Going ahead, the prospects for the trade look constructive with development anticipated to be led by the infra section which accounts for almost 25 per cent of demand for cement. A number of authorities schemes reminiscent of MGNREGA, PM Garib Kalyan Rozgar Abhiyan and State-level schemes reminiscent of Matir Srisht (West Bengal) and public work schemes (Jharkhand) are anticipated to assist demand too. If excessive rates of interest don’t play spoilsport, retail housing tasks, together with rural housing, are anticipated to choose up.

Here’s a temporary overview of the trade and the components that buyers have to know when investing in cement shares.

Trade lowdown

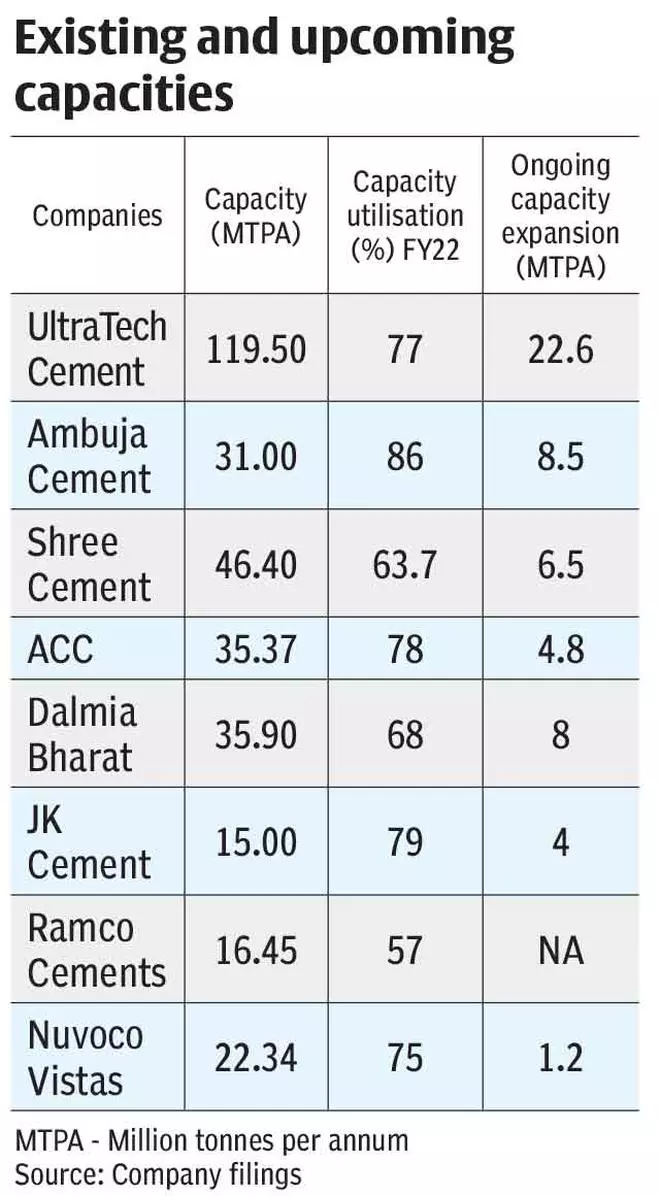

The whole put in cement capability of the nation is round 500 million tonnes every year (MTPA) with manufacturing of 298 MTPA. This makes the Indian cement Trade the second largest on the earth after China. The highest-20 cement producers within the nation contribute to almost 70 per cent of quantity within the nation. The trade is concentrated within the western and and southern areas.

The cement market could be broadly divided into 5 zones — North, South, East, West, Central. Among the many massive gamers, UltraTech Cement, being the most important participant within the trade, has important presence throughout all of the zones. Shree Cement has a big presence within the North zone.

Through the years, the trade has seen consolidation with smaller gamers being acquired by bigger ones. Examples embrace UltraTech’s acquisition of Binani Cement in addition to the merger of the cement enterprise of Century Textiles. In Could, Holcim introduced the sale of its stake in Ambuja Cements and ACC to the Adani group for about ₹50,200 crore. The Adani group will now turn into the second largest participant within the trade giving it a beneficial place within the West and North zones, which have been having fun with good pricing in latest occasions.

