Traditionally, monetary return has been the predominant driver for the investing choices taken by traders. However, of late, some traders the world over have been goal investee firms via the ESG lens — the place E stands for Atmosphere, S for Social, and G for governance. ESG investing, they are saying, is constructed on how the investee firm treats the planet, how the corporate cares about individuals, and the way the agency is being ruled/run.

The solutions type the crux of all ESG investing, the place property globally surpassed the $35-trillion mark already in 2020. But, ESG investing by itself is nothing novel as a result of it has been round in several types similar to inexperienced investing, socially accountable investing, sustainable investing, moral investing or impression investing.. Name it maybe one of many luxuries of a chronic bull market, or a skilful technique to direct capital to the do-gooders of the company terra firma. Not surprisingly, ESG investing, like each different subject, has break up the investing hoi polloi into pro-ESG and anti-ESG camp.

Portfolio Podcast | ESG Investing: Hype or hope?

Decoding ESG not simple

Historically, investing has concerned distributing our financial sources throughout monetary merchandise to generate earnings or acquire income. ESG investing goes past that and is focussed on how firms earn a living, somewhat than simply how a lot cash they make.

In about twenty years since educational literature first began utilizing ESG references, the ESG motion has grown from merely a company social accountability (CSR) initiative to a worldwide investing phenomenon. Within the final two years alone, over $32 billion flowed into ESG-focussed US ETFs, signifying how the development has picked up tempo.

Given the plain FOMO (worry of lacking out) relating to ESG theme, some international funds have been stretching the unique definitions of ESG and sustainable investing to get cash. And, they’ve a powerful motive to take action. A 2021 evaluation by Morningstar discovered that Millennials, Gen X and Boomers all had comparable preferences for proudly owning sustainable investments.

