, albeit with heightened threat. Therefore, if in case you have the next threat urge for food, then you definately may take into account such excessive beta shares, anticipating higher returns, whereas these preferring conservative investments might go for decrease beta shares.

Take the case of Quick-Transferring Shopper Items (FMCG) and Shopper discretionary industries corresponding to vehicles. Hindustan Unilever (HUL), a outstanding participant within the FMCG sector, sometimes displays a low beta of 0.51 (contemplating a 20-year weekly interval). This low beta will be attributed to the important nature of its merchandise which fall underneath the patron non-discretionary class. Conversely, firms within the shopper discretionary sector, corresponding to Tata Motors, usually boast larger betas owing to their sensitivity to financial cycles, shopper sentiment shifts, and commodity worth fluctuations. Tata Motors holds the next beta of 1.35 — evidenced by its 52-week highs and lows of 977.2 and 401.7, respectively.

Furthermore, even throughout the similar business phase, shares can exhibit various beta values. Take Maruti Suzuki and Tata Motors, each working within the vehicle sector. Maruti Suzuki has a beta of 0.9, whereas Tata Motors’s beta is larger than one. These discrepancies can stem from variations in enterprise fashions, market positions, capital buildings, and plenty of different components. Whereas beta will be manually computed, it’s available in varied monetary databases corresponding to Bloomberg (paid) and Refinitiv (paid), inventory market evaluation web sites corresponding to Ticker Tape (paid), and some brokerage corporations, together with 5paisa (free).

Limitations: Whereas beta can provide you an thought of how a inventory strikes relative to the market, it’s not an ideal measure as a result of it’s based mostly on previous knowledge which can not mirror future efficiency precisely and doesn’t take into account all of the components affecting a inventory’s efficiency.

Alpha

In 2023, amidst a buoyant international market backdrop, the Indian bellwether indices exhibited sturdy efficiency, surpassing lots of their international counterparts. Regardless of the general constructive returns witnessed throughout varied shares, one ought to perceive that mere uncooked returns don’t present a complete image contemplating threat.

As a substitute, the idea of alpha affords an analysis of efficiency which considers the surplus return you may get from a inventory past the market returns. However this doesn’t take into account the chance taken to acquire the upper returns and whether or not the returns are commensurate to the chance. Right here, alpha computed utilizing the Capital Asset Pricing Mannequin (CAPM) gives a way to evaluate a inventory’s risk-adjusted returns. This mannequin helps us predict how a lot return an funding may give us based mostly on various factors — such because the risk-free fee (returns from authorities bonds) and the market threat premium (the additional return you get from investing in shares in comparison with safer choices). By utilizing CAPM, we are able to estimate how a lot return we’d get from an funding by multiplying its beta (how unstable it’s in comparison with the general market) by the market threat premium and including the risk-free fee.

For example, in 2023, the India 10-year authorities bond yielded a mean of seven.21 per cent, representing the risk-free fee, whereas the Nifty 50 index yielded returns of 20 per cent, signifying market returns. Using CAPM, the anticipated returns for Infosys, with a beta of 0.66 (contemplating a 20-year weekly interval), have been projected at 15.7 per cent. Conversely, Infosys delivered a meagre return of two.3 per cent throughout the identical interval, leading to a adverse alpha of 13.4 per cent.

Limitations: Whereas inventory alpha gives insights right into a inventory’s efficiency relative to its threat degree and the broader market, it has limitations as a consequence of its reliance on mannequin assumptions, sensitivity to knowledge high quality, short-term focus, susceptibility to market situations, and restricted scope of research.

Correlation

Correlation performs a significant position in varied facets of day-to-day life, influencing decision-making, and understanding patterns in several phenomena. In monetary markets, it may be exemplified by way of the evaluation of inventory costs, the place evaluation of correlations between property can add worth to funding methods and portfolio diversification efforts.

