Traders in these shares additionally made neat beneficial properties. Pattern this: the US-based power main Exxon Mobil noticed its income and web revenue (Revenue) develop by 49 per cent and 191 per cent within the September 2022 quarter, on a year-on-year foundation. The corporate’s inventory has additionally gained an excellent 80 per cent for the reason that begin of 2022.

Whereas power producers and exporters world over have raked in massive beneficial properties from spiralling power prices (oil and gasoline), in India the story has been fairly completely different. At the same time as Indian refiners and oil drilling firms have, prior to now, benefitted considerably from greater international crude oil costs, they may not capitalise on the buoyant international crude oil costs this time round. Secondly, energy-deficient international locations equivalent to India, that are closely reliant on different international locations for power sources, needed to face the brunt of excessive oil costs.

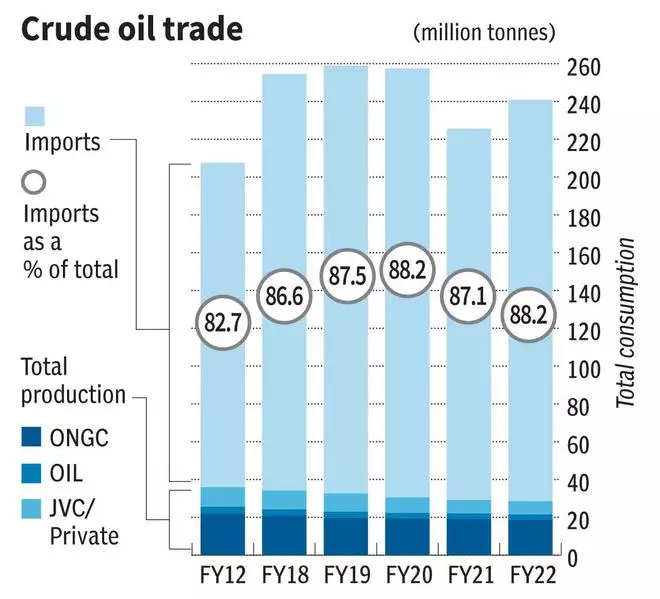

In India, crude oil imports have solely been on an rising pattern. In FY12, India’s crude imports stood at 171.7 million tonnes and home manufacturing was at 35.9 million tonnes. Again then, imports constituted 82.7 per cent of the nation’s complete requirement. Ten years therefore, in 2022, India’s crude oil imports have risen to 212.4 million tonnes, implying an annual development of two per cent. Apparently, home manufacturing has declined by about 21 per cent over the previous decade. In consequence, imports as a proportion of complete requirement rose to over 88 per cent. This pattern has continued within the first half of FY23.

