International headwinds

It is because the sustainability of agriculture the world over has come below query now. International warming and the resultant local weather change have led to erratic rainfall. With the abysmally-low rainfall in Europe and China, rivers, which weren’t solely the supply of water for agriculture, however had been additionally used for transportation, are on the verge of drying up utterly. Pattern this: The water ranges in Europe’s Rhine river, which is the second largest river and probably the most travelled waterway used for transportation of quite a lot of items from grains, chemical compounds to coal, has dwindled by greater than half. This has resulted in a diminished load of products being transported by way of the river, with ships now crusing at 25-35 per cent of their capability to keep away from working aground.

Likewise in China too, the longest heatwave in 60 years has brought on a number of rivers to dry up utterly, together with a number of elements of the mighty Yangtze. In accordance with Chinese language authorities, the present drought has already impacted 2.2 million hectares of arable land.

What does this imply for the worldwide agri sector?

Ought to the present drought state of affairs proceed, cultivation in China and Europe will be in danger. The world might be gazing a meals grain scarcity, leading to a surge in world crop costs – meals and business. Whereas this can be good for farmers, this may compound the present world financial headwinds, with a number of economies, together with India, already waging a battle with inflation.

India impression

The impression for India on account of the drought in these nations could also be combined. On the constructive aspect, greater crop costs globally also can assist greater realisation for farmers right here, on condition that the home costs are likely to comply with the worldwide development, directionally no less than. Exporters of meals grains might profit from greater value realisations. On the flip aspect, for firms exporting agri inputs – agrochemicals significantly, to those markets, particularly Europe, the impression could also be pronounced. Apart from, provide disruptions in China, attributable to energy shortages and drought, might hamper agrochemical trade in India given its dependence on China for uncooked supplies.

Fertilisers, which is the opposite agri-input, will see negligible impression since India is a web importer of fertilisers. Any correction in world fertiliser costs might scale back the federal government’s import subsidy invoice. International recessionary fears, persevering with into the 12 months, might help correction in crude costs. This shall be constructive for fertiliser and agro chemical gamers, because the uncooked materials for fertilisers and agrochemicals are crude-based.

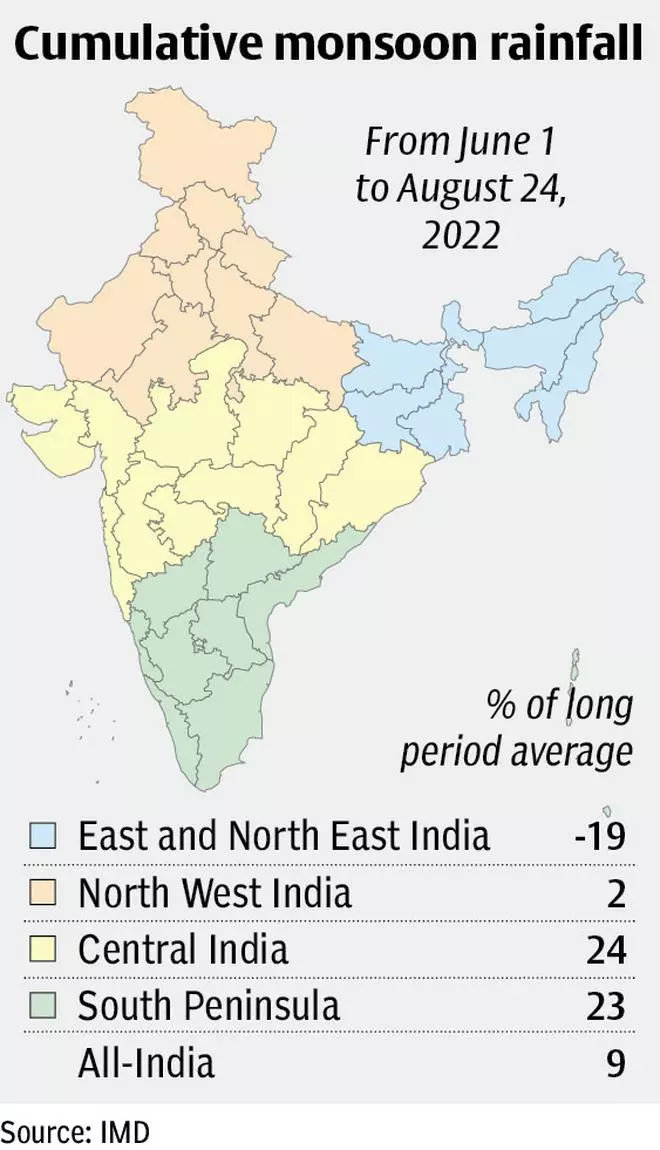

With respect to the home panorama, on this 12 months’s southwest monsoon season, whereas the entire rainfall is greater than the lengthy interval common (LPA) by 9 per cent, the actual subject is with the distribution of rainfall. As an example, East and West Uttar Pradesh, sugarcane belts, obtained 46 and 41 per cent much less rainfall because the begin of monsoon until date, in comparison with the lengthy interval common. This could probably impression sugarcane and sugar manufacturing.

