In accordance with 4 bankers conscious of the matter, UAE’s largest financial institution, First Abu Dhabi Financial institution (FAB), and Japan’s main lender, Mizuho Financial institution, have proven curiosity buying SBI’s stake in Sure Financial institution.

Whereas NBD Emirates, additionally headquartered within the UAE has evinced curiosity in YES Financial institution, FAB and Mizuho are stated to be main the race.

Discussions with RBI

It’s gathered that Mizuho Financial institution has appointed Financial institution of America to run the deal. FAB has had a couple of rounds of discussions with the Reserve Financial institution of India on the acquisition beneath varied buildings.

The mandate to discover a purchaser for SBI’s shares has been given to Citibank and, in keeping with sources, the funding financial institution is reaching out primarily to massive overseas buyers. “A key directive given to the funding banker is that the deal ought to fetch prime greenback overseas direct funding into the banking area,” stated a banker conscious of the event.

Additionally learn: Kotak Mahindra Financial institution: Shedding the underperformer tag could also be a troublesome job

At current, no home investor or overseas personal fairness fund has been approached.

Emails to SBI, Sure Financial institution, FAB and Mizuho Financial institution remained unanswered until press time.

Contours of deal

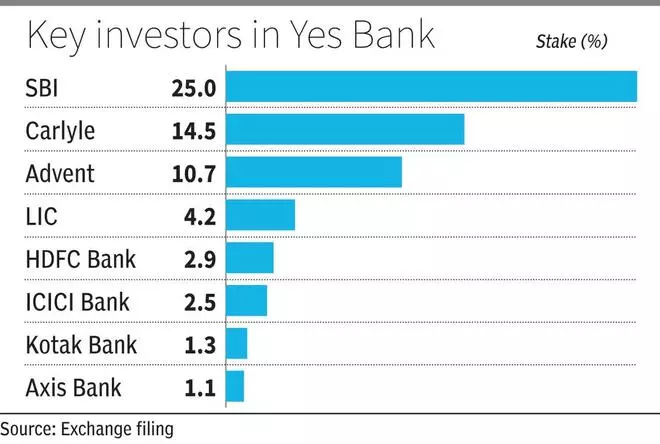

In accordance with newest shareholding sample of Sure Financial institution, SBI holds 25.02 per cent. buyers have been requested to contemplate three choices vis-a-vis SBI’s stake — take the 26 per cent stake; go as much as 49 per cent which might contain making an open supply after taking on SBI’s stake; and, final, if the investor is eager on a easy majority shareholding of 51 per cent, apply to the Reserve Financial institution of India.

Additionally learn: AU SFB to discover common financial institution conversion

The RBI’s 2016 grasp course on possession in personal sector banks permits overseas funding from all sources, that’s, FDI, overseas institutional buyers, and non-resident Indians, as much as 74 per cent of the paid-up capital.

FAB and Mizuho Financial institution have department operations in India. They function in company finance and world transaction banking, catering to massive abroad company clients. Nevertheless, globally, FAB and Mizuho are identified for his or her retail banking strengths and FAB particularly for its bank card merchandise.

YES Financial institution bailout

To place issues in perspective, in March 2020, SBI led the consortium of banks that bailed out Sure Financial institution when it was positioned beneath moratorium. SBI picked up 48 per cent, whereas HDFC Ltd and ICICI Financial institution took 10 per cent every with Axis Financial institution, Kotak Mahindra Financial institution, IDFC First, Federal Financial institution and Bandhan Financial institution selecting up smaller stakes. Collectively, the eight banks held about 75 per cent in Sure Financial institution.

In accordance with the newest inventory alternate information, aside from SBI, Axis Financial institution, Kotak Mahindra Financial institution, ICICI Financial institution and HDFC Financial institution collectively maintain 7.7 per cent in Sure Financial institution.

Sure, there’s a lot curiosity!

- UAE’s First Abu Dhabi Financial institution and Japan’s Mizuho Financial institution stated to have curiosity to amass SBI’s 25% stake in Sure Financial institution

- Citibank dealing with the mandate to search out purchaser for SBI’s stake

- I-bank presently reaching out to massive overseas buyers for this function

- buyers requested to contemplate three choices:

- Purchase 26 per cent stake in Sure Financial institution

- Enhance stake to 49 per cent stake by open supply

- Search RBI okay to amass 51 per cent stake in Sure Financial institution

#Abu #Dhabi #Financial institution #Mizuho #Financial institution #race #SBIs #stake #Financial institution