India seems to be comparatively well-placed, like a gradual ship in uneven waters, given stronger macro fundamentals in comparison with many friends. The RBI initiatives India to develop at 7 per cent in FY23. This locations the Indian economic system, the fifth largest now after overtaking the UK, on monitor to pip Germany in 2027 and Japan by 2029 on the present price of progress, as per an SBI analysis report.

Portfolio Podcast | 4 enticing thematic funds to purchase now

On this backdrop, traders in India immediately have a possibility to dig their heels deep and improve publicity to 4 choose themes to wager on the home economic system — manufacturing, infrastructure, monetary companies and transportation/logistics. All these funding performs are multi-year alternatives, given the anticipated progress within the Indian economic system. We spotlight for you the best-in-class choices obtainable within the MF path to capitalise on these enticing thematic alternatives.

Manufacturing

India missed the manufacturing bus within the eighties, despite the fact that we did excel in companies resembling software program to develop into the again workplace to the world. Now, with China+1 changing into a geopolitical crucial, it’s an opportune time for India to broaden the manufacturing sector. Actual manufacturing gross mounted capital formation is anticipated to rise from 5.5 per cent to 7 per cent ranges of GDP by FY27, with absolute quantity nearly doubling on this interval. That is anticipated on the again of a renaissance within the Indian manufacturing sector, because of phased manufacturing programmes, ‘Make in India’ focus, Manufacturing Linked Incentive (PLI) scheme, 100 per cent automated overseas direct funding in sectors, tax cuts, single-window clearance system, import responsibility safety, and so forth. Briefly, manufacturing in India now has the potential to be a significant driving drive for the economic system.

What may work in India’s favour immediately is the potential for important home demand, Authorities’s drive to encourage manufacturing, and a definite demographic edge. The manufacturing sector might outpace total GDP progress by roughly 4 per cent, resulting in an incremental contribution alternative of $300-$500 billion from the manufacturing sector to the economic system in 2030, as per Mirae Asset. On this situation, the manufacturing sector’s share in direction of India’s GDP in 2030 might probably attain round 20 per cent, it mentioned.

Funds: There are over half a dozen manufacturing theme-focussed choices, together with three passive funding choices. However half of them are current funds, having been launched throughout the final one 12 months. Given the quick time interval that the theme has been in focus, go for choices with some monitor file. The funds that match the invoice listed below are ABSL Manufacturing Fairness and ICICI Pru Manufacturing. The latter has executed higher by way of beating benchmarks. Each have differentiated portfolios however ICICI Pru providing is extra concentrated. Auto shares are a giant wager for each the actively-managed funds we advocate however whereas ABSL’s prime preferences are client non-durables and pharma, the ICICI Pru providing favours petroleum merchandise and cement .

One other noticeable function is the multi-cap strategy (giant: 50, mid: 25 and small: 20) of the ABSL fund, whereas IPru scheme has capped small-cap publicity to 7 per cent. Value-conscious traders can use Navi Nifty India Manufacturing Index Fund (direct plan: expense ratio of 12 bps) or (36 bps) to play this theme. Whereas the S&P BSE Manufacturing Index has outperformed S&P BSE 100 within the final one 12 months, there’s a tactical alternative for the manufacturing sector, given its under-performance in 3- and 5-year intervals.

