The Fed, in its newest financial forecast launch in March this 12 months, has projected its median fund charge to be at 4.6 per cent for 2024. The median fund charge is at present at 5.37 per cent. So, that leaves the door open for a complete of 75 foundation factors (bps) minimize within the US rates of interest this 12 months. Six extra Fed conferences will probably be held this 12 months.

Market expects the Fed to start slicing rates of interest in June. In line with the CME FedWatch Instrument, the chance of seeing a charge minimize in June is 51 per cent. CME FedWatch Instrument provides the probability/chance of change within the Fed fund charge and financial coverage.

So, what occurs to totally different asset lessons comparable to equities, bond yields, currencies and gold as soon as the rate of interest minimize begins? Here’s a examine based mostly on the previous information.

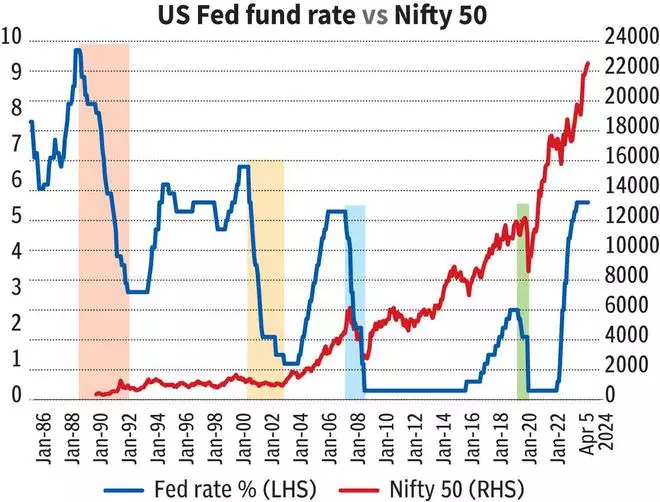

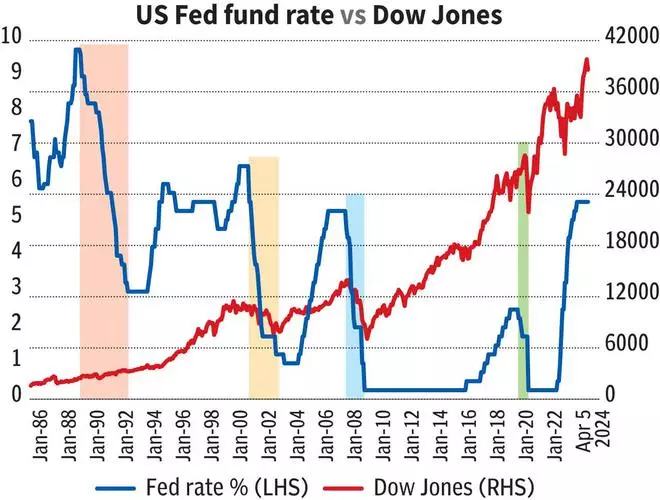

On this examine, we see how equities, bond yields, currencies, and so on, have moved previously throughout the charge minimize cycle within the US. We now have seemed on the US rates of interest historical past from 1986. Since then, there have been 4 charge minimize cycles. Primarily based on technical evaluation, we additionally attempt to give our projections as soon as the speed minimize begins this 12 months.

Break up into phases

Our examine analyses how the asset lessons have carried out in two phases. Part one will assess their efficiency within the interval throughout which the rates of interest within the US have been retained at their peak for a while earlier than the speed cuts started. The second section is how equities, currencies, gold, and so on, have carried out throughout the charge minimize cycle.

Equities: Dow Jones, Nifty crushed down

When rates of interest have been retained at their peaks, equities have gone up on a regular basis. The interval between June 2006 and August 2007 was the perfect among the many 4 charge minimize cycles analysed since 1989.

Throughout this time, the Dow Jones rose 20 per cent and the Nifty surged 43 per cent. The 12 months 2000 was an exception for the Nifty the place it fell 8.5 per cent.

Alternatively, equities have declined sharply within the charge minimize cycle section. Certainly, Nifty has been crushed down extra badly than the Dow Jones on this section. As an illustration, from July 2019 to March 2020 when the Fed decreased the charges from 2.25 per cent to 0.25 per cent, the Dow Jones fell about 12 per cent. Nifty, then again, tumbled about 28 per cent.

