Triveni Engineering and Industries has been the perfect performer with as much as 47 per cent beneficial properties until date, whereas others resembling Balrampur Chini Mills, EID Parry and Bannari Amman noticed their inventory worth rise by 6-20 per cent since July 2022. The broader market, nonetheless, measured by the Nifty 50 efficiency, has been on a brand new excessive, raking in beneficial properties of over 40 per cent. Relative underperformance of the sector to the broad market has been because of a mixture of world sugar situation and hostile coverage strikes.

Falling manufacturing

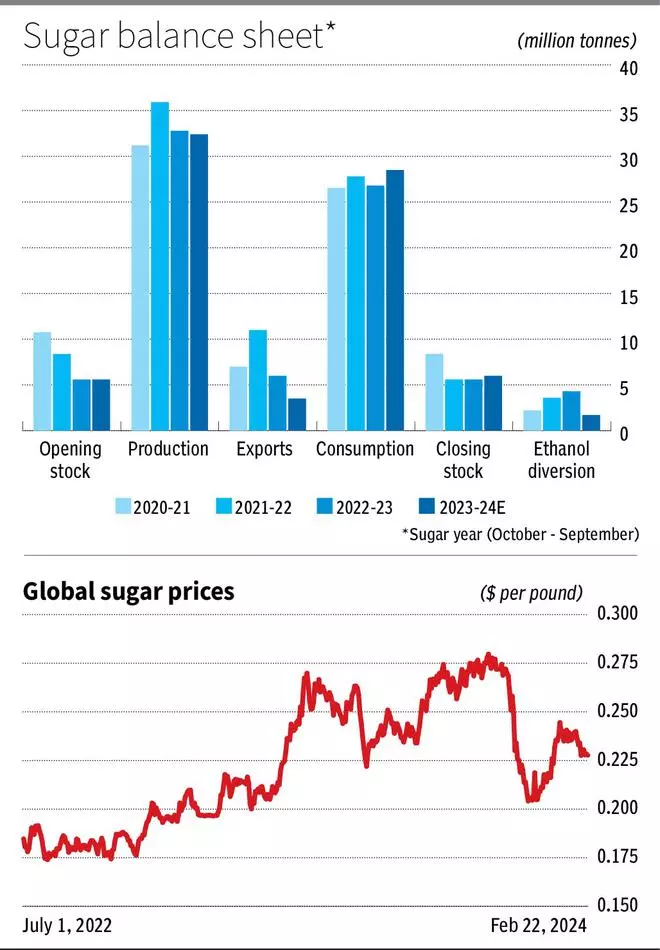

Within the sugar yr 2021-22 (October-September), India produced a file 39.4 million tonnes of sugar, overtaking Brazil (32 million tonnes) to change into the world’s largest sugar producer. Robust demand from international market, coupled with decrease output from Brazil, helped India set a brand new file in exports as nicely. India exported 10.9 million tonnes that yr, which was over 57 per cent larger than in 2020-21. File manufacturing alongside agency sugar costs globally helped Indian sugar makers’ inventory efficiency in FY23. About 3.6 million tonnes of sugar was diverted for ethanol manufacturing.

Whereas international sugar costs continued to rule excessive in 2023, earlier than moderating in direction of the fag finish of 2023, India’s cane and sugar manufacturing was marginally decrease within the following sugar yr 2022-23 at 36.62 million tonnes. The discount was on account of insufficient monsoon rainfall. Therefore, to be able to guarantee availability of sugar for home consumption, the Authorities needed to limit the overall exports to six.1 million tonnes. With sturdy international costs, Indian corporations needed to accept decrease exports because of the precautionary measure by the federal government. Sugar diverted for ethanol stood at 3.1 million tonnes in sugar season 2022-23.

Within the present sugar season (October 2023–September 2024), sugar manufacturing is predicted to say no additional to about 33 million tonnes, a couple of 9 per cent fall in comparison with the earlier yr. That is totally on account of lower-than-expected rainfall in the principle cane-growing states Maharashtra and Karnataka, because of which cane manufacturing took a beating. Whereas larger manufacturing in Uttar Pradesh — the opposite key cane rising state — might partially compensate for this, Maharashtra is a vital marketplace for uncooked sugar, which is primarily exported.