Advertising and marketing margins reduce

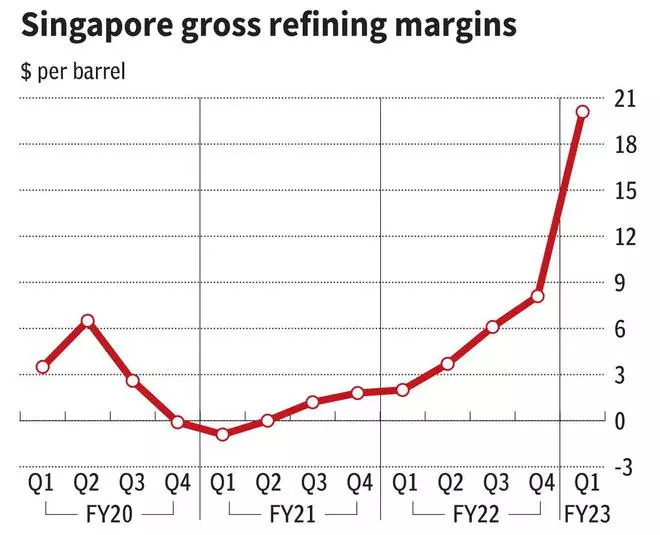

At the same time as international crude oil costs had been ruling above $100 per barrel, petrol and diesel had been offered to home customers at costs that had been equal to crude oil costs of $70-80 ranges to maintain a lid on inflation, lest it impair development. In consequence, public sector oil advertising and marketing firms equivalent to Indian Oil Company (IOCL), Hindustan Petroleum (HPCL) and Bharat Petroleum (BPCL) took a haircut on their advertising and marketing margins, as they ended up incurring losses on their gross sales of auto fuels. Thus, whereas these firms recorded historic gross refining margins at over $20 per barrel in Q1FY23 in comparison with $3-6 per barrel in 1QFY22, resulting from greater realisation on the downstream merchandise, the losses on advertising and marketing eroded their profitability fully.

Indian Oil Company, which is the most important refiner and marketer, posted a modest revenue of ₹883 crore, in contrast with ₹6,141 crore, in the identical interval final yr. For BPCL and HPCL, it was report losses of ₹6,148 crore and ₹8,557 crore, respectively, in Q1FY23

Now, with the correction and volatility in crude oil costs, the refining margins have additionally come off from their highs, at the same time as there was some respite on the advertising and marketing losses resulting from a moderation within the crude oil costs from ₹120-plus ranges to under ₹100 ranges in latest months. For HPCL, the moderation in advertising and marketing losses has helped slim losses within the September quarter with a web lack of ₹2,476 crore. Within the case of IOCL, which loved refining margins superior to HPCL and BPCL at $31.81 a barrel, the autumn in refining margins resulted within the firm posting a lack of ₹910 crore within the July-September 2022 interval.

Second, so as to add to the sky-high crude oil costs, the falling rupee solely accentuated the troubles for India. It was a double whammy for the nation, with an inflating subsidy invoice resulting from rising oil and falling rupee on one hand and elevated outflow of {dollars}, resulting from greater imports, on the opposite. To ease the strain on the nation’s funds, Authorities of India, on July 1, launched the windfall tax (often known as the particular extra excise responsibility) aimed toward absorbing the tremendous regular income earned by home crude producers, on condition that their realisation is linked to greater international costs.