The interval between June 1989 to September 1992 was an exception. Right here, when the charges fell from 9.75 per cent to three per cent, the Dow Jones surged about 32 per cent. Information out there in Bloomberg from July 1990 reveals that the Nifty has surged 170 per cent.

Takeaway

Historical past means that the fairness markets can run right into a sell-off probably within the second half of this 12 months when the Fed begins to chop charges. So, it’s extra probably that the present rally within the Dow Jones and the Nifty is coming near their tops. Traders should stay cautious.

On the charts

Nifty (22,514) has room to the touch 23,650 on this quarter assuming that the speed is retained at this peak of 5.5 per cent until June. Thereafter, when the Fed begins to chop charge, a corrective fall to 21,500-21,000 is feasible. If the sell-off worsens, 20,000-19,500 may be seen on draw back.

Dow Jones (38,904) can contact 40,800 on the upside from right here. After that, we might get a corrective fall to 38,000-37,000.

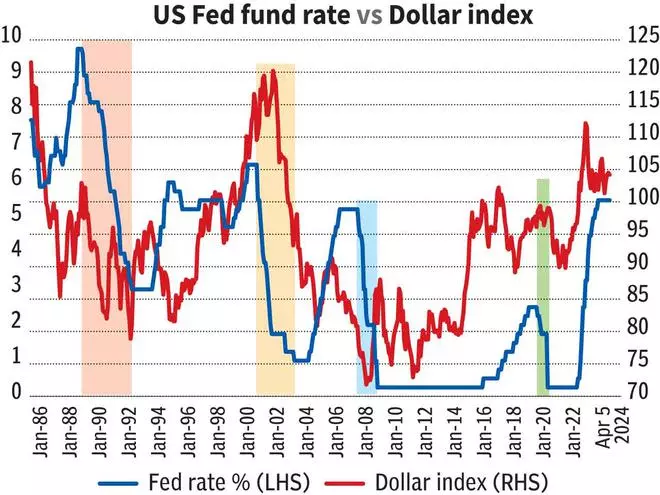

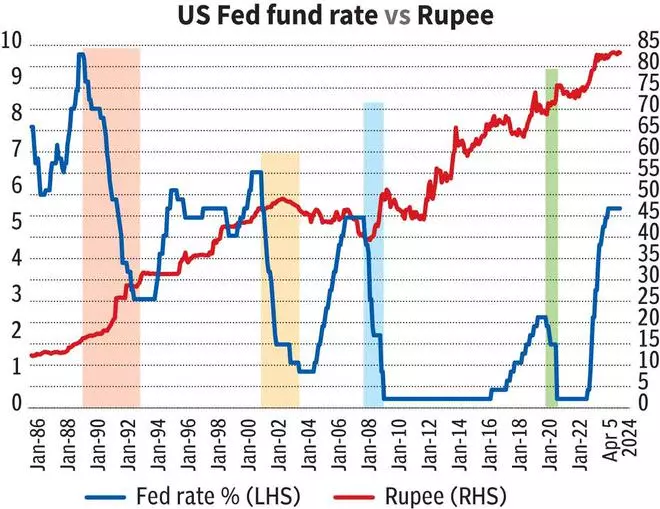

Currencies: Combined greenback and weak rupee

The efficiency of the greenback index has been combined in each the phases (ie, rates of interest being held on the peak and throughout the charge minimize cycle). So, it is going to be troublesome to take a selected stance on the greenback index as soon as the speed minimize begins this time. One particular development that’s seen right here is that the extent of weak spot is rather more than the quantum of energy within the greenback in each the phases. That’s, the energy within the greenback index has been subdued to a mean of two per cent. However, if the greenback declines in any of those two phases, the weak spot prolonged to a mean of about 10 per cent.

In case of the Indian rupee, it’s evident that it has at all times weakened in opposition to the greenback throughout the charge minimize cycle section. The interval of January, 2001 to June, 2003, when the charges have been minimize from 6.5 per cent to 1 per cent, was an exception. On this interval , the rupee gained marginally by 0.4 per cent.

Takeaway

The prevailing development within the greenback index can prevail for a while, atleast till the rates of interest are retained on the present peak. If the development reverses after the speed minimize begins, then we are able to see some weak spot within the greenback.

Rupee is making an attempt to weaken progressively over the previous couple of weeks. Taking a look at historical past, we are able to anticipate the rupee to see extra weak spot within the second half of this 12 months throughout the charge minimize cycle.