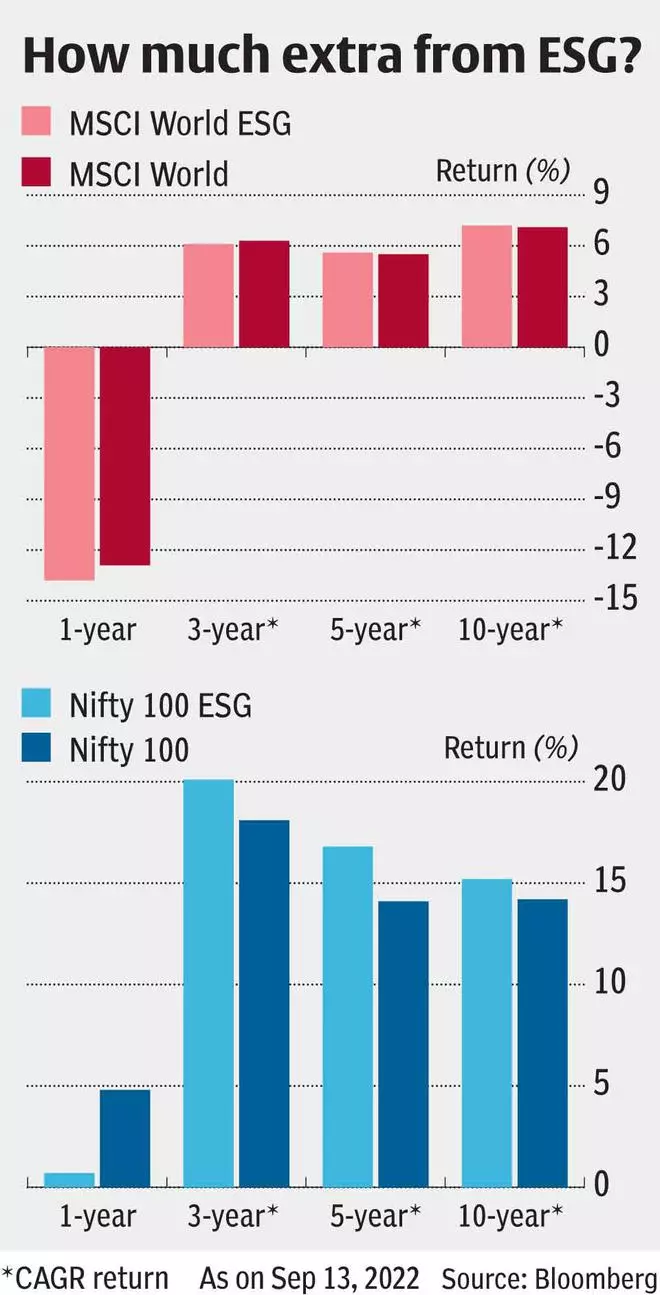

But, returns have been pedestrian. The MSCI World ESG index in final 10 years has doubled however that is barely 100 foundation factors greater than the plain Jane MSCI World index. Moreover, there aren’t any universally agreed norms and requirements. Customary-setting our bodies similar to IOSCO, FSB, and many others. are working on this space, together with improvement of standardised disclosures for funds within the ESG area. Till then, regulators around the globe will proceed to grapple with the difficulty of figuring out whether or not an ESG label on a fund is warranted. Within the US, the Securities and Trade Fee might quickly require extra disclosures about how ESG rules match into managers’ funding methods. Europe is alleged to be growing a few of the most inflexible standards. Indian market regulator SEBI has floated an exhaustive session paper on introducing disclosure norms for ESG MF schemes.

Handy definitions and the usage of adverse/constructive screening have led to ESG/sustainability funds globally constructing portfolios from firms that might ideally not slot in ESG baskets. For instance, some ESG fairness funds have been growing their investments in companies similar to Shell and Repsol since Russia’s invasion of Ukraine boosted the power markets. Certainly one of this 12 months’s top-performing managers of sustainable funds holds ConocoPhillips and Exxon. To international traders, China’s authoritarian regime ought to be an computerized disqualifier and ‘un-investible’ from any ESG perspective, but ESG funds maintain about $130 billion in Chinese language property.