Banking and finance

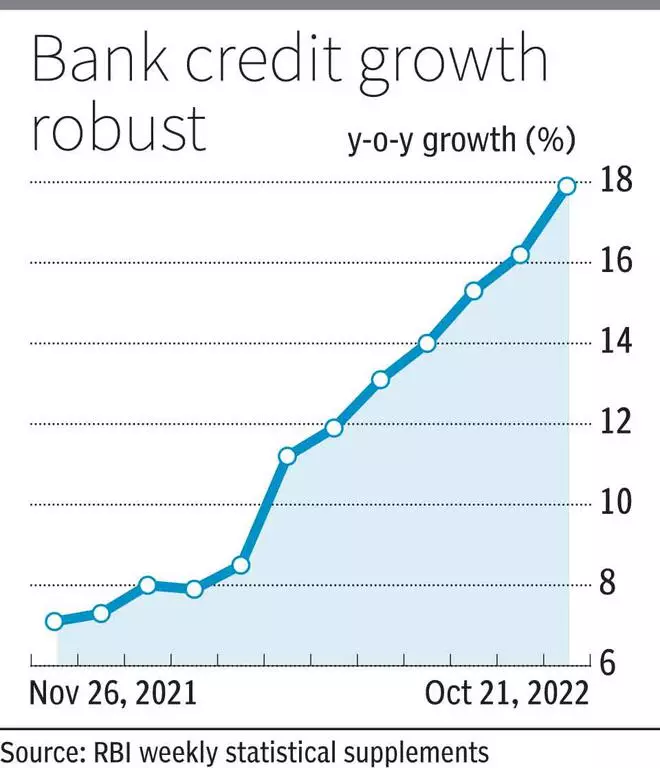

The banking and monetary companies sector serves as a proxy to India’s rising economic system, since each side of the economic system is influenced by it. This broad universe seems well-placed for significant progress, with tailwinds resembling bettering credit score progress (nine-year excessive of 16 per cent yoy in September 2022), adequately capitalised stability sheets, clean-up of NPAs, and so forth. The Authorities thrust on infrastructure and manufacturing is anticipated to supply impetus to the credit score demand. Retail credit score has been rising at a gradual tempo over the previous few years and is anticipated to develop, given the under-penetration of retail credit score in India.

Within the quick time period, there’s continued traction within the retail and SME phase, whereas the Company phase can be seeing a revival. Dwelling, Automobile, Unsecured, and Small Enterprise proceed to do effectively, whereas the demand for CV can be bettering. Bank cards enterprise is seeing wholesome momentum too.

Over the previous decade, India’s monetary companies sector has been hammered by demonetisation, IL&FS disaster, YES Financial institution’s collapse, and so forth. However, investing in high-quality monetary shares has confirmed to be rewarding. Moreover banks, NBFCs, insurers, asset managers and brokers have a large alternative to consolidate market shares. Nicely-run lenders with ample capital can develop quicker because the economic system turns into bigger. With solely 5 per cent of Indian wealth in monetary property, non-lenders are a good way to play the big structural alternative that presents itself from the ‘financialisation’ of Indian family financial savings. Fast urbanisation (50 per cent by 2050), rising earnings (per capita earnings progress almost 7 per cent over the past 15 years) and excessive financial savings price (29 per cent) are key progress drivers of the monetary sector. Nifty Financial institution index is anticipated to point out 30 per cent earnings progress over CY21-23, as per Bloomberg consensus expectations.

Funds: At this second, there are 15 actively-managed banking and monetary companies funds. We want a minimum of 5-year monitor file funds which have balanced publicity to financials throughout domains resembling banks, finance and insurance coverage — for example, ABSL Banking & Monetary Providers (60:29:6), ICICI Pru Banking & Monetary Providers (55:29:10) and Nippon India Banking & Monetary Providers (60:31:5). From pure alpha perspective, SBI Banking & Monetary Providers is the one providing that has overwhelmed benchmark on 1-, 3- and 5-year returns.

Three-year and 5-year rolling returns primarily based on final 10 years of the largest actively-managed funds present that Nifty Financial institution whole return index has been onerous to beat, for almost all. So, passive funds could also be a greater technique to play this theme. There are 20 passively-managed choices comprising 4 index funds and 16 ETFs primarily based on banks as an entire, private-sector/public-sector banks, and financials (excluding banks). Edelweiss ETF-Nifty Financial institution (5 bps) and Navi Nifty Financial institution Index Fund (10 bps) are the most affordable within the respective sub-segments. When it comes to lowest one-year monitoring error, ICICI Pru Nifty Personal Financial institution ETF and SBI Nifty Personal Financial institution ETF are alternate options.