Materials sourcing and prices

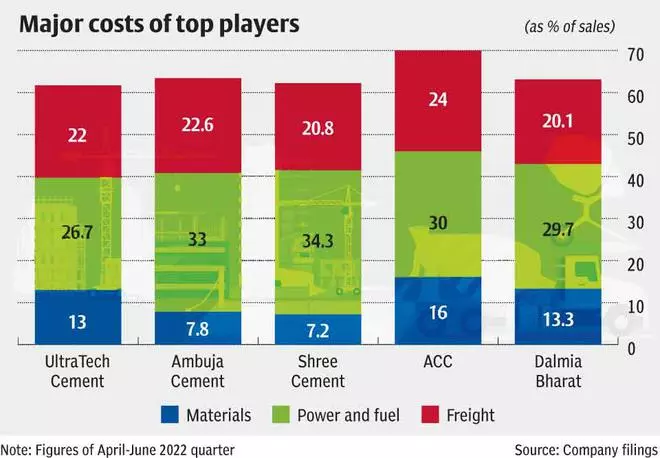

Within the cement trade, there are three primary elements of prices: energy and gas , freight and logistics , and uncooked supplies. Energy and gas contain crude oil, coal and pet coke; logistics value is very depending on crude oil costs. The important thing uncooked supplies that go into the manufacturing of cement are limestone and clay, which can be found within the nation. Fly ash from energy crops and blast furnace slag from metal crops are additionally added. It could, subsequently, not be a shock after we see a cement unit positioned strategically close to an influence plant or a metal plant.

For gas and energy, a lot of the firms use imported coal and pet coke whose costs are decided in worldwide markets and are susceptible to geopolitical dangers and forex charge threat. Though cement firms can use home coal (grade 7 or increased), energy producers have preferential allotment of coal and therefore different producers have to depend on imported coal. The whole provide of coal and lignite to cement trade by Coal India and Singareni Collieries has largely remained stagnant during the last three years, resulting in increased import dependence, in response to Hetal Gandhi, Director, CRISIL Analysis.

On the uncooked materials entrance, a lot of the firms have captive limestone mines and take part in public sale as and when required. In accordance with an Ambit Capital Report put out in March, UltraTech Cement has 4.5 billion tonnes of limestone reserves, adopted by Shree Cement with 2-2.5 billion tonnes and ACC, Ambuja Cements and Dalmia Cements have round 1 billion tonne of limestone reserves every.

Energy and gas and logistics value have been within the vary of 20-25 per cent of the gross sales income every and the uncooked materials value has been within the vary of 10-15 per cent of gross sales income from FY18 until FY22 for the highest firms. Therefore, firms that are capable of optimise prices take pleasure in higher EBITDA margins. Apart from, firms have been looking for alternate routes to cut back its energy invoice and together with it, begin being ESG-compliant too. One of many methods to do that is through the use of Waste Warmth Restoration System (WHRS). Firms additionally use supplies reminiscent of rubber crumbs, pharma waste and municipal waste for gas. The typical charge of mixing is 5-10 per cent, however few firms have been capable of take it up as a lot as 25 per cent, says Gandhi.

Take Shree Cement, as an example. In accordance with a latest Nirmal Bang report, Shree Cement, as an example, often targets cheaper gas and it makes use of 100 per cent pet coke for cement manufacturing which is a less expensive different. The corporate meets 50 per cent of its energy requirement by WHRS, thus decreasing coal requirement. The corporate can be growing its solar energy capability which is anticipated so as to add ₹50-60 crore to the underside line. These value management measures are a purpose why Shree Cement enjoys a premium valuation

UltraTech generates 1,188-MW energy, out of which 436 MW (36.67 per cent) is from WHRS, windmill and photo voltaic.

In latest occasions, prices beneath numerous heads escalated for firms within the wake of the Russia-Ukraine struggle. Pet coke costs virtually doubled from $210 per tonne in December 2021 to round $400 per tonne in Could 2022, however has cooled right down to $190 per tonne in August. One other vital supply of gas is imported coal, the value of which was $142.5 per tonne in December 2021 and touched $280 per tonne in Could 2022, whereas it’s $413.5 now. In March, the value of Brent went as much as as excessive as $134.9 per barrel, however has cooled right down to $95.8 per barrel now. Other than choices reminiscent of WHRS, firms are additionally attempting different options to regulate prices.

For instance, it was reported lately that UltraTech has procured 1.57 lakh tonnes of coal from Russia by paying in Yuan. The whole value labored out to be round $165 per tonne vs world costs of $397 per tonne One other latest media report by Reuters talked about that Indian cement firms have began procuring pet coke from Venezuela at a reduced worth vis-à-vis the US. Whereas pet coke has increased power content material than coal, it pollutes greater than coal too.

The Western market has the very best per capita consumption within the nation, whereas the Japanese market has the least per capita consumption, giving extra room for penetration and development.

Pricing

Other than value management, pricing is an important side which has important impression on the margins of the businesses. As per a latest JM Monetary report, the common all-India cement worth in Q1 FY23 was ₹394, 3.8 per cent increased than the previous quarter and 5.5 per cent increased than Q1 FY22. If one appears on the regional markets, the Japanese market has been the weakest by way of pricing and has lagged from different areas. There was no change in worth within the Japanese markets in Q1 FY23 from This autumn FY22; the value was stagnant at ₹357. Even on a year-on-year foundation, the value development was 2.8 per cent whereas in different markets like West and Central, the year-on-year development was 7.9 per cent and 12.2 per cent respectively.

