CAD narrowed to $10.5 billion (1.2 per cent of GDP) in Q3 (October-December) FY24, decrease than $11.4 billion (1.3 per cent of GDP) within the previous quarter. It narrowed appreciably vis-a-vis $16.8 billion (2 per cent of GDP) within the 12 months in the past quarter.

Merchandise commerce

The merchandise commerce deficit in Q3, at $71.6 billion, was up a tad than $71.3 billion a 12 months in the past.

A 16 per cent year-on-year (yoy) improve in web providers receipts to $45 billion ($38,7 billion a 12 months in the past) helped cushion the present account deficit.

Internet outgo on the first earnings account, primarily reflecting funds of funding earnings, elevated to $13.2 billion from $12.7 billion a 12 months in the past, per the RBI’s assertion on ‘Developments in India’s Steadiness of Funds’.

Additionally learn: Demonetisation: A stress check for the financial system

Non-public switch receipts, primarily representing remittances by Indians employed abroad, amounted to $31.4 billion, a rise of two.1 per cent over the extent within the corresponding earlier interval.

International portfolio investments, overseas direct investmentsand non-resident deposits remained strong within the reporting quarter.

FPI inflows up

FPI recorded a web influx of $12 billion in Q3, increased than $4.6 billion a 12 months in the past. Internet FDI flows jumped to $4.2 billion ($2 billion). Non-resident deposits in Q3 rose to $3.9 billion from $2.6 billion a 12 months in the past.

Exterior business borrowings to India recorded a web outflow of $2.6 billion as in contrast with a web outflow of $2.5 billion a 12 months in the past.

Additionally learn: Monetary circumstances could also be much less supportive of progress in fiscal 2025: Crisil

“The present account deficit narrowed in Q3 regardless of a wider merchandise commerce deficit, cushioned by a report excessive providers commerce surplus and secondary earnings. Optimistic FDI and FPI flows saved the BoP (Steadiness of Funds) in surplus. We count on present account financing wants to stay manageable this fiscal 12 months and the following,” stated Rahul Bajoria, Head of EM Asia (ex-China) Economics Analysis, Barclays Funding Financial institution.

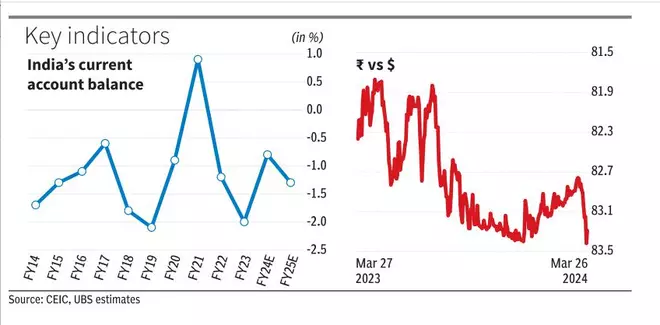

In a report, UBS Securities India stated that primarily based on its evaluation, the edge CAD degree for India is 2.2-2.5 per cent of GDP in a gradual state, assuming actual GDP progress of 6-7 per cent, with inflation averaging 4-5 per cent and the price of exterior liabilities at 2-3 per cent, holding the edge degree of web exterior liabilities regular.

#CAD #dips #GDP #providers #exports #rise