High performers

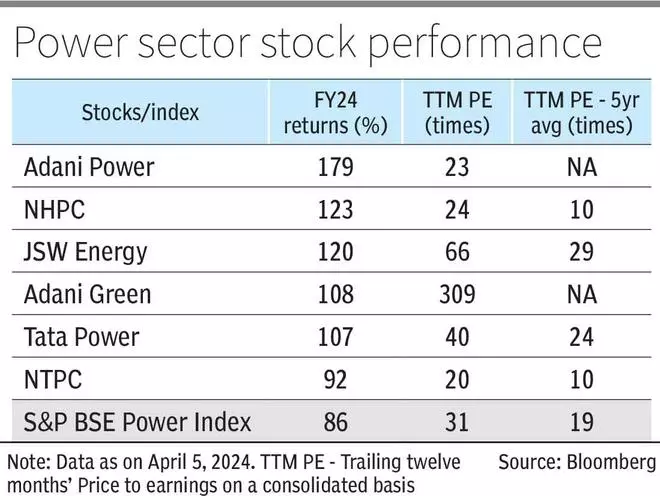

Adani Energy, India’s largest personal thermal energy producer, emerged because the standout performer, buying and selling at a P/E (TTM) of twenty-two. Adani Energy’s fortunes improved as a result of decision of regulatory points, and receipt of previous regulatory claims as famous by credit standing company ICRA. The corporate goals to broaden its thermal energy capability by almost 6 GW, propelling its general capability to surpass 21 GW over the following 5 years, as per its investor presentation.

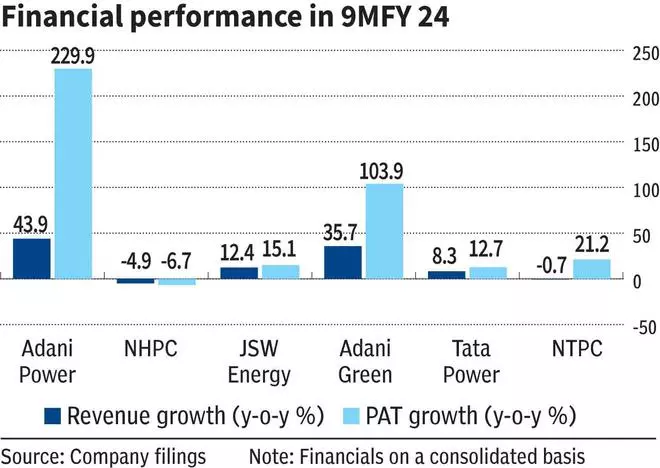

Throughout 9MFY24, Adani Energy reported a income development of 44 per cent YoY whereas the PAT has elevated greater than threefold on account of upper income from the Godda thermal energy plant (commissioned in Q1FY24) and decrease import gas price.

Furthermore, the renewable vitality arm of Adani Group, Adani Inexperienced Vitality is steadfast in its ambition to realize 45 GW capability by 2030, with current milestones of surpassing the ten GW put in capability mark within the final week. In FY24, the inventory value has greater than doubled, in sync with income and PAT development of 36 and 104 per cent, respectively.

Following them, NHPC, with a 15 per cent share of the nation’s hydro-electric capability, has surged over 123 per cent in FY24, regardless of challenges stemming from diminished energy technology as a consequence of constrained water availability and opposed climate circumstances in some elements of Himachal Pradesh. Undeterred, NHPC is diversifying its operational portfolio by commissioning photo voltaic and wind energy vegetation. The corporate at the moment has an put in capability of round 7,097 MW (hydropower includes 98 per cent) whereas it’s establishing round 10,449 MW capability, with 3,135 MW devoted to solar energy.

Personal energy utility corporations JSW Vitality and Tata Energy, buying and selling at TTM P/E of 66 and 40 occasions respectively, have seen their inventory value bounce by 120 per cent and 108 per cent in FY24, respectively, pushed by new renewable vitality capability additions. JSW Vitality has reported a 12 per cent YoY enhance in the course of the 9M FY24 on account of upper internet energy technology. As compared, Tata Energy registered 8 per cent YoY development and likewise confronted operational price escalations. Notably, Tata Energy’s dominant market share within the rooftop photo voltaic phase positions it to capitalise on the alternatives offered by PM Surya Ghar Muft Bijli Yojana introduced in Price range 2024.

The PSU thermal main NTPC’s inventory has gained 92 per cent in FY24 underpinned by vital enchancment in operations and substantial capability additions in each thermal and renewable vitality segments whereas the income noticed a marginal decline of 0.7 per cent throughout 9MFY24. It at the moment trades at a TTM P/E of 20 occasions.

Outlook

Trying forward, the Central Electrical energy Authority (CEA) forecasts energy demand to escalate to 260 GW by the upcoming summer season and a staggering 366 GW by 2032. In response, the federal government has intensified its give attention to augmenting incremental thermal capability to bolster vitality safety whereas additionally pursuing the bold goal of attaining 500 GW of put in technology capability from renewable sources by 2030, signalling a decisive shift in direction of inexperienced vitality. Furthermore, the directive for imported-coal based mostly (ICB) energy vegetation to maintain full-capacity operations till September 2024 is anticipated to additional buoy the sector’s development trajectory, amplifying the optimism surrounding energy sector entities.

#Adani #Energy #NHPC #JSW #Vitality #Adani #Inexperienced #Tata #Energy #NTPC #Shares #turbocharged #BSE #Energy #Index #alltime #excessive