As per the corporate, Lithium-ion demand in India is predicted to develop by almost 3x-4x throughout 2025-30 (from 40-50 GWh in 2025 to 150-160 GWh by 2030), aided by sturdy Authorities coverage and regulatory assist, and elevated market adoption. With a view to capitalise on this chance, Exide had arrange two subsidiaries — Exide Vitality Personal Restricted (EEPL) in 2018 and Exide Vitality Options Restricted (EESL) in 2022. EEPL has an order ebook of ₹600-700 crore as of September ‘23.

With EESL, the newer entity, Exide intends to supply a extra full end-to-end answer. The corporate signed a long-term technical partnership with SVOLT Vitality Know-how (SVOLT), for manufacturing lithium-ion cells. SVOLT specialises within the growth and manufacture of lithium-ion batteries and storage options for a number of purposes. EESL is establishing a 12 GWh inexperienced subject undertaking for li-ion cell manufacturing at a complete funding of ₹6,000 crore. Section 1 of the undertaking with 6 GWh capability is predicted to be accomplished by 2025.

The variety of registered EV autos in India has been rising quickly with a CAGR of almost 77 per cent throughout FY18-24, going by knowledge from Vahaan. With centered coverage intervention and elevated market adoption, the EV market is predicted to proceed this sturdy progress momentum. Practically 70 per cent of Exide’s income is derived from the auto business, with lead acid batteries being the first product providing.

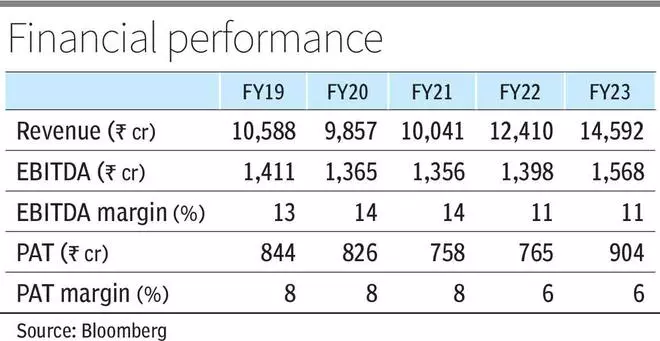

Because of being largely tied to the home auto demand cycle, the corporate’s monetary efficiency over the previous couple of years has been muted. Its core income grew at a CAGR of almost 9 per cent throughout FY18-23 with margins being underneath stress.

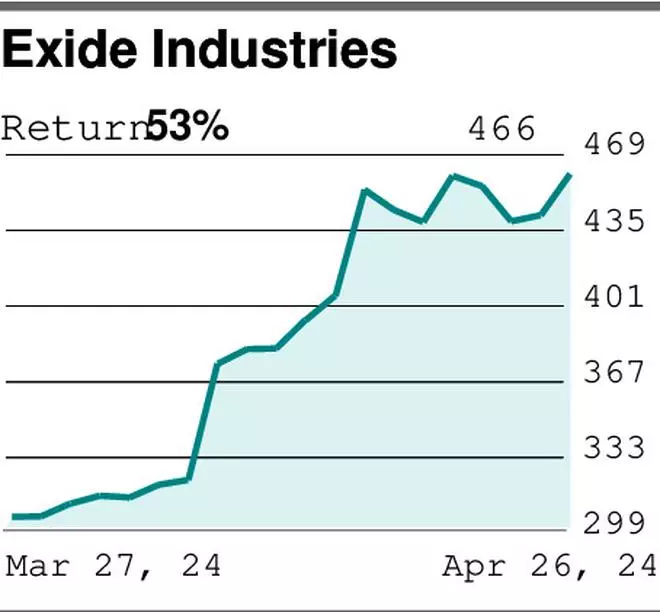

Throughout this part, the inventory was down almost 20 per cent and underperformed the broader market and the auto sector. Current developments have renewed investor optimism within the inventory. Alongide, the valuations have moved up too. Bloomberg consensus estimates present an anticipated income CAGR of almost 13 per cent throughout FY24-26 and EBITDA margin enlargement of fifty bps. The inventory is at present buying and selling at a ahead P/E of 30x, a premium of almost 75 per cent over its two-year common.

#Actuality #Verify #Provide #Prospects #Energise #Exide #Industries