On the charts

The greenback index (104.28) has sturdy help round 103. It may well rise to 106-107. The worth motion thereafter will want an in depth watch. Whether or not the index breaks above 107 or not will decide the subsequent course of transfer.

The Indian Rupee (83.30) has been range-bound between 82.50 and 83.50 since September final 12 months. We are able to anticipate the rupee to stay under 82.50. If the development of rupee weak spot continues this time additionally when the Fed begins to chop charges, then we are able to see the home forex weakening in the direction of 85.75-86.25 this 12 months.

Bond Yields: Peaks and tumbles

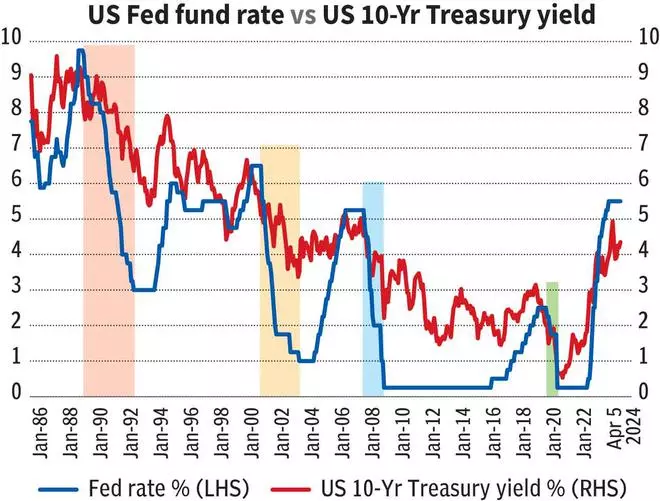

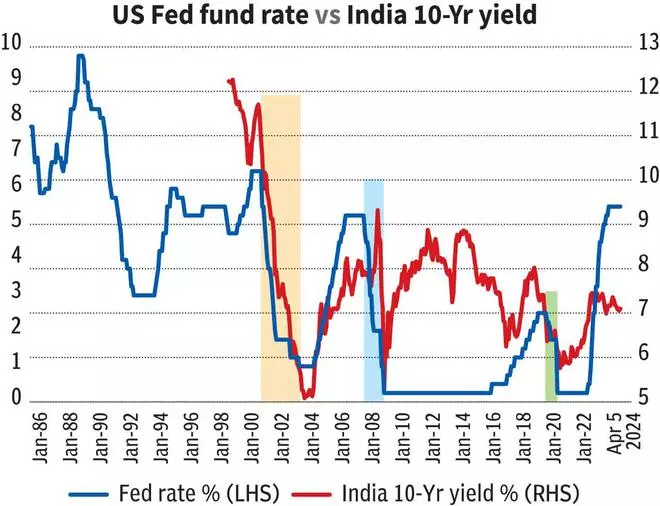

The bond yields, each the US and India, have virtually adopted the identical sample. The US 10Yr Treasury and India’s 10Yr Authorities bond yields both peak simply earlier than the rate of interest within the US peaks or throughout the time when the charges have been retained on the highs.

However, the speed minimize cycle phases have been very unhealthy for the bond yields. Each the US and Indian 10Yr bond yields have been knocked down badly throughout this time. As an illustration, when the rates of interest within the US fell from 5.25 per cent (August 2007) to 0.25 per cent (December 2008), the US 10Yr yield fell from round 4.5 per cent to 2.2 per cent. The Indian 10Yr bond yield tumbled from round 7.94 per cent to five.26 per cent.

Takeaway

The US and Indian bond yields are more likely to drift decrease in the direction of the top of this 12 months as the speed minimize cycle begins. Though the US 10Yr Treasury yields have been rising just lately, the upside may very well be capped from right here as seen from historical past. The identical would be the case with the Indian yields additionally.

On the charts

The US 10Yr Treasury yield (4.40 per cent) has sturdy resistance round 4.6 per cent. We are able to anticipate it to show down from there and fall under 4 per cent within the coming months. The draw back is open to see 3.8 and even 3.6 per cent.

The Indian 10Yr Authorities bond yield (7.12 per cent) has room to check 7.2-7.3 per cent. However an increase past 7.3 per cent is unlikely. The yield can fall to six.9-6.8 per cent within the coming months.

