US operations

The US is the biggest marketplace for Lupin (37 per cent of gross sales in Q3FY24) and can proceed to be so within the medium time period. In comparison with two years again, when 5 of its vegetation have been underneath US FDA observations, Lupin has managed to clear three of them and the resultant movement of product launches has began from FY24.

The first launch has been that of gSpiriva. The inhalation product accredited for COPD had innovator-level gross sales of $1.2 billion. Within the first 12 months, even assuming nominal low cost and penetration, Lupin ought to mop up $150-200 million. That is 20-30 per cent larger than earlier analyst estimates, as Lupin reported that neither an authorised generic (from the innovator) or different competitors is at the moment anticipated. The corporate expects to collect 40 per cent market share inside a 12 months and to maintain the share with out competitors for a minimum of two extra years. For comparability, Lupin US gross sales in FY23 have been $623 million.

Complementing gSpiriva might be a number of different injectables, ophthalmics, and complicated merchandise. Key of these launches might be Bromfenac (launched), Mirabegron, Pegfilgrastim, Tolvaptan, Liraglutide and others. The pipeline additionally holds biosimilar Ranibizumab, and three different respiratory merchandise, that are additionally giant alternatives.

Excessive base of operations

Lupin maintains that it will probably maintain its new base of $200 million per quarter in FY25-26 and given the power of launches, the corporate can sufficiently meet the expectations. Assuming a 50 per cent likelihood of approval for brand spanking new merchandise in FY25, Lupin ought to cut back to $1 billion in gross sales from US in FY25 itself, a scale it final achieved in FY17 earlier than going through headwinds.

From such base within the US, Lupin could discover driving excessive development within the US difficult. A nominal 5 per cent value erosion in base portfolio would suggest that Lupin would want a number of blockbusters together with oral stable dosages and different generics to ship even a single-digit annual development. The present spree of launches was aided by the back-to-back plant approvals, which allowed for a slew of product approvals it had been engaged on within the backdrop.

Focus danger additionally runs excessive with Lupin. Three merchandise in respiratory account for near half of Lupin’s US revenues — gSpiriva, gAlbuterol and gBrovana. Any sudden competitors in any of the three can danger a steep fall in revenues and the valuation premium at the moment assigned.

India and Different markets

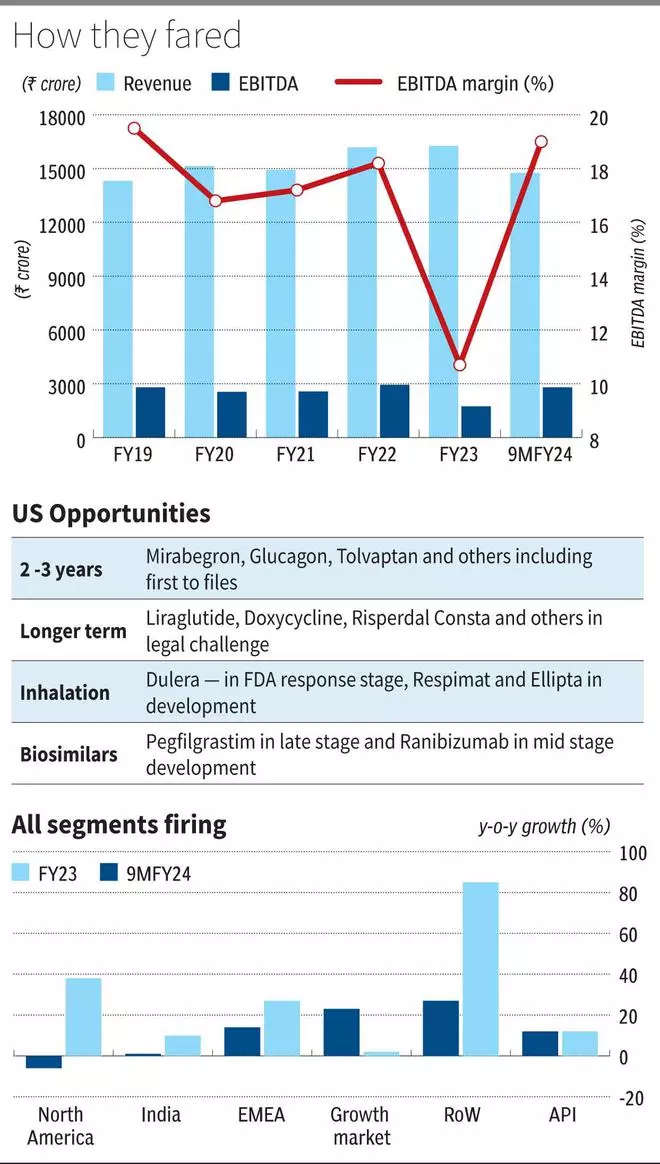

India accounts for 34 per cent of gross sales in Q3FY24 and EMEA, Development Markets and RoW accounted for 10/9/4 per cent respectively. These segments are additionally within the midst of a revival at the moment, aiding the present valuation premium for Lupin. India has gained from gross sales power addition of 20 per cent within the final one 12 months. Indian development in FY23 was impacted by pricing restrictions and lack of exclusivity in diabetes remedy space.

With headwinds within the background and new approvals, India section has reported 10 per cent YoY development in 9MFY24. As the brand new gross sales power good points traction, India, within the quick time period, can maintain above-market-growth charges. The opposite three markets are additionally on a robust footing, aided by gFostair (respiratory product) launch gaining traction in European markets and product launches in different markets over a excessive base in FY23.

Finance and valuation

Lupin’s internet debt has come all the way down to ₹1,043 crore (0.28 instances EBITDA) as of December ‘23 and the corporate is anticipated to be debt-free by 12 months finish. The robust money flows have lowered the corporate’s leverage place. Lupin began the fiscal 12 months hoping to exit with an EBITDA margin of 18 per cent, which it has achieved by Q3FY24. The margins had stooped to as little as 9 per cent in FY23 earlier than the turnaround. Analyst estimates are actually anticipating one other 200-300 bps enchancment within the subsequent two years as effectively, driving earnings development of 130 per cent CAGR in FY23-25.

On the excessive base of expectations, the ahead earnings a number of of 32 instances FY25 earnings is at a 20 per cent premium to final five-year vary. Earnings development may be realised, pushed by the launch calendar and margin enlargement from the resultant working leverage. However on such a excessive base, Lupin could revert to normalised single-digit earnings development from FY26, which ought to lead to tempering of valuations. Therefore, buyers can lock in on the good points and ebook earnings now.

#Lupins #Market #Robust #revival #priced #valuations