Brakes on ethanol diversion

Maharashtra accounts for nearly half of the nation’s exports. Decrease manufacturing in Maharashtra, as additionally authorities’s issues over availability for native consumption, led to an unprecedented coverage transfer in early December 2023 — the banning of sugar diversion for ethanol, and in addition use of B-heavy molasses and cane juice for manufacturing of ethanol. Expectation of decrease sugar manufacturing and rising demand led the federal government to play it cautiously, on condition that sugar is a vital commodity and it could have a snowballing impact on the meals and beverage business.

Nonetheless, the federal government quickly reversed its ban on diversion of cane juice and B-heavy molasses however has capped the diversion of general sugar for ethanol at 1.7 million tonnes for now. That is half of the overall sugar that was obtainable for ethanol in sugar yr 2022-23. Trade sources anticipate the federal government to evaluation the scenario over the subsequent few months and accordingly modify the present cap.

However is the knee-jerk response to fall in estimated manufacturing warranted, regardless of the opening inventory being comfy at 5.6 million tonnes and consumption estimated at 28.5 million tonnes? Whereas on the face of it , the transfer by the federal government to use brakes on ethanol diversion could appear pointless, it is crucial on condition that the margins in ethanol are way more secure and enticing as in comparison with sugar.

With a purpose to deter the business from profiteering from the ethanol alternative at the price of sugar availability, and be certain that the worth equilibrium for sugar is maintained, the federal government presumably intervened nicely forward of time.

Influence on sugar corporations

What would be the affect of the above transfer on sugar producers? Nicely, clearly the impact might be unfavourable because the margins on distillery phase are considerably larger for sugar makers and therefore with the sugar obtainable for ethanol manufacturing being minimize by greater than half, this can translate into income and revenue minimize for sugar and ethanol producers.

For example, Triveni Engineering’s distillery phase margins have been upwards of 20 per cent even in years when the sugar phase reported losses. Although it’s potential that the cane value (uncooked materials) is captured totally within the sugar phase and therefore the distillery margins are larger, curbs on sugar availability for ethanol will, nonetheless, have an effect on distillery phase and, therefore, general profitability.

Additionally, from an end-product worth perspective, the realisation on ethanol is way larger than sugar. Whereas minimal assist worth is fastened at ₹31 a kg, ethanol from C-heavy molasses fetches ₹49.41 a litre, whereas C-heavy molasses and sugar juice-based ethanol might be procured by oil advertising and marketing corporations at ₹60.73 and ₹65.61 a litre respectively.

Nonetheless, corporations that function twin feed crops, resembling Balrampur Chini and Triveni, have the flexibleness to modify between feedstocks relying on availability. However even for these distilleries, the problem stays with respect to availability and pricing of alternate feed resembling corn, rice and different feedstocks. For example, maize MSP went up from ₹19 to ₹25 a kg final quarter, whereas the identical has not been totally priced into the end-product worth, resulting in decrease margins.

That stated, the significance of sugarcane-based ethanol can’t be undermined as molasses-based ethanol accounts for nearly two-thirds of the nation’s whole ethanol capability, whereas the remainder comes from grain-based distilleries.

As of November 2023, the ethanol manufacturing capability within the nation stood at 1,380 crore litres of which about 875 crore litres is molasses-based whereas the stability 505 crore litres is grain-based. The full capability requirement by 2025, to attain 20 per cent mixing, is estimated at 1,700 crore litres. The incremental 400 crore litres of capability, in keeping with ISMA (Indian Sugar Mills Affiliation), will entail funding of ₹17,500 crore.

Main gamers resembling Balrampur Chini Mills and Triveni Engineering and Industries have been in enlargement mode over the past two years. Within the final quarter of this fiscal yr, Triveni is commissioning a distillery in Rani Nangal (Uttar Pradesh) with a capability of 225 KLPD. Nonetheless, the corporate has placed on maintain its distillation capability enlargement at its Sabitgarh (Uttar Pradesh) unit from 660 KLPD (kilo litres per day) to 1,100 KLPD. That is largely because of the present regulatory panorama and challenges in availability of grains/feedstock at viable worth factors. Nonetheless, the corporate has all the mandatory approvals and in addition the general design and distributors finalised to a big extent. With a extra secure atmosphere, Triveni will be capable of full the enlargement in a couple of yr’s time.