Visually, by way of scatter diagrams, one can see whether or not the costs of two shares transfer in tandem or exhibit contrasting actions. When costs transfer concurrently, we establish a constructive correlation; conversely, if one inventory’s worth ascends whereas the opposite’s declines, a adverse correlation is indicated. We infer no correlation between the shares if the sample is simply random.

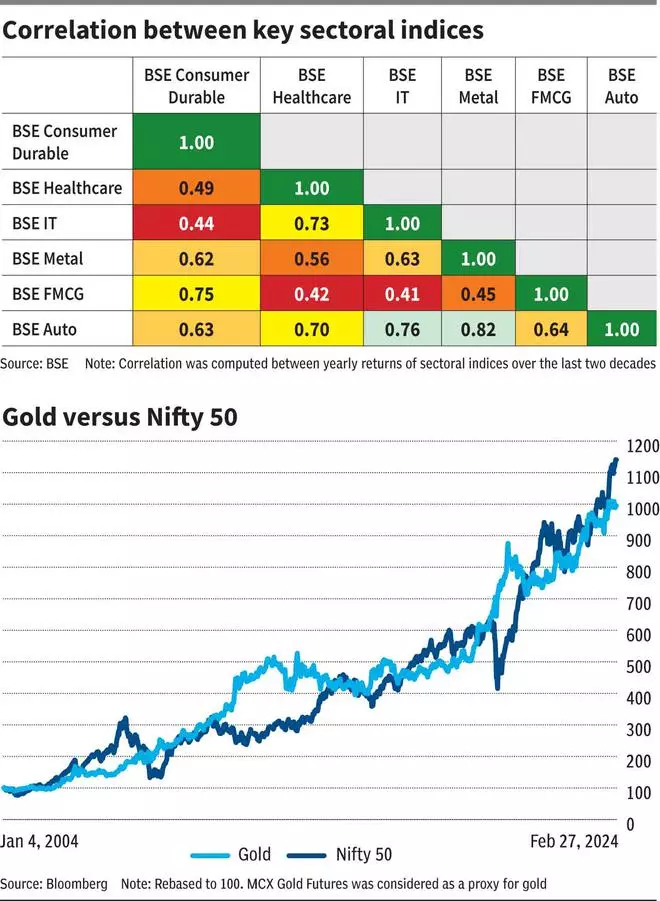

Mathematically, quantifying this correlation entails the calculation of a correlation coefficient, a measure bounded between -1 and +1 that encapsulates the extent of co-movement between the returns of two shares. For example, amongst varied BSE sectoral index returns over a two-decade interval, the correlation coefficient between the IT and FMCG sectors emerged because the lowest.

The IT sector is commonly thought of cyclical, experiencing intervals of speedy progress adopted by downturns or consolidation phases, influenced by components corresponding to, say, the digital growth or the worldwide slowdown. FMCG firms, being suppliers of important shopper items, are much less cyclical and are thought of defensive investments, with comparatively steady demand even throughout financial downturns. An investor could make use of this chance for sector rotation to capitalise on altering market tendencies or diversify his/her holdings to minimise the general threat of the inventory portfolio.

Past particular person shares, correlation additionally lets you assemble diversified portfolios by assessing the connection between completely different asset lessons. If we have a look at the MCX gold future costs and Nifty 50 over the previous 20 years, we discover that their costs have been inverted between 2011-14 and 2020-22 with the correlation coefficient between their weekly returns being -0.03. Asset lessons with low or adverse correlations have a tendency to maneuver independently of one another, offering higher threat mitigation when mixed in a portfolio. Diversification helps cut back general portfolio volatility and enhances risk-adjusted returns.

Limitations: Whereas correlation can provide us insights into how shares transfer collectively, it doesn’t suggest causation. In a well-known instance, researchers discovered a surprisingly excessive correlation between butter manufacturing in Bangladesh and the actions of the S&P 500 index. Regardless of there being no logical connection between Bangladesh butter and US inventory market efficiency, the correlation appeared sturdy over a sure interval. This was purely coincidental and didn’t point out any causal relationship.

#Statistical #Instruments #Inventory #Market #Investing