Home panorama nascent

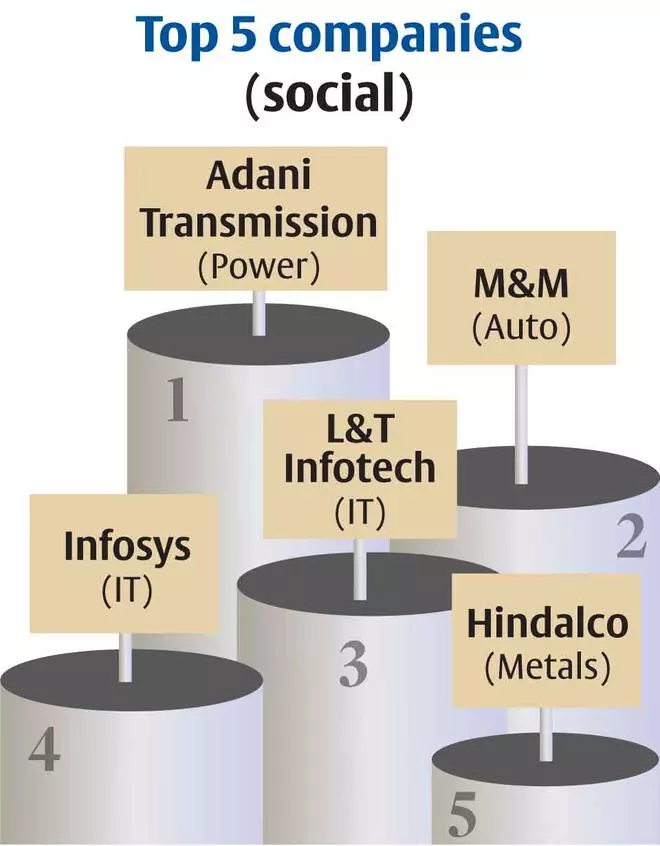

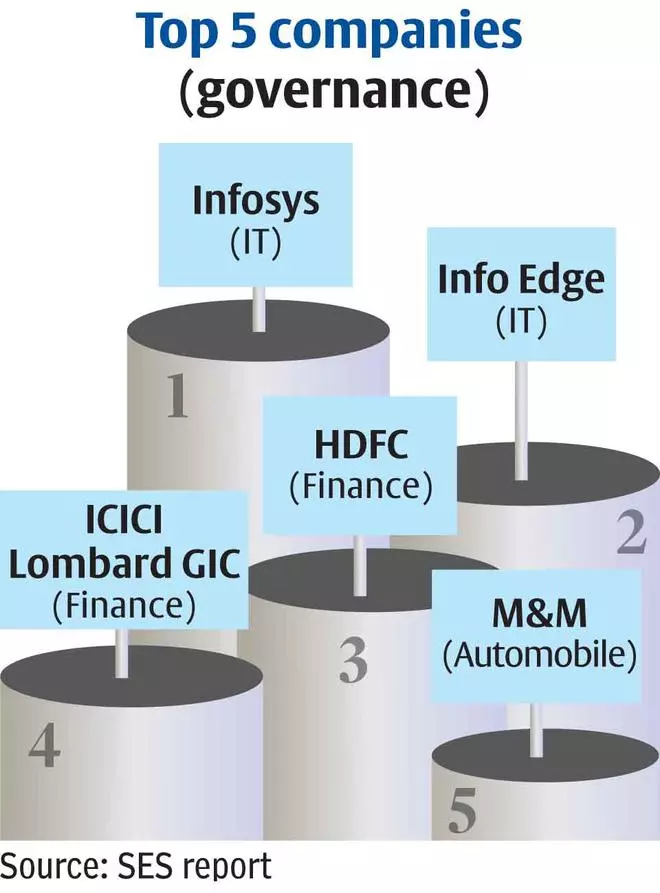

An growing variety of traders wish to do their very own analysis and decide shares, which could possibly be daunting sufficient; and this could possibly be much more difficult in the event that they lengthen their filtering standards to ESG objectives. There are a number of free sources similar to SES Governance which make accessible the ESG ranks for particular Indian firms, however they’re few and much between. For others, you’ll have to pay up. You’ll be able to, in fact, entry the highest 10 holdings from the newest factsheets of ESG inventory indices similar to Nifty 100 ESG or S&P BSE 100 ESG. The load of every inventory in Nifty100 ESG index is tweaked primarily based on ESG threat rating assigned to the corporate.

In comparison with this, home mutual funds supply readymade ESG portfolios. At current, there are 10 ESG-focussed thematic fairness mutual fund choices. These funds, put collectively, handle property over ₹11,400 crore ($1.4 billion). Eight of the ten have been launched within the final two years. Two of the merchandise are passive in nature. Just one fund has an extended historical past, nevertheless it didn’t start as an ESG fund at inception and altered observe solely in 2018.

Given the absence of water-tight definition for ESG, what’s the funding technique that mutual funds comply with?

ESG-focussed mutual funds spend money on a basket of securities primarily based on combining current conventional elementary, bottom-up monetary evaluation with an evaluation on the ESG points of the corporate. Most of them declare they’ve a ‘proprietary funding framework’. The ESG evaluation is a part of the funding framework, which can use knowledge shared by exterior service suppliers. As an illustration, CRISIL, in June final 12 months, launched its ESG scores for 225 firms throughout 18 sectors in India.

To shortlist ESG-compliant firms, funds often do sector-level screening and stock-level screening. Whereas ESG scores/threat scores are an integral a part of the funding analysis course of, some funds should not restrained by them and might use discretion to determine on firms that are long-term sustainable companies with good ESG practices. Schemes might specify chosen no-go sectors that are deemed as dangerous or unfavourable from the societal perspective.

Firms are additionally thought-about in ESG portfolio owing to their ‘power’ in anyone or two of the ESG parameters and never essentially all three together and vice versa. The portfolios are reviewed and rebalanced on periodic foundation as a consequence of change in ESG rating/threat rating. Funds are allowed to take a position solely in fairness securities which have Enterprise Duty and Sustainability Report (BRSR) disclosures from October 1, 2022. The present investments within the scheme for which there aren’t any BRSR disclosures could be grandfathered until September 30, 2023.