Do be aware that since BFSI is already a giant weight in Nifty 50/Sensex or any large-cap fund/index, traders ought to go for incremental publicity solely after making an allowance for their present oblique allocation by way of different funds.

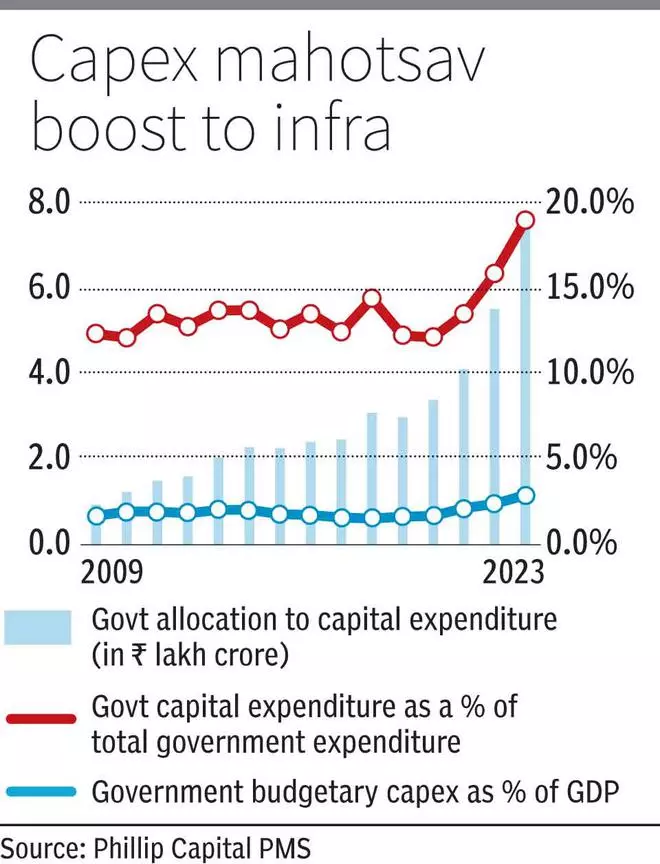

Infrastructure

With India aiming to be a $5-trillion economic system, the give attention to infrastructure growth has deepened in some ways over the previous few years. Investments in infra have a snowballing impact on progress in a number of provide and demand-side channels. To realize GDP of $5 trillion, India must spend about $1.4 trillion (over ₹100 lakh crore) over these years on infrastructure in order that lack of infrastructure doesn’t develop into a constraint to the expansion of Indian economic system, in accordance with authorities calculations (Eco Survey 2020). Given the big listed universe of shares that fall in infra theme, it’s a multi-sector alternative spanning asset house owners (roads, railways, ports, energy and telecom), asset financiers (lenders) and asset creators (building, cement).

Infrastructure as a theme got here into vogue in 2004 and picked up tempo until 2008 earlier than the worldwide monetary disaster spooked markets. As a result of concentrated publicity, infrastructure theme can undergo prolonged intervals of under-performance because it did in 2018 and 2019. On condition that infrastructure initiatives are long-gestation in nature, it’s high-risk and there’s a lengthy wait concerned. Therefore, traders on this house should prep as much as abdomen intermittent intervals of under-performance. Nifty Infrastructure index earnings are anticipated to point out double-digit CAGR progress over CY21-23, as per Bloomberg consensus estimates.

Funds: Many of the 20+ infrastructure-oriented thematic mutual funds have 3- and 5-year monitor file. About half of the funds have overwhelmed related benchmarks in 1-, 3- and 5-year intervals, whereas half a dozen have additionally outshined class common returns. We want Kotak Infra & Eco Reform, ICICI Pru Infrastructure and Tata Infrastructure on account of higher portfolio diversification by way of prime sectoral and prime shares focus. Throughout infra funds as a class, Industrial Merchandise, Development Initiatives, Industrial Capital Items, Energy, Cement and Banks are prime decisions and this performs out for the really helpful funds. When it comes to m-cap publicity, Tata and Kotak choices are extra mid- and small-cap oriented however ICICI Pru seems to have most well-liked large-caps and capped mid-cap publicity. Do be aware these are thematic bets and will kind a part of the satellite tv for pc portion of your portfolio.