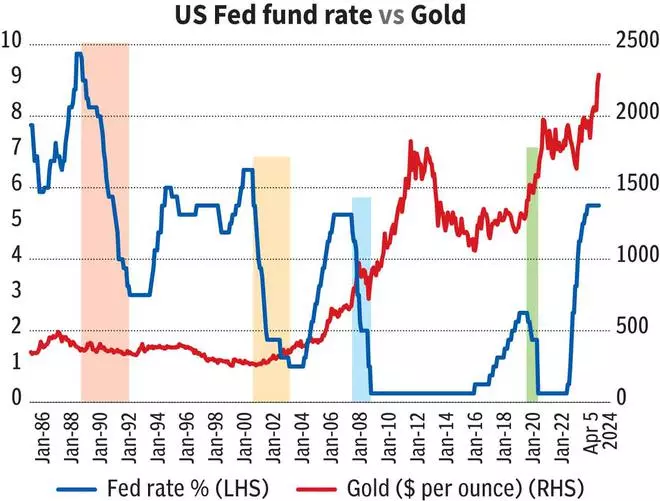

Gold: To shine extra

Besides in 1989-1992, gold has carried out properly in each intervals of the rates of interest being held on the highs and throughout the charge minimize section. In 1989-1992, gold fell 6.5 per cent when the charges have been retained on the peak and three per cent throughout the charge minimize section.

Within the different situations, the speed minimize cycles have been superb for the yellow steel whereby it has given a mean return of 25 per cent.

Takeaway

Gold value has been surging since final month. So, the development of the yellow steel gaining sheen now at charge peaks and after the speed cuts start is more likely to stay intact this time additionally. So, we are able to search for increased gold costs, going ahead.

On the charts

Gold ($2,330 per ounce) has sturdy helps at $2,200 and $2,100. It has potential to focus on $2,450-2,475 on the upside within the second half of this 12 months. Gold value will come below strain provided that it declines under $2,100. That appears much less probably.

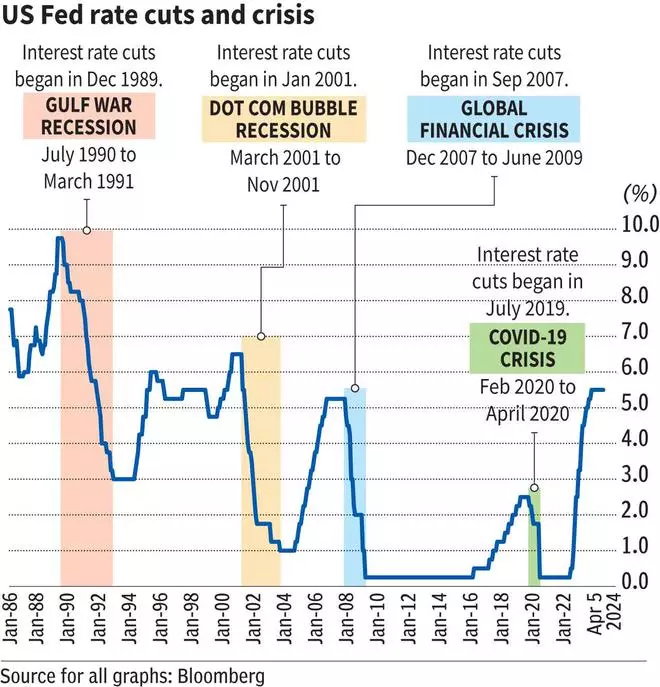

Price cuts and disaster

A examine on the historic Fed Fund charges since 1986 signifies {that a} disaster in some kind has occurred after the rate of interest minimize cycle begins. As an illustration, in 2000, the rates of interest peaked within the US in Could at 6.5 per cent. After that, the primary charge minimize was carried out in January, 2001. Then in March, 2001, the dotcom bubble burst occurred, which lasted until November 2001.

Equally, rates of interest peaked at 5.25 per cent in June, 2006. Thereafter, the primary charge minimize started in September, 2007. Two months later, the International Monetary Disaster (GFC) hit the markets in December, 2007.

So, are we heading into some type of disaster like previously after the Fed begins to chop charges, probably in June? Previous efficiency is not any assure of the long run. However, what if historical past repeats itself? So, it’s higher to stay cautious.

#Nifty #Dow #Jones #USDINR #Gold #Greenback #Index #Bond #Yields #Transfer #Fed #Cuts #Charges #12 months