- Additionally learn:Indices surge on world cues, rally in financial institution shares

Marginally higher than anticipated This fall earnings and a correction in oil costs led to a constructive begin to the week. A establishment by the Fed that hinted that charges may stay greater for longer led to a broad-based correction.

Market Turbulence

