We have a look at the mutual funds route for investing within the banking phase.

With a plethora of choices in each lively and passive methods, and an equally good return efficiency, traders have many choices within the phase. We not too long ago beneficial Nippon India ETF Financial institution Bees within the passive area. Within the lively area, traders can contemplate ICICI Pru Banking & Fin or Nippon India Banking & Monetary Companies funds, which have delivered excessive returns and overwhelmed benchmark constantly.

Valuations, earnings development

Nifty Financial institution, buying and selling at 15.5 occasions trailing earnings, is at a 30 per cent low cost to its final 5 years trailing PE. Even on a trailing value to ebook ratio, the index is consistent with its five-year common at 2.4 occasions. Nifty50, then again, buying and selling at 23 occasions trailing earnings or 3.8 occasions value to ebook (trailing), is consistent with its five-year common and at a major premium to banking shares.

The sector returns have additionally been underwhelming. Within the final yr or final 5 years, the banking index has returned 13 per cent/62 per cent in contrast with Nifty50 returns of 26 per cent/92 per cent. This regardless of a robust earnings development for the banking index which exceeds Nifty50 earnings development within the final two years. Nifty Financial institution has reported earnings development CAGR of 29 per cent in FY21-23 in contrast with Nifty50’s CAGR development of 21 per cent in FY21-23. But it surely needs to be famous that consensus estimates for Nifty50 for FY23-25 are larger at 20 per cent in contrast with 17 per cent for Nifty Financial institution index.

Sturdy credit score development led by retail phase and decrease credit score prices are present drivers for the sector. The much-anticipated rebound in personal capex publish elections and an anticipated rebound in web curiosity margins pushed by rate of interest cuts can maintain the earnings momentum of the sector. The optimistic Indian GDP development estimates for FY25 and past are additionally optimistic tailwinds for the sector.

Mutual fund route

Regardless of optimistic undercurrents for the banking sector, traders can spend money on phases contemplating the pending election end result and uncertainty in world monetary macros and geo-political unrest.

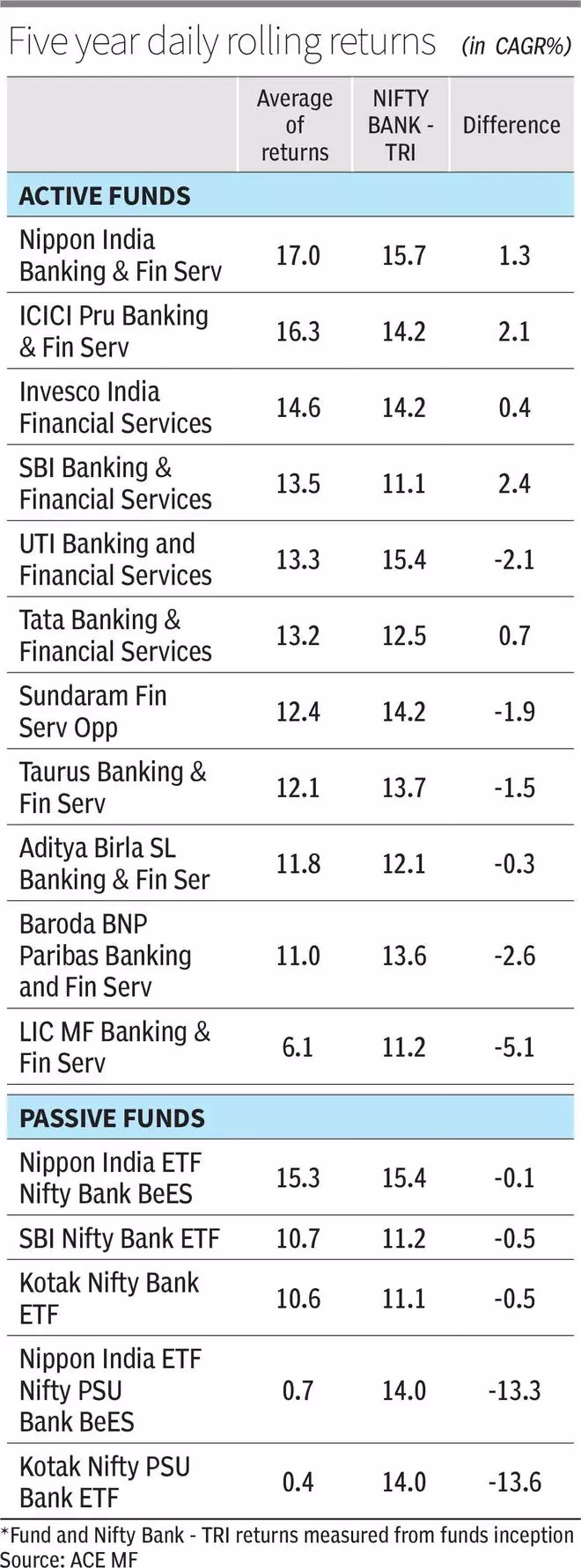

There are 11 mutual funds with greater than 5 years of historical past in lively mutual funds. Nippon and ICICI’s banking funds have delivered an every day common five-year CAGR development of 16.9 per cent and 16.3 per cent respectively since their introduction. Additionally the 2 funds have returned unfavourable returns over a five-year interval — a negligible lower than 1 per cent of the time since inception.

In contrast with a benchmark – Nifty Financial institution TRI over their working durations, of the 11 funds, solely 5 funds have overwhelmed the benchmark on every day common five-year CAGR development.

Over a shorter timeframe of three years, the identical two funds lead the charts however with the addition of Mirae Asset’s banking fund (however shorter 3.3 yr historical past).

Within the passive area, there are just a few mutual funds monitoring the index however primarily ETFs of which there are 4 with greater than five-year historical past. Of the 4, Nippon Nifty Financial institution ETF has the least monitoring error with Nifty Financial institution index at 13 foundation factors over 5 every day common of 5 yr CAGR returns. The ETF additionally delivered a median 5 yr CAGR of 15.3 per cent which is akin to the main lively funds and higher than most different lively funds. For traders passive route of investing which entails decrease bills, this fund may be perfect.

#Banking #BFSI #Mutual #Funds