Logistics and auto

If everyone seems to be shifting ahead collectively, then success takes care of itself, mentioned Henry Ford. Fast urbanisation is accelerating progress in private mobility necessities. Moreover, highly effective enablers resembling robust demand-led restoration cycle and margin enchancment present visibility for robust earnings progress for the auto/transportation and logistics sector. Consisting of greater than a dozen sub-sectors, this theme offers a large spectrum of funding alternatives, facilitating efficient diversification of the portfolio.

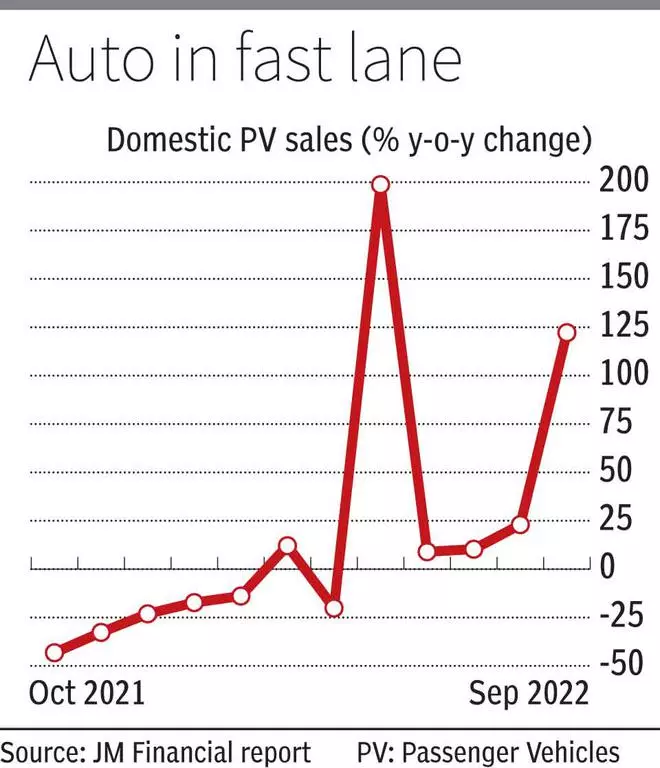

After a hiatus beginning effectively earlier than the pandemic, the auto cycle is lastly trying up now, with utility car (UV) and business car (CV) gross sales main the pack. After Energy, BSE S&P Auto index is the very best performing sectoral index 12 months up to now, with 22 per cent positive aspects versus 2.9 per cent for the Sensex. Given the auto cycle sometimes holds for about three years, there’s a case for tactical funding in funds focussed on the auto sector. Alternative demand, order backlog and decrease stock are key drivers right here, other than long-term ones such because the shift to electrical automobiles. Nifty Auto is anticipated to point out multifold (100 per cent CAGR) progress in earnings over CY21-23 interval, as per Bloomberg consensus estimates

In case of logistics and transportation, enablers resembling elevated cashless funds, regulatory adjustments/insurance policies resembling Nationwide Logistics Coverage (NLP) and PM Gati Shakti, technological development and export potential are optimistic. For logistics service suppliers, components resembling rise in overseas commerce, shifts from unorganised to organised markets put up GST and bettering infrastructure are boosting fortunes. Lengthy-term drivers resembling e-commerce are additionally brightening the ecosystem.

Funds: Those that have a excessive urge for food for danger can take into account investing in UTI Transportation and Logistics. That is the one energetic fund focussed on the sector at present with a ok monitor file (IDFC and ICICI Pru gives launched not too long ago). Nifty Auto ETFs (from Nippon India and ICICI Pru) and one index fund from IPru could also be good funding choices if you wish to monitor the underlying basket at a low price (direct plan: 20 bps). Nevertheless, the UTI T&L fund ought to be the go-to alternative because the energetic fund is a confirmed participant by way of offering broader market publicity and good returns

#Huge #Story #promising #themes #make investments #route