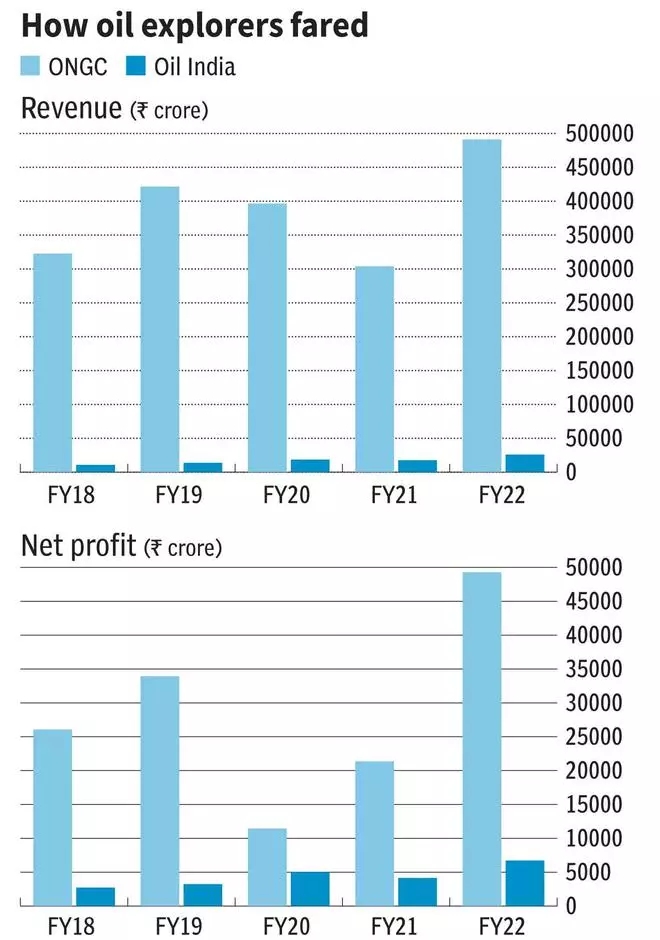

For home crude producers Oil and Pure Fuel Company (ONGC) and Oil India, the brand new tax meant decrease web realisation on the crude produced. From ₹23,250 a tonne on July 1, the Authorities, which has been reviewing the charges on a fortnightly foundation and making appropriate revisions, has now decreased it to ₹9,500 for a tonne of crude. Likewise, to make sure home availability of downstream merchandise — petrol, diesel, and aviation turbine gas (ATF) — it had imposed extra responsibility on exports, at ₹6 per litre on petrol and ATF and ₹13 per litre on diesel. This has led to erosion of income for upstream firms equivalent to ONGC and OIL and export-focussed downstream refiners equivalent to Reliance Industries.

Reliance Industries’ lacklustre efficiency in September 2022 quarter, with a flat web revenue of ₹15,512 crore, was largely on account of the windfall tax on exports of downstream merchandise, at the same time as different segments equivalent to Retail and Telecom reported strong efficiency.

Given the present situation of risky crude oil costs, what might be in retailer for the upstream and downstream firms?

Windfall tax issue

If crude costs transfer up from hereon, going by historical past, it’s good for each upstream and downstream firms in a traditional situation. For oil exploration upstream gamers equivalent to ONGC and Oil India, greater crude costs assist greater realisation. Apart from, greater realisation, stock beneficial properties additionally add to margins and income in a rising crude worth situation. Nevertheless, now with the arrival of windfall tax, the quantum of income and revenue development will likely be restricted to the extent of the tax. Ought to brent crude worth transfer above $100 ranges for a barrel, Authorities is prone to revise the windfall tax upwards, simply as the way it has been downward-revising the identical with the moderation in international costs. Nevertheless, even after adjusting for the tax, greater crude costs should still be good for upstream firms.

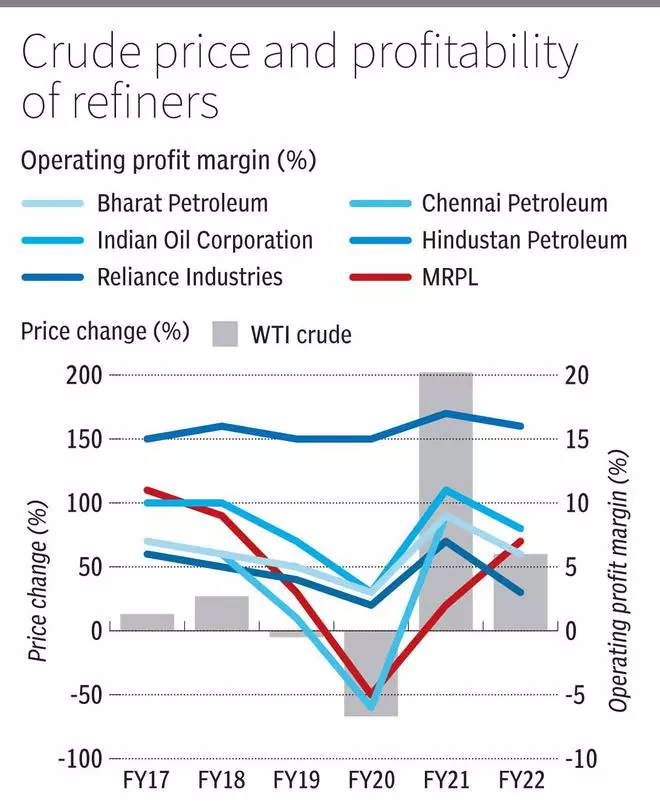

Likewise, robust crude oil costs have helped margins of refiners and oil advertising and marketing firms. Indian Oil Company, which is the most important refiner within the nation, noticed its working revenue margin increase from 2-5 per cent throughout FY13-15, when crude costs had been on a falling spree, to 6-10 per cent in FY16-18, when international oil costs recovered and had been ruling excessive. For HPCL, the working revenue margin improved from about 2 per cent in FY13-15 to 5-6 per cent in FY16-18.