Costs within the North and Central markets have constantly grown from March 2019 to March 2022. Worth of per cement bag within the Northern market has grown at a CAGR of 6.97 per cent on this interval to ₹398. Within the Central markets, the value per bag in March 2019 was ₹347, whereas in March 2022 it was ₹370. It should be famous that in these two markets worth has been rising steadily over the previous 4 monetary years with out a lot glitch.

The Western markets have additionally been fairly secure. The Western market has the very best per capita consumption within the nation, whereas the Japanese market has the least per capita consumption, giving extra room for penetration and development.

The Japanese market is anticipated to drive the demand within the medium time period, on account of elevated infrastructure spending by the federal government and decrease base. Therefore, gamers with a presence on this area or upcoming capacities on this area will profit. Ambuja Cements has deliberate for a 7-MTPA capability enlargement Sankrail and Farakka in West Bengal and a greenfield grinding unit at Barh, Bihar; Shree Cement is establishing a 3-MTPA unit in Purulia, West Bengal. ACC has ongoing tasks in Sindri (Jharkhand), Tikaria and Salai Banwa in West Uttar Pradesh. Dalmia is growing its brownfield capability in Calcom, Assam (1.2 MTPA), Mednipur, West Bengal (0.6 MTPA), and Kapilas, Odisha (0.4 MTPA).

Making the selection

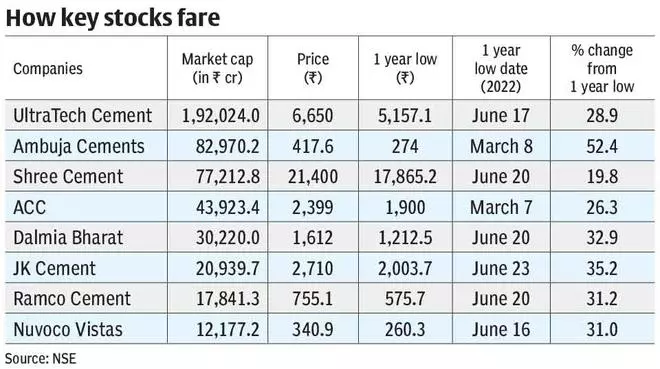

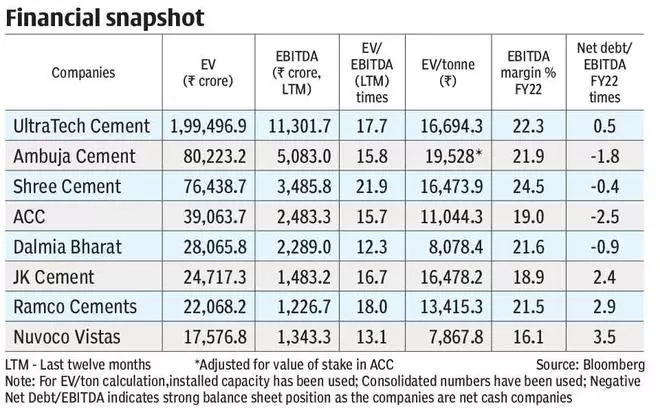

Thus, buyers in cement shares ought to take into account components reminiscent of entry to uncooked supplies, value management efforts, pricing stability capability utilisation and anticipated advantages from the upcoming capacities of firms earlier than they arrive at a brief checklist of shares. Coming to the financials, two components could be thought-about. One, debt ranges of firms, particularly for these embarking on capability enlargement. As an example, UltraTech, which is including about 22.6 MTPA capability now, has seen its internet debt to EBITDA for FY22 come right down to 0.53 occasions in comparison with 3.14 occasions three years in the past.

Two, the valuations must be thought-about. EV/EBITDA and EV/tonne are broadly used for valuing cement shares. EBITDA is a proxy for money flows and displays operational income. It provides an thought of what number of years of current-year money flows are required to make up for the worth of the agency (market cap + internet debt), represented by the Enterprise Worth or EV. In comparison with friends or historic common, a decrease ratio typically signifies beneath valuation. Utilizing EV/EBITDA as a metric to worth shares is frequent throughout industries the place leverage is broadly prevalent and companies are capital-intensive, together with cement.

EV/tonne is utilized in sectors reminiscent of cement and metals to evaluate whether or not the shares are buying and selling above or beneath their alternative prices (value of organising a brand new plant). In fact, the valuations also needs to be seen within the mild of how firms are positioned on different components talked about earlier, earlier than you zero in on a inventory. The accompanying tables places out these metrics for key firms.

(With inputs from Parvatha Vardhini C)

#Key #components #selecting #cement #shares