- Additionally learn: Banks’ credit score development to sluggish a mite to about 14-15% in FY25

15 of the 20 largest banks in India logged beneficial properties in market capitalisation, with 13 of them posting double-digit will increase. Market capitalisation of all PSU banks, on the checklist of the nation’s 20 largest banks, improved from the earlier quarter.

“India expects its $3.5-trillion financial system to develop 7.6 per cent in FY24 in contrast with 7.0 per cent in FY23, making it the fastest-growing main financial system. The federal government is spending billions of {dollars} upgrading the nation’s infrastructure, constructing highways and airports. The federal government’s deal with such long-term tasks probably profit state-owned banks greater than personal lenders as they historically have larger publicity to those sectors,” the be aware mentioned.

Toppers

Indian Abroad Financial institution led the nation’s 20 largest banks, logging a 38.5 per cent sequential enhance in market capitalisation to ₹1.13-lakh crore as of March 2024. Punjab & Sind Financial institution and Financial institution of Maharashtra ranked second and third, with beneficial properties of 38.4 per cent and 38.1 per cent, respectively.

- Additionally learn: Public sector banks’ dividend payout could exceed ₹15,000 crore in FY24

However, solely ICICI Financial institution and Sure Financial institution noticed an enchancment amongst personal banks, posting single digit development in market capitalisation. All 5 banks that witnessed a decline of their market capitalisation have been personal sector banks — HDFC Financial institution, Kotak Mahindra Financial institution, Axis Financial institution, IndusInd Financial institution and IDFC First Financial institution, per S&P information.

Investor sentiment towards Indian banks, particularly PSU banks, has notably strengthened lately as a consequence of sturdy credit score development in a fast-growing financial system. The Nifty PSU Financial institution Index surged by greater than 22 per cent in Q1, whereas the Nifty Personal Financial institution Index declined by over 5 per cent in the identical interval.

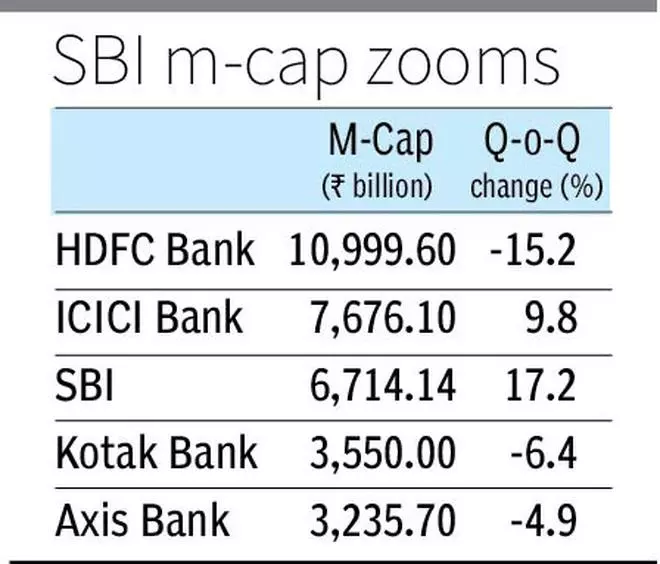

The personal financial institution index was dragged down by HDFC Financial institution, which includes about 26 per cent of the index. Market capitalisation of HDFC Financial institution declined 15.2 per cent on quarter to just about ₹11-lakh crore. Even so, HDFC Financial institution retained its place as the highest financial institution. ICICI Financial institution and State Financial institution of India, too, held their second and third ranks, respectively.

#PSU #banks #beat #personal #friends #market #capitalisation #beneficial properties