On the portfolio administration companies (PMS) aspect (minimal ₹50 lakh funding), a handful of merchandise exist within the type of SBI ESG Portfolio, Avendus ESG Fund PMS and White Oak India Pioneers Fairness ESG Portfolio.

ESG has additionally made its approach into curated shares baskets, with choices similar to Inexperienced Power (managed by Niveshaay), Omni Perception Compliant Technique (Omniscience Capital), Socially Accountable Investing (Rupeeting), MWG ESG (My Wealth Information) and Shariah ESG (SenSage) incorporating ESG rules absolutely or partially.

Insipid returns up to now

Does ESG investing work in India? For all the massive enamel, there’s not a lot of a chew. That is borne out by index-level actions. As an illustration, Nifty 100 ESG index has delivered 15.25 per cent CAGR in final 10 years, which is barely 100 foundation factors greater than 14.2 per cent CAGR given by Nifty 100. This alpha is small, particularly given the truth that ESG index statistically prevailed towards the common index in 8 out of 10 situations by way of calendar 12 months returns.

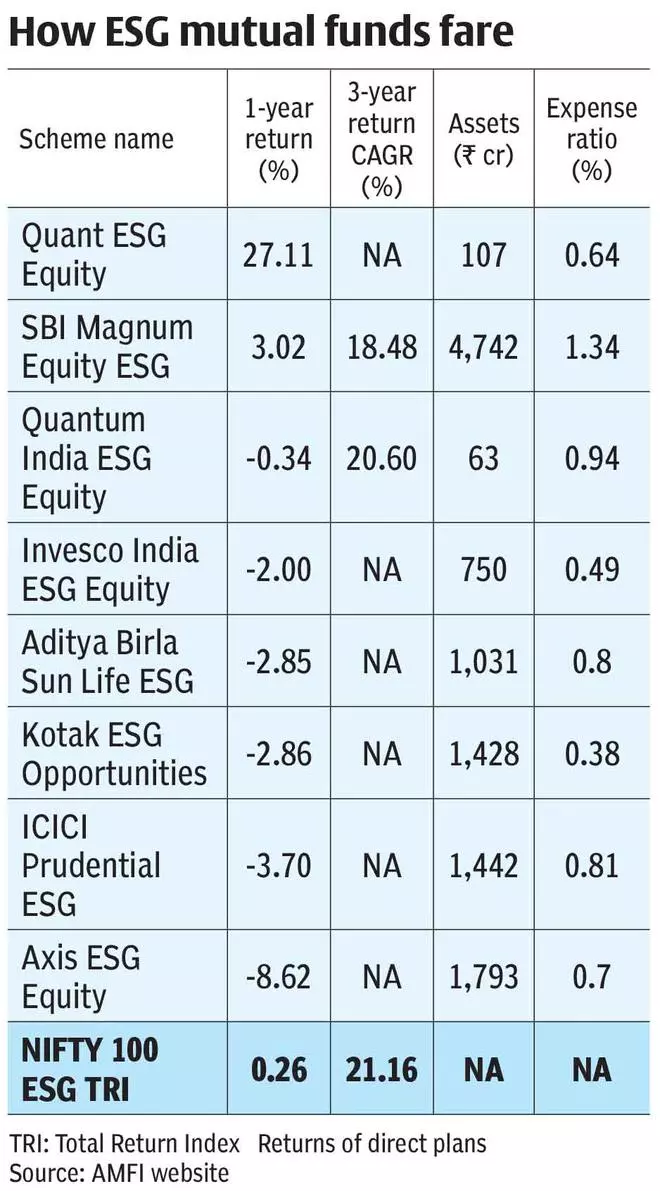

For all of the hullabaloo, ESG-focussed mutual funds haven’t proven any nice monetary returns both. The person one-year fund returns vary from -9 per cent to +27 per cent, bringing the class common to a forgettable -0.15 per cent amid flattish markets. Damaging returns by seven funds don’t lend to them any risk-adjusted return evaluation. The paltry returns place the ESG thematic class among the many worst out of the 20 broad buckets tracked by the business. Nevertheless, ESG funds appeared to have outscored sectoral funds betting on pharma (down 12 per cent) and IT (down 15 per cent), and worldwide fairness funds (down 17 per cent) in one-year interval. On threat ratios (1-year and month-to-month), 30 per cent of the ESG funds sport higher-than-average upside seize and that has translated into their outperforming.

