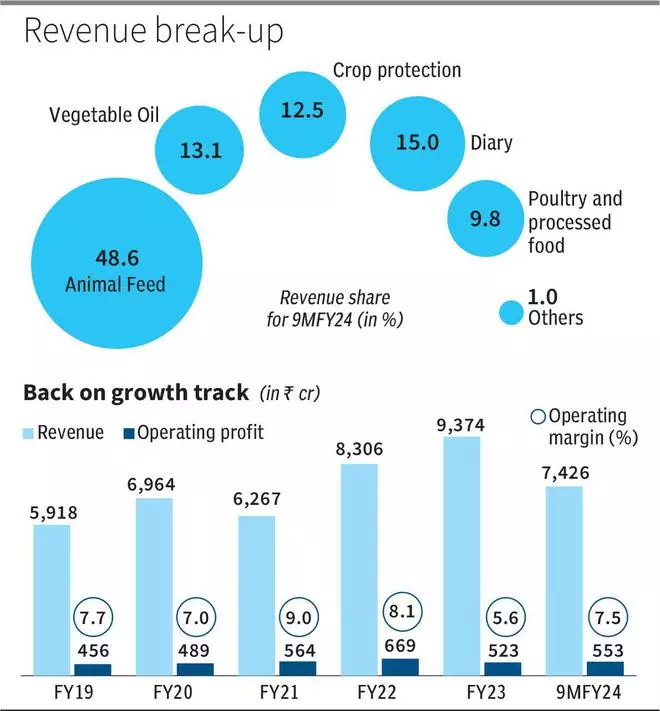

The corporate’s enterprise can broadly be segmented into 5 key divisions: Animal feed enterprise (accounting for almost half the corporate’s income as of 9MFY24), dairy (15 per cent), vegetable oil (13 per cent), crop safety (12.5 per cent) and poultry processed meals (10 per cent).

The corporate’s growth initiatives within the crop safety phase, vegetable oil and dairy enterprise will drive wholesome development within the medium time period. On the present worth of ₹485, the inventory trades 28 occasions its trailing twelve-month earnings as in comparison with 5 12 months common of 30 occasions. We imagine that the inventory holds good potential over the subsequent 2-3 years, as administration is now consolidating the enterprise with a transparent imaginative and prescient to give attention to companies with robust development potential, enhance operational efficiencies and give attention to backside line enchancment.

On a relative foundation, the inventory might seem pretty priced in comparison with trade. Nonetheless, the explanation for a similar is the earnings compression witnessed over the past two years. With the revenue development anticipated to maintain at a wholesome tempo over the subsequent couple of years, the inventory makes for a superb funding for these with a medium-term horizon.

Enterprise

The group’s shopper foray began method again in 1897, by means of merchandise akin to swadeshi soaps. The group has since organised all its companies and Godrej Agrovet is the agribusiness firm from the Godrej secure.

At present, animal feed enterprise, which incorporates poultry, cattle and aqua feed, is the biggest phase inside Godrej Agrovet, accounting for over 48 per cent of the income (9M FY24). With over 30 manufacturing items and presence not solely in India, but in addition in Bangladesh by means of its JV ACI Godrej Agrovet, the corporate is the biggest compound feed participant within the Indian market. Robust development in fish feed phase and the commissioning of a brand new facility in Uttar Pradesh final 12 months to cater to the North and East markets ought to help development.

Nonetheless, the problem stays by means of regulatory strikes akin to permitting soymeal imports, which may danger short-term development. Final 12 months, the corporate invested ₹20 crore in Godrej Maxximilk Personal Restricted, which is into improvement of high-quality cattle embryo, publish which the corporate introduced that it had achieved new milestones in R&D and manufacturing.

The third largest phase — vegetable oil, whereby the corporate manufactures and sells Crude Palm oil and Palm Kernel Oil, accounts for 13 per cent of Godrej Agrovet’s income. The corporate is the biggest producer of oil palm and has a share of over 30 per cent within the Indian market. Curiously, India imports over 97 per cent of its oil palm want.

Godrej, with partnerships with over 9,000 farmers throughout the nation and a possible cultivation space exceeding 2 lakh hectares, is well-placed to capitalise on the large native demand. The brand new refinery with a capability of 400 MTPD and Solvent Extraction plant with capability of 200 MTPD, and the industrial MoUs with varied State governments — Assam, Manipur, Tripura, Nagaland and Odisha for palm plantation — will drive development on this phase.

Plant safety chemical substances phase contributes about 12 per cent to the corporate’s income. This consists of Astec enterprise which is the institutional enterprise whereby the corporate does contract analysis and improvement (CRDO) for different massive gamers. Moreover this, the corporate additionally has a home formulations phase whereby it sells generic branded fungicides, herbicides and pesticides to finish prospects.

The portfolio additionally consists of a variety of merchandise that cater to all the lifecycle, akin to plant development regulators and natural manures. It’s the world’s largest producer and marketer of Homobrassinolides, a plant hormone used to stimulate development and enhance yield. The corporate has began capital growth initiatives value ₹300 crore for growth in Astec Lifesciences and is assured of robust income development yearly.

The dairy enterprise below Creamline Dairy Merchandise accounts for 15 per cent of the income at present. Offered below “jersey” model title, the corporate is focussing on worth added dairy merchandise. The corporate has an combination processing capability of 1.36 million tonnes per day and has robust presence within the South — Tamil Nadu, Andhra Pradesh, Telangana, Karnataka and Maharashtra. Final 12 months, it expanded its packaging capability, including a brand new line, with which its capability in the present day stands at 70,000 litres per day. Worth added merchandise and capability growth ought to drive the expansion on this phase.

Poultry and processed meals bought below Actual Good Hen and Yummiez model account for 10 per cent of income. This division is a JV between Godrej and Tyson Meals, US.

Efficiency

In FY23, the corporate reported weak efficiency due to a couple one-off causes, akin to hostile regulatory transfer to permit imports of soymeal, enter worth fluctuations on account of which the working revenue margin took a success. Whereas income grew by about 13 per cent as in comparison with the earlier 12 months to ₹9,374 crore, working revenue declined by 22 per cent largely on account of uncooked materials worth enhance.

Nonetheless, within the 9MFY24, although the income development was flat, the corporate has managed to develop working revenue by 21 per cent, due to wholesome efficiency within the home plant safety chemical substances enterprise, dairy phase. Over the subsequent two-three years, profit from working leverage and growth in CRDO, dairy and animal feed ought to help sustainable development in income and earnings.

#Godrej #Agrovet #Good #Funding #Mediumterm #Horizon