Increased crude costs assist refiners in two methods. One is by means of greater gross refining margins, on condition that the realisation on downstream merchandise can be sometimes greater. Two, stock beneficial properties resulting from rising oil costs also can assist step up margins. Nevertheless, for export-focussed refiners equivalent to Reliance Industries, the windfall tax could also be necessary to maintain a watch on. Abolishment or vital moderation will likely be constructive for Reliance Industries. For oil advertising and marketing firms (HPCL, BPCL, IOCL), any change within the retail sale worth of petrol, diesel and ATF will likely be necessary to watch. Increased crude costs, with none change in retail gas costs, may even not assist oil advertising and marketing firms since advertising and marketing losses would wipe off the upper refining margins.

Whereas the case for a gradual to greater oil costs within the close to time period could seem extra real looking, ought to crude costs head south, the exchequer, for positive, will heave an enormous sigh of reduction. Nevertheless, for refiners and oil producers, this may imply not simply decrease realisation but additionally stock losses, which is able to affect profitability. For oil advertising and marketing firms, it is going to be decrease advertising and marketing losses compensating for decrease refining margins. Therefore, falling crude costs, whereas good for the nation and customers, might not assist the efficiency of environment friendly refineries equivalent to IOCL and exploration firms equivalent to ONGC and Oil India.

What traders ought to maintain tabs on

Whereas it’s laborious to foretell the best way ahead for oil costs, there are a couple of elements that one must maintain an in depth watch on. One is modifications within the windfall tax. Any downward revision of the quantum of tax, or Authorities fully taking away the brand new tax regime in a really optimistic case, will spell an enormous reduction for the trade. Additionally, modifications within the retail costs of petrol, diesel and ATF will play an important function in figuring out the profitability of OMCs. In spite of everything, given the capital-intensive nature of the enterprise, the Authorities ought to guarantee a good and remunerative coverage framework in an effort to assist firms maintain operations and likewise commit extra capital in the long run.

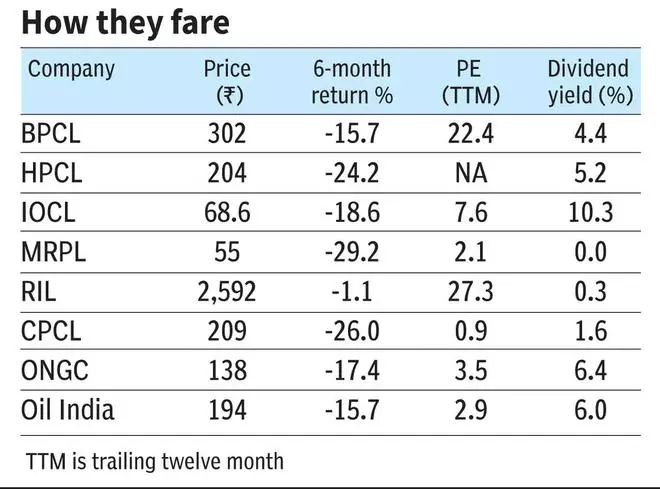

Given the regulatory controls and volatility within the crude costs, the efficiency of upstream and downstream firms has by no means been constant. Lengthy-term investing on this sector has not labored properly, given the up and down cycles and volatility in monetary efficiency of those firms. For traders who nonetheless need to play the chance in oil, you will need to time it proper and put money into the fitting enterprise. For example, if you wish to play the upside in refining margins in a rising crude oil situation, Reliance Industries and Indian Oil Company, which take pleasure in superior refining margins, relative to the trade could also be a greater concept to contemplate. Throughout downcycles and / or risky instances, you might be higher off staying away from refining and exploration shares.

#Oil #Shares #Elements #inserting #bets