Nevertheless, one might argue that traders want to offer extra time for ESG funds to ship efficiency given their younger age.

Portfolios not distinctive

A detailed take a look at the newest portfolios of ESG funds throws up fascinating insights.

One, there are broadly 200-odd home shares and 40 worldwide shares that discover place in ESG fund portfolios. As per laws, these schemes fall below the class of thematic funds and so a minimal of 80 per cent of complete property are invested in securities following ESG theme. SEBI’s session paper proposes that the residual portion of the funding shouldn’t be starkly in distinction to the philosophy of the scheme from the theme. Some funds choose shares if they’ve ESG orientation “within the opinion of the fund supervisor”.

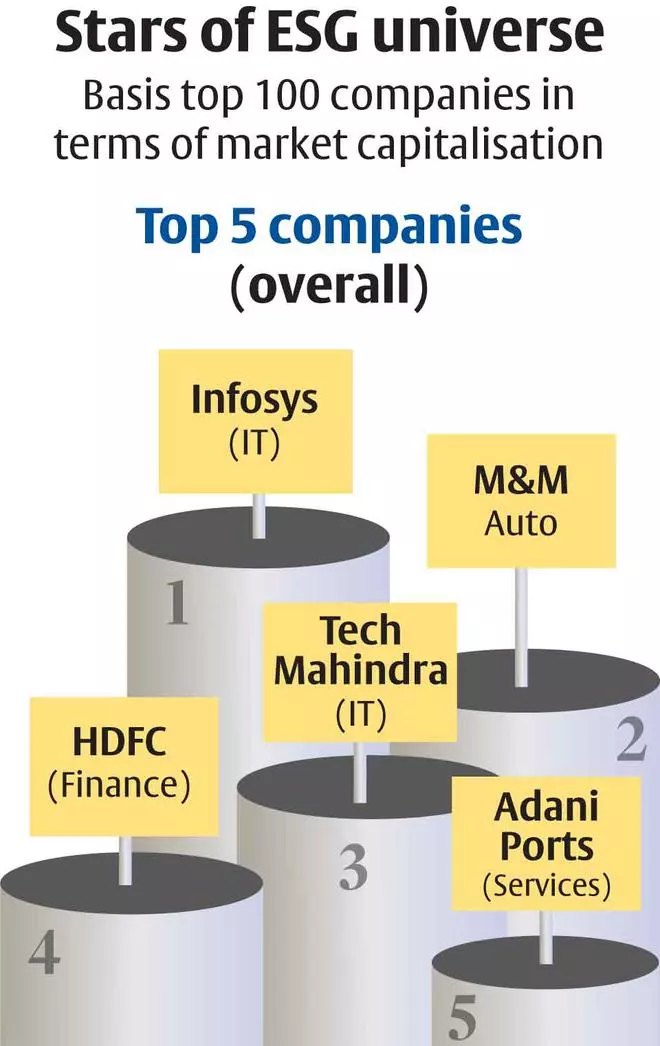

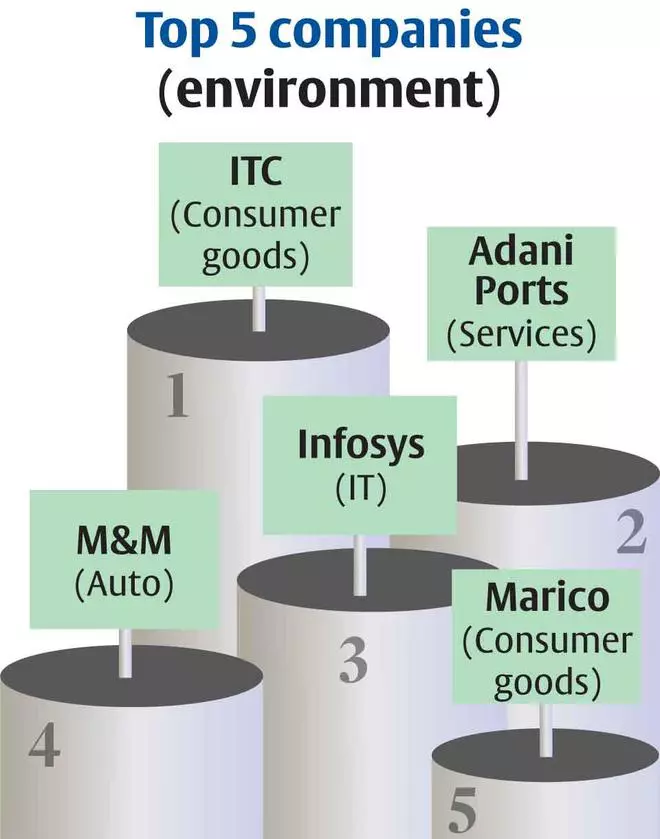

Two, BFSI and IT shares are the dominant sectors in most funds (they had been by no means doing one thing terrible to the planet or to the individuals within the first place!) Infosys is a top-3 holding in 80 per cent of the funds. Equally, ICICI Financial institution, TCS, HDFC Financial institution and HDFC are high 3 holdings in lots of ESG funds. Nevertheless, many of those inventory names are extensively owned within the fund universe in as many as 330-520 schemes. So, how totally different will the expertise of traders be with ESG funds if they’re allocating cash to the identical family shares? That is additional introduced out for those who take a look at the highest 10 holdings (40-60 per cent weight) of ESG funds.

Each fund has an overlap of 4 to 9 shares of high 10 holdings with one other peer. Presence of shares from Adani group and others has helped increase returns of some ESG funds.

Hottest high ESG shares throughout PMS and MF portfolios additionally inform the identical story. They embody Infosys, TCS, HDFC, Bajaj Finance, Titan, HCL Tech., Tech Mahindra, Wipro, HDFC Financial institution and HUL. So, no actual surprises right here.

Beware greenwashing

Since firms get higher market valuation (Nifty 100 ESG enjoys a 13 per cent premium valuation), given the elevated demand from traders, many company aspirants have began greenwashing. It is a means of conveying a misunderstanding or offering deceptive details about how an organization’s merchandise are extra environmentally sound.