Likewise, the rainfall in Jharkhand and Bihar which develop rice and wheat, was decrease than the lengthy interval common by a whopping 27 per cent and 41 per cent, respectively. In distinction, the southern state of Tamil Nadu obtained extra unseasonal rainfall, which has broken a number of acres of land below rice cultivation. India is probably bracing for greater meals grain prices, given the deficiencies in rainfall distribution. The acreage below cultivation within the present season has been decrease by 2.4 per cent on a year-on-year foundation, at 101.3 million ha.

Within the mild of those challenges within the world and Indian agri sector, how ought to one strategy agri-inputs as an area from an funding perspective?

Agrochemicals

Drivers

The expansion drivers for the Indian agrochemicals trade over the medium-long time period are more likely to be four-fold.

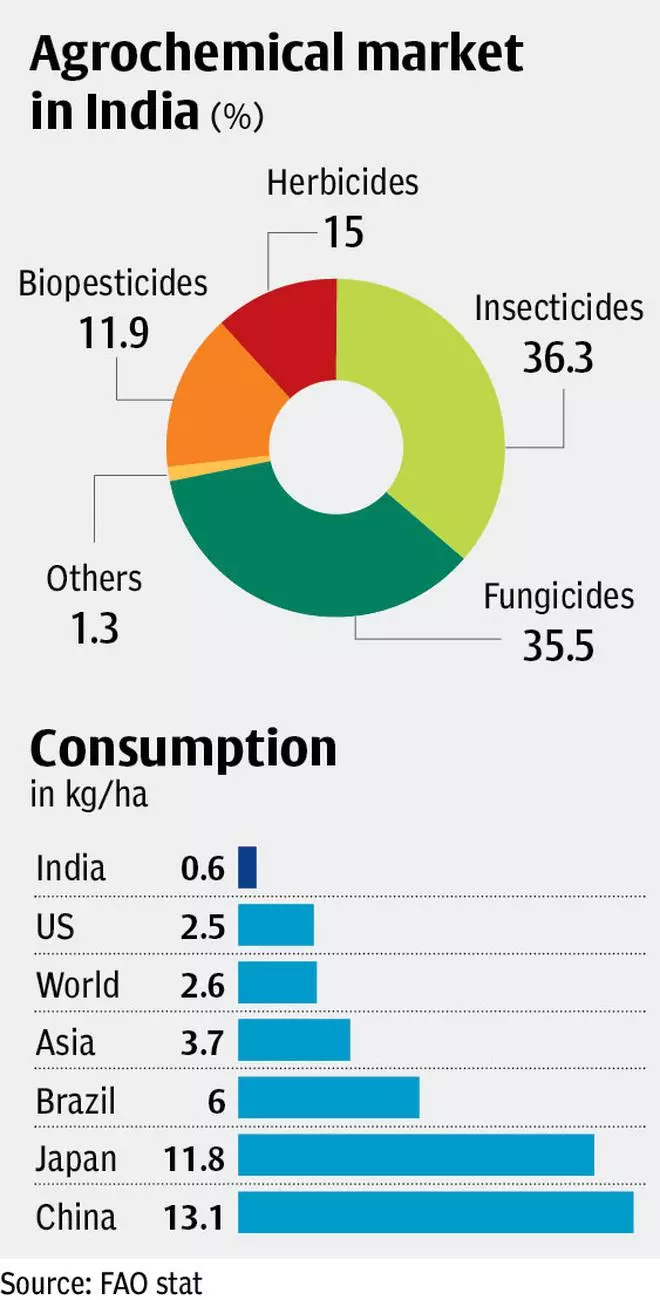

First, at present, the utilization of agrochemicals in India is among the many lowest on the earth. India’s consumption stands at 0.6 kg/ha, and that is only a fraction of that of Brazil, Japan and China, which is at 6 kg/ha, 11.8 kg/ha and 13.1 kg/ha, respectively. Additionally, at present the crop loss as a consequence of pest infestation is sort of excessive at 25-30 per cent and that is on account of decrease utilization of agrochemicals. Thus, there may be immense room for home consumption to extend, which ought to help progress.

