However within the final couple of weeks, the Securities and Alternate Board of India (SEBI) has been warning that the occasion is getting too wild. It has additionally determined to curtail the booze, by asking fund homes to conduct stress assessments of all their small and mid-cap funds, to evaluate if they may meet sudden redemption calls for. This has set off a correction in small and mid-cap shares and levelled internet asset values (NAVs) of funds.

Mutual funds have been conducting liquidity stress assessments of their mid-cap and small-cap funds and have began disclosing this information from March 15.

Right here’s all that that you must know.

What’s a stress take a look at?

Ever executed a treadmill take a look at for a well being check-up? On this take a look at, your coronary heart price is monitored when you stroll or run at a brisk tempo on a treadmill. This helps your physician gauge in case your coronary heart features nicely when subjected to irregular exercise.

Stress assessments of monetary establishments are comparable. They assist regulators or others gauge whether or not an establishment can perform usually if market circumstances flip hostile. Each six months, Reserve Financial institution of India conducts stress assessments of banks to evaluate if they may fall in need of capital or liquidity, in the event that they face stress conditions. Stress testing of small and mid-cap funds is an try to find out how funds fare in the event that they face massive and sudden redemption calls for.

Why do we’d like it?

In India, it’s not simply bond market liquidity that dries up when antagonistic occasions crop up. The liquidity for mid- and small-cap shares can dry up too. This wasn’t a really huge situation so long as small- and mid-cap mutual funds managed comparatively small belongings. However with the flood of cash up to now 12 months, small-cap funds have grown to handle ₹2.49 lakh crore and mid-cap funds ₹2.95 lakh crore by finish of February 2024.

The most important funds in these classes at the moment are at ₹25,000 crore to ₹60,000 crore. At this dimension, promoting even a 1 per cent place will imply placing by means of inventory gross sales of ₹250 crore to ₹600 crore, which markets can wrestle to soak up. If such gross sales had been to occur in shares with low liquidity, influence prices could also be excessive, leading to disproportionate NAV declines.

How are these assessments performed?

On the finish of every month, small- and mid-cap funds will calculate how lengthy it’s going to take to liquidate 50 per cent and 25 per cent of their portfolios primarily based on 4 assumptions. First, they may arrive on the common buying and selling volumes for all their inventory holdings for the previous three months. Two, they may exclude the underside 20 per cent illiquid shares. Three, they may assume a three-fold spike in volumes on a hypothetical buying and selling day when markets are below stress (greater market volatility often spikes volumes). 4, they may calculate what number of days it could take to promote their holdings, if in a position to take part to the extent of 10 per cent of a inventory’s traded amount on the given day. This yields the variety of days a fund will take to liquidate 25 per cent or 50 per cent of its portfolio.

Funds will disclose this information in a regular format on their web sites each month, beginning March 15, 2024. Comparable disclosures might be executed inside 15 days of the tip of each month in future. Together with the stress take a look at information, SEBI has additionally requested funds to reveal the belongings held by the highest 10 traders, money positions, trailing returns, portfolio PE and customary deviation.

How ought to traders interpret the info?

The primary information factors traders must look out for are the variety of days estimated for liquidating 50 per cent and 25 per cent of the portfolio. In addition they must verify if the fund has a focus downside — a number of traders holding a big proportion of belongings. Funds that take longer to liquidate their holdings can have a better problem in assembly distinctive redemption calls for. They may additionally face greater influence prices when promoting. Concentrated traders make a fund extra prone to lumpy redemptions.

What does the primary set of knowledge present?

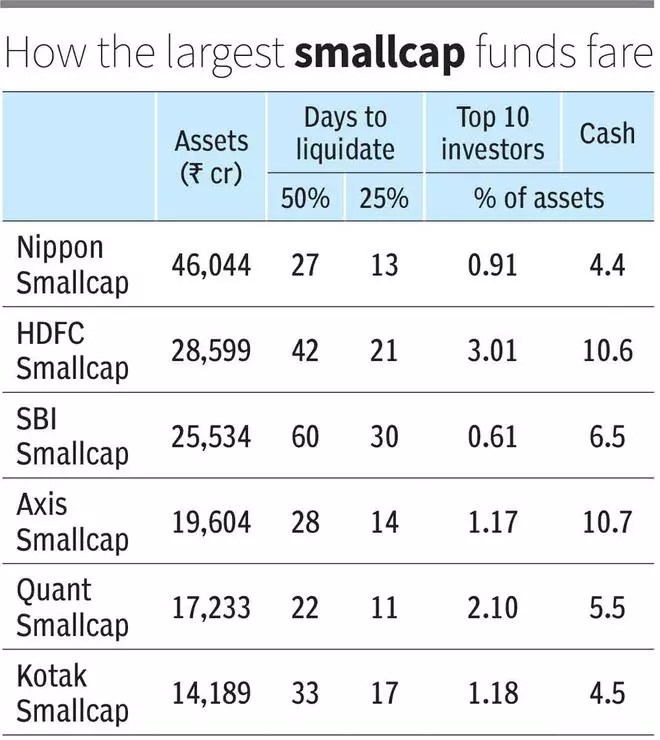

The information exhibits that small-cap funds have an even bigger problem in coping with stress eventualities, than mid-cap funds. The most important small-cap funds reported that they’d take anyplace between 22 and 60 days to liquidate 50 per cent of their portfolio and 11 to 30 days to liquidate 25 per cent. They held money positions starting from 4.5 to 11 per cent of belongings as a buffer. Investor focus wasn’t a problem, with their prime ten traders holding solely 0.61 per cent to 2.1 per cent of the belongings. Small-cap funds with belongings of ₹10,000 crore or extra, usually reported an extended time to liquidate.

