Amongst India’s top-10 mutual fund corporations, UTI Asset Administration Firm (UTI AMC) is among the oldest gamers within the house, with a protracted monitor document operating to a number of many years.

Aside from mutual funds, the corporate additionally runs a a lot bigger PMS (portfolio administration service) enterprise (which incorporates the worker provident fund organisation: EPFO) and is a significant participant within the nationwide pension system (NPS) house as properly. It additionally has worldwide and alternate options segments.

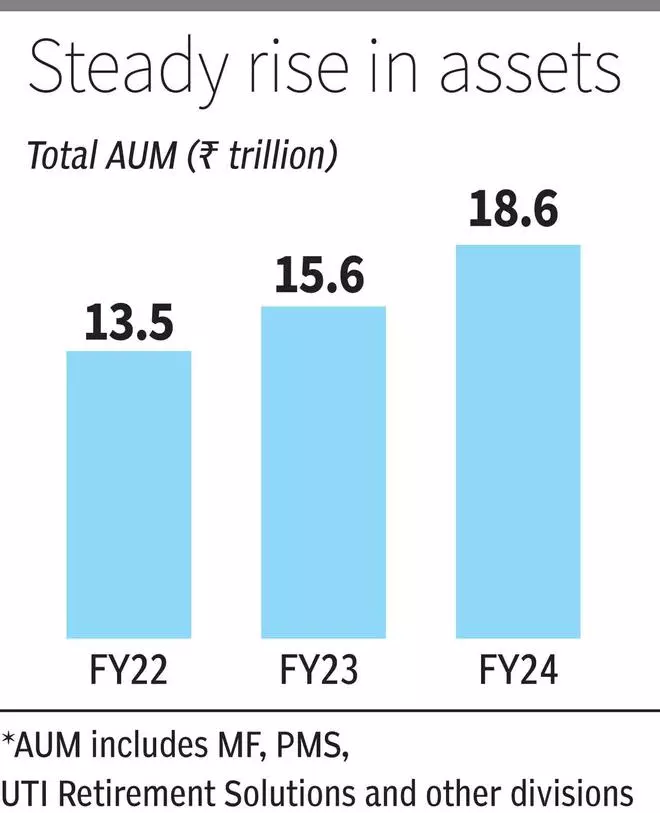

Collectively, UTI AMC manages ₹18.5 trillion as of March 2024.

Regular development in mutual fund AUM, affordable flows through the systematic funding plan (SIP) route and a wholesome mixture of asset courses unfold throughout a number of avenues are key positives for the corporate.

In some segments similar to hybrid and debt, the fund has executed properly, although most of the AMC’s fairness funds have some catching as much as do.

At ₹976, the inventory trades at 16 instances its per share earnings for FY24 and slightly over 14 instances its anticipated EPS for FY25. That is at a steep low cost to HDFC AMC’s PE of 40 instances and Nippon Life AMC’s 33 instances primarily based on FY24 earnings. When the market capitalisation to AUM ratio is taken, Nippon Life AMC’s determine is at about 7.1 per cent, and HDFC AMC’s is 13.1 per cent. When UTI AMC’s mutual fund AUM to its market capitalisation is taken, it’s lower than 4 per cent – it’s a lot decrease if NPS and PMS belongings are included.

UTI AMC’s valuations are thus at a steep low cost to friends, even taking the corporate’s decrease mutual fund AUM into consideration. Buyers should buy the inventory with a three-year perspective.

The corporate’s working (EBIT) margins have all the time been comfy at properly in extra of 40 per cent.

There’s additionally the added incentive of being a dividend yield inventory at 2.3 per cent in FY24 (4 per cent if particular dividend is taken into account).

In FY24, UTI AMC’s revenues rose 37 per cent over FY23 to ₹1,737 crore, whereas web income elevated 75 per cent to ₹766 crore. The figures embrace truthful worth modifications, curiosity and dividend revenue and rental revenue. Excluding these, the income development determine is 5 per cent, whereas the web revenue development is 8 per cent.

MFs, retirals and PMS

Market regulator SEBI has maintained a hawk’s eye on mutual fund expense ratios in recent times. Even so, many fund homes have nonetheless managed to increase their revenues and develop their belongings strongly.

UTI AMC manages ₹2.9 trillion (up 21.8 per cent YoY) in mutual funds as of March 2024, with a market share of 5.37 per cent and it’s the eighth largest fund home by AUM in India.

Its SIP belongings have risen sharply by almost 43 per cent from ₹21,509 crore in March 2023, to ₹30,747 crore as of March 2024. As a lot as 90 per cent of UTI AMC’s systematic investments guide tends to remain for greater than 10 years, and 95 per cent for greater than 5 years. The trade common is lower than 30 per cent.

UTI AMC has a big passive funds (ETFs and index funds) AUM. At ₹1.15 trillion as of March 2024, it’s up 39.5 per cent YoY. It has a market share of 13.2 per cent, which locations it among the many high few within the trade.

The debt and hybrid fund classes have additionally grown at a wholesome tempo within the final one 12 months.

The nonetheless low penetration of mutual funds in India in comparison with most different rising and superior nations, speedy digitisation leading to ease of investments through on-line platforms and the rising incomes and financialisation of financial savings are components that might give additional thrust to asset development.

Its PMS enterprise, which incorporates EPFO, Coal mines provident fund, ESIC and so forth., manages a staggering ₹12.25 trillion as of March 2024, which is up almost 17 per cent YoY.

With the thrust on employment creation, development in EPFO enrolments and the growing emphasis on investing within the markets for retiral funds to have the ability to cater to long-term wants of subscribers, this house is about for additional growth within the case of UTI AMC, as solely a restricted quantity is allowed and there may be little competitors.

Different development areas

UTI Retirement Options, a subsidiary of the corporate, manages pension funds, notably the NPS. The division manages ₹3.02 trillion in belongings as of March 2024 (up 25 per cent YoY). For the reason that public sector NPS can be managed by the subsidiary, it has a big 25.8 per cent share in NPS belongings.

In view of the growing thrust to NPS by the federal government, given the pension burden an outlined pensions scheme imposes, there may be ample scope for development within the section, which can profit the corporate.

UTI Worldwide, one other subsidiary, is a supervisor of offshore funds and has ₹27,645 crore in belongings and is rising steadily.

General, UTI AMC has a number of development areas exterior the mutual funds enterprise and is a resilient long-term participant within the asset administration and retiral companies.

#OldTime #Asset #Administration #Firm #Resilient #Funding