Second, the main target of Indian firms on newer, modern merchandise and tie-ups with world innovators for analysis ought to assist them scale their enterprise globally. Nevertheless, on condition that modern product improvement is time- and cost-intensive, a sound associate with capital and competency is important for constructing the novel pipeline. As an example, Delhi-based Pesticides India has collaborated with Japanese OAT Agrio Co by way of a three way partnership entity to arrange a analysis and improvement unit in Chopanki (Rajasthan) for novel analysis. The JV has already been granted patents and expects their first novel product to be commercialised by 2025. Such collaborations will assist trade scale up their income and revenue by opening up newer alternatives globally.

Third, new product submitting is gaining momentum. As an example, Sumitomo Chemical substances, PI Industries and Pesticides India have launched three merchandise every within the June quarter. Rallis and Dhanuka have added two merchandise to their basket, whilst Greatest Agro and Coromandel Worldwide topped the checklist with 4 launches within the April-June interval. Apart from generics, firms are additionally submitting for 9 (3) merchandise that are first-in-India launches and can usually get pleasure from greater margins.

4, firms globally are adopting ‘China plus’ coverage with respect to sourcing technical/key materials to cut back dependency on China. This could augur effectively for India, given its positioning as a low-cost manufacturing vacation spot subsequent to China and its analysis and improvement capabilities.

Issues

At the same time as alternatives for the trade are wanting promising, some considerations stay.

First, there may be nonetheless a lack of expertise among the many farming neighborhood relating to new merchandise and progress continues to be pushed by older merchandise. As an example, Glyphosate, Monsanto’s modern herbicide molecule, has been utilized in India for over 4 many years and had gross sales of over ₹1,000 crore final 12 months. This can be a fourth of the nation’s herbicide market. Nevertheless, now, agrochemical firms are participating with farmers and creating consciousness to teach and promote newer merchandise. Whereas these initiatives ought to assist enhance the amount and worth of gross sales for the trade, it takes a variety of effort and time on condition that sellers affect the shopping for choice of farmers in India.

Second, whilst firms are investing in novel analysis, the event value for novel molecules is excessive. This provides to the product value, making it much less inexpensive for the farmers.

Third, the regulation in India must be simplified and the registration of merchandise must be made simpler. India nonetheless lags friends relating to new registrations. New filings in India are at 273 molecules, vis-à-vis 473 new filings in EU and 527 in Japan.

Within the close to time period although, the volumes within the present season may even see some impression as a consequence of rainfall distribution – extra rainfall in a number of States might necessitate re-sowing. Nevertheless, the trade expects this to common out given the expectation of a greater rabi season and better reservoir storage at present, in comparison with the earlier 12 months.