Monetary returns from ESG investing haven’t been extraordinarily excessive

Lack of standardisation and uniform guidelines leaves gaps in ESG regulation

ESG inventory choice might not result in building of a really totally different portfolio

ESG fund portfolios can have shares chosen in every of E, S and G classes — or in only one or two of the classes

In some circumstances, ESG portfolio might have securities that don’t fit any of the ESG classes

Greenwashing by firms as additionally funds/advisers makes it tough for traders to differentiate them from the real ones

In a bid to keep away from this peculiar downside, India, for example, has framed new environmental guidelines that may require firms to submit detailed emissions knowledge beginning subsequent fiscal 12 months. Beneath the foundations, corporates must present knowledge on greater than 120 metrics, together with from the previous two years.

Whereas ESG relies upon upon third-party ranking organisations to evaluate firms on their credentials, there isn’t a unified benchmark or methodology behind ESG rankings. Inconsistencies have muddled what qualifies as adhering to ESG rules. This leaves the door ajar on ESG malpractices.

Clear, concise, and related guidelines can put an finish to such occurrences, in order that solely the great apples of the ESG panorama get the investments and traders draw returns from them. Alternatively, if ESG firms and ESG funding autos similar to funds change into true-to-label, that may also result in much less wiggle room for stakeholders concerned. Standardisation could make it tough for sure funds to tweak their funding insurance policies for alpha chase. Some can argue that ESG traders should look past mere monetary return. SEBI’s session paper proposes that investments by mutual funds ought to be designed to generate a helpful ESG/sustainability impression alongside a monetary return and the asset administration firm ought to clearly state the meant ‘actual world’ end result in qualitative phrases.

Given all this, as of at present, ESG investing will not be but a fingers down winner.

#good #dangerous #ugly #ESG #investing