Authorities’s initiatives resembling PLI scheme for brand new investments, curiosity subvention scheme — the place the federal government supplies subsidy of 6 per cent or half the price of financial institution curiosity whichever is decrease — have helped generate funding curiosity. Nonetheless, long-term viability is vital to make sure that capability for 20 per cent mixing goal is made obtainable by 2026. Investments up to now in new distillery capability, in keeping with the federal government, stand at ₹40,000 crore. Any knee-jerk transfer resembling banning juice and B-heavy molasses for ethanol, and a cap on the sugar diversion for ethanol, could also be unfavourable for the Trade.

Outlook

With Brazil gearing up for larger manufacturing in sugar season 2023-24, international costs will seemingly proceed to average as incremental sugar provides begin coming into the market. Provided that globally the provision scenario is predicted to ease additional, timing exports (by capitalising on larger international costs) from India might be vital to make sure that Indian corporations profit from the wholesome market costs.

That stated, whereas it is very important guarantee ample inventory availability for home consumption, business members we spoke to, really feel that India will shut this sugar yr with about 6 million tonnes of stock and are hoping for a beneficial coverage directive over the subsequent few months, as readability emerges over manufacturing and consumption for the present season.

For Indian sugar producers, FY24 and first half of FY25 might stay a muted yr, ought to the present cap on ethanol diversion proceed. Nonetheless, we consider that within the medium time period, the ethanol mixing programme will stay a vital device to comprise subsidy invoice on crude oil imports. Incentivising sugar molasses and grain-based gamers to put money into capability would be the solely medium-term answer to handle this. Whereas we consider that directionally the coverage and authorities initiatives are aligned with that of the business, short-term adjustments and/or tightening could also be inevitable to be able to hold inflation below examine.

Sugar shares: What’s in retailer?

Whereas 2023/24 has been a stellar yr for the fairness market broadly, sugar shares have delivered 6-46 per cent returns over the past 18 months, and have been underperformers on a relative foundation, barring Triveni Engineering, which gained about 46 per cent.

On the income and revenue entrance too, the expansion has remained subdued. Uncooked materials worth improve within the sugar enterprise has put stress on the margins. Pattern this — Triveni’s sugar phase margin declined from 11 per cent in FY22 to 7 per cent in FY23. Equally, on the distillery entrance too, working revenue margin declined from 14 per cent to 11 per cent. This was on account of decrease restoration on cane, larger cane prices and better value of grains/different feedstock. Uncooked materials value as a proportion of income rose from 67 per cent in FY22 to 73 per cent in FY23.

Equally, for Balrampur Chini additionally, the general working margin declined from 15 per cent in FY22 to 11 per cent in FY23. Uncooked materials as a proportion of income rose to 73 per cent versus 71 per cent in FY22.

Curiously, corporations which have a better skew in direction of cogeneration energy, resembling Bannari Amman Sugars, have fared nicely in FY23. From 11 per cent in FY22, working margins have expanded to 12 per cent in FY23. Robust demand for energy and enticing pricing helped the 40 per cent leap in working revenue. We consider that the facility phase will proceed to develop at a wholesome tempo and sugar producers, whereas making the most of the ethanol alternative, are additionally trying past sugar and ethanol.

Balrampur Chini Mills has introduced foray into bio plastics with an funding of ₹2,000 crore over the subsequent few years, for establishing a inexperienced subject manufacturing plant near its present services, in UP. These merchandise have potential to interchange the single-use plastic market, which is at present being phased out in India.

Whereas the federal government is predicted to work out a beneficial technique for ethanol within the medium time period, corporations are additionally de-risking their enterprise by specializing in different value-added merchandise — which might go a great distance in lending stability and sustainability to their current enterprise fashions.

#Shortterm #Bitterness #Sugar #Hindu #BusinessLine