SEBI guidelines allow all mid-cap and small-cap funds to carry money or different equities to the extent of 35 per cent of belongings. Small-cap funds that used this leeway to personal large-cap shares gave the impression to be higher positioned on liquidity in contrast to those who didn’t.

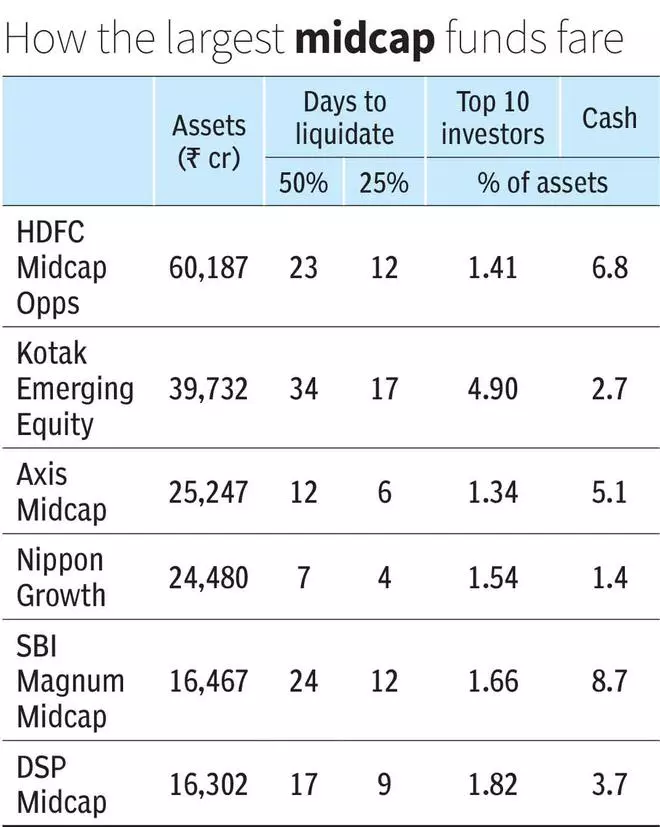

Mid-cap funds appear to hold a lot decrease danger from cumbersome redemptions in comparison with small-cap funds. Most mid-cap funds estimated taking about half the time to liquidate 50 per cent of their portfolios as small-cap funds from the identical AMC. Investor focus was barely greater for mid-cap funds, at 1.3 to 4.9 per cent. Once more, funds with important large-cap holdings had been higher off.

If a fund says it’s going to take 60 days to liquidate 50 per cent of its portfolio, does this imply it received’t honour redemptions?

No. You will need to hold three issues in thoughts when deciphering this information. One, stress testing is a hypothetical train which goals to seize what’s going to occur to a fund in an excessive state of affairs. Instances of mutual funds in India dealing with redemption calls for of 25 per cent or 50 per cent of belongings are very uncommon.

Once they’ve occurred, it’s debt funds which have confronted such pressures reasonably than fairness funds. Bond market liquidity in India is erratic and debt funds are patronised by company treasuries and establishments, which might set off lumpy redemptions. Fairness funds are held primarily by retail traders. Historical past means that, when markets fall, retail traders could cease new investments, however they don’t instantly redeem from fairness funds, as a consequence of loss aversion.

Two, AMCs are conscious of liquidity dangers in small and mid-caps and might use the 35 per cent leeway to carry large-cap shares, other than money. SEBI rules additionally permit funds to borrow to the extent of 20 per cent of belongings to fulfill short-term liquidity wants. This offers funds a major cushion.

Three, SEBI’s stress testing requirement is prone to power AMCs which have been flirting with dangers to loosen up on illiquid names and personal extra liquid names. In spite of everything, no open-end fund would love stress take a look at disclosures to alarm traders into redeeming.

If an antagonistic world occasion had been to abruptly unfold or markets had been to crash, can the stress situation play out?

Sure, it might probably. In actual fact, this stress testing relies on sure assumptions, resembling a spike in buying and selling exercise in a stress situation and particular person funds with the ability to promote 10 per cent of the day by day quantity. An actual-life state of affairs can end up worse than what’s being assumed. It’s also very tough to gauge in regular occasions, how liquidity or investor behaviour will play out in a disaster. However then, most monetary establishments are prone to crises in the event that they face an outflow of 25 or 50 per cent of their funds. So, there isn’t a level in staying away from small or mid-cap funds because of this.

Ought to traders promote their small-cap and mid-cap funds now?

That small and mid-cap funds are dangerous and maintain shares with patchy liquidity has been identified for a while. Stress testing solely quantifies the influence of those dangers. Due to this fact, stress testing can’t be a set off to promote your funds. But when you weren’t conscious of the dangers lurking in these funds whenever you invested and can’t deal with sharp draw-downs in NAV, you need to cut back your publicity to them.

You possibly can resolve to e-book earnings on any of your small or mid-cap holdings if in case you have uncomfortably excessive allocations to them inside your fairness portfolio or want the cash inside the subsequent 3-4 years. Promoting funds which are part of your long-term portfolio isn’t a good suggestion. Whereas exiting funds is simple, re-entering the identical funds on the proper time when the market is tumbling might be a tricky job. That the majority small-cap funds have stopped lumpsum investments and permit solely SIPs makes re-entry tougher.

#Smallcap #Funds #Midcap #Funds #SEBI #Stress #Checks