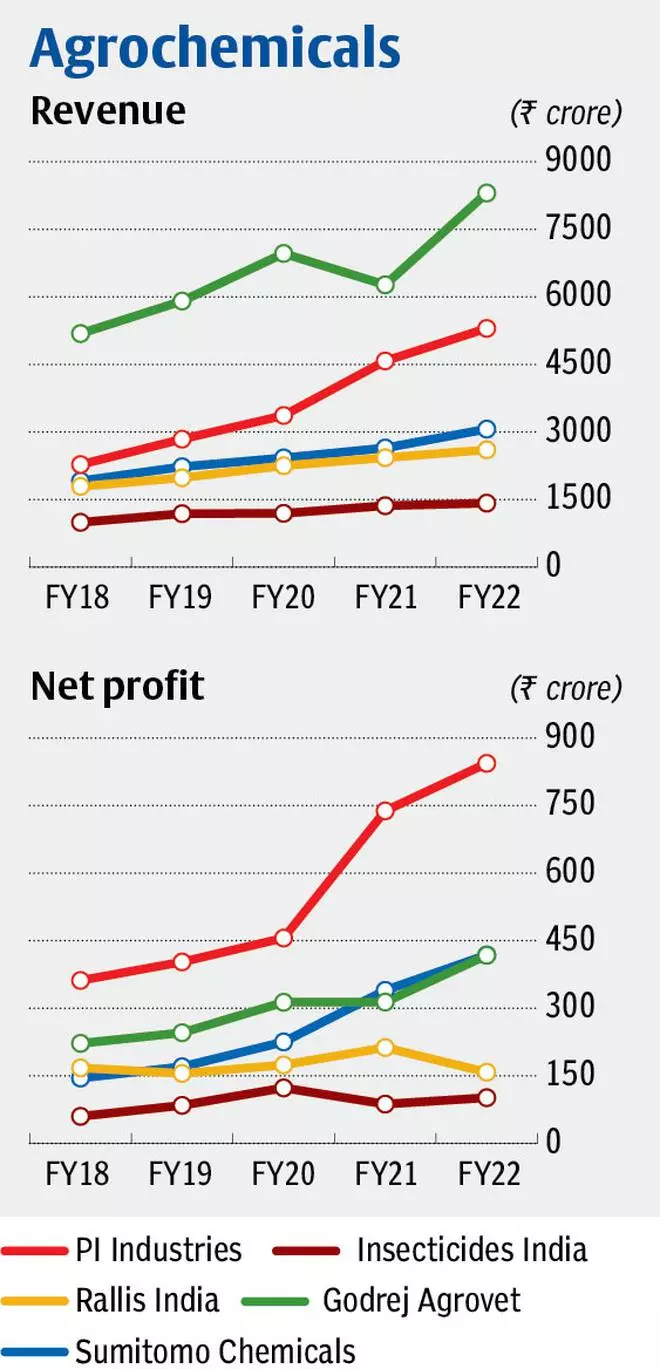

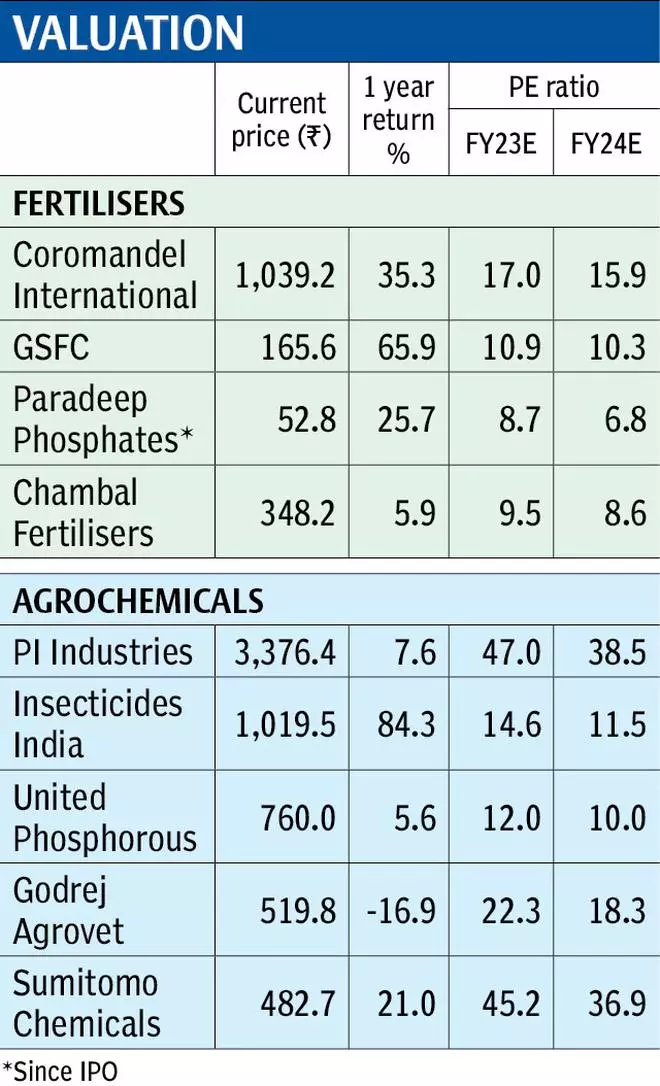

Lastly, on condition that world points reminiscent of local weather change and drought might impression export demand, pricing and receivables, domestic-focused gamers reminiscent of Pesticides India (95 per cent from India), Sumitomo Chemical substances (80 per cent) could also be insulated from world event-driven volatility. Corporations that get their lion’s share of income from exports embrace UPL (86 per cent), Sharda Crop Chem (100 per cent), PI Industries (74 per cent), and Meghmani Organics (89 per cent).

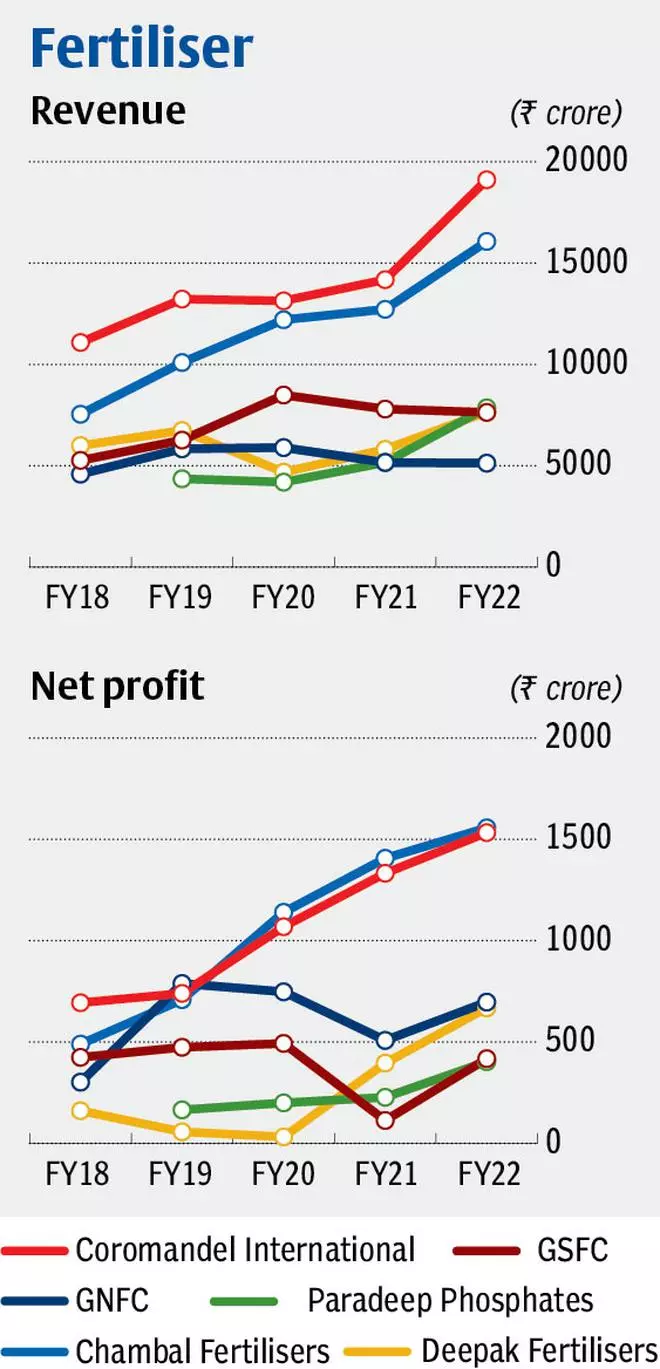

Fertilisers

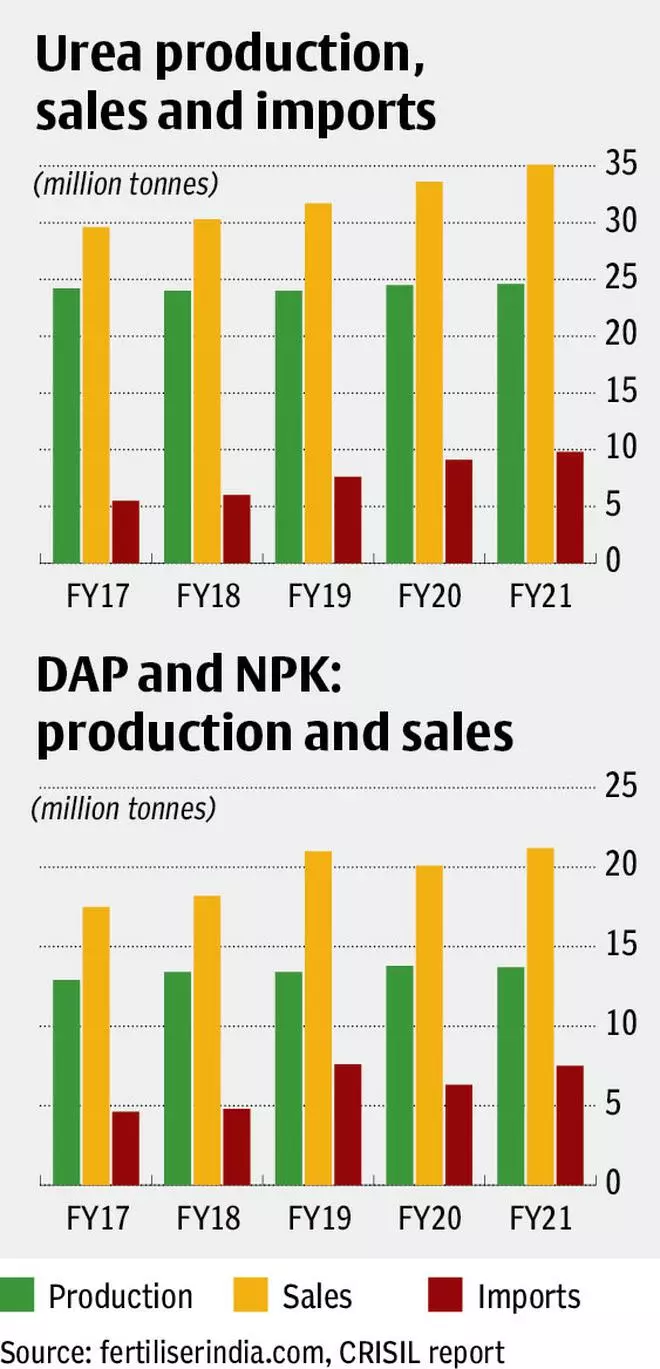

India is among the many largest shoppers of fertilisers, one other key agri enter. India meets about one-third of its wants by way of imports. Nevertheless, the demand for fertilisers has been resilient given the federal government’s subsidy help.

In India, the sale value of urea is mounted by the federal government at ₹5,360 a tonne (earlier than taxes), which is nearly one-third of its value. The steadiness is paid by the federal government as subsidy to the producers. This insulates farmers from value fluctuations, leading to regular demand.

The phosphatic and potassic fertilisers are at present decontrolled. The federal government fixes a subsidy for each nutrient (say N, P and Okay) and the steadiness is recovered from the farmer. Any value will increase within the enter prices are borne by the federal government by way of subsidy and are usually not handed on to the farmer.

If the drought in China and Europe continues, it could impression the general world demand for fertilisers. Slack in demand will imply decrease costs of fertilisers within the world market.

Whereas the autumn in world fertiliser costs will assist the Indian authorities save on its import invoice, for urea makers, this can be marginally unfavorable. The reason is that import parity costs are thought-about whereas computing the subsidy for urea producers on manufacturing over and above their reassessed capability. That mentioned, any decline in crude and fuel costs shall be constructive for urea producers in addition to the federal government.

India produces two-thirds of the home requirement of phosphatic and potassic (complicated) fertilisers, whereas the steadiness is imported. Therefore, the impression of worldwide complicated fertiliser value correction will largely profit the exchequer.

Alternatives

Given this backdrop, the prospects for phosphatic and potassic firms appear extra promising. The reason is the coverage regime which permits pricing flexibility, growing demand for decontrolled fertilisers, a few of that are differentiated merchandise reminiscent of GSFC’s 20:20:0:13, Paradeep Phosphates’ 19:19:19 and 10:26:26, to call a number of.

Greater fuel costs within the European market, as a consequence of non-availability of fuel from Russia, has made home ammonia manufacturing unviable in Europe and this opens up export alternative for Indian ammonia producers reminiscent of GNFC and GSFC.

Issues

The latest transfer by the federal government to promote all fertiliser merchandise as one model “Bharat” is a priority that has risen now. However it might not have any materials impression on fertiliser producers, on condition that India is a suppliers’ market with demand outstripping provide, therefore the manufacturing will get absorbed domestically. Fertilisers, significantly urea, is a commodity, and provides no differentiation and therefore branding doesn’t impression gross sales materially.

Therefore, we don’t see any near-term concern on account of the federal government’s proposal to model all fertilisers uniformly.

Branding shall be important solely when the nation’s manufacturing outstrips demand, and corporations should compete arduous to promote their product. This, we consider, could also be a number of years away, on condition that the fertiliser trade has not seen any significant investments within the final decade. Additionally, any new funding on this trade would require a beneficial coverage atmosphere for firms to commit giant long-term capital, given the capital-intensive nature of the enterprise.

Thus, general, for the agri inputs area, prospects within the medium time period are intact, the one wild card being altering monsoon sample.

#Harvesting #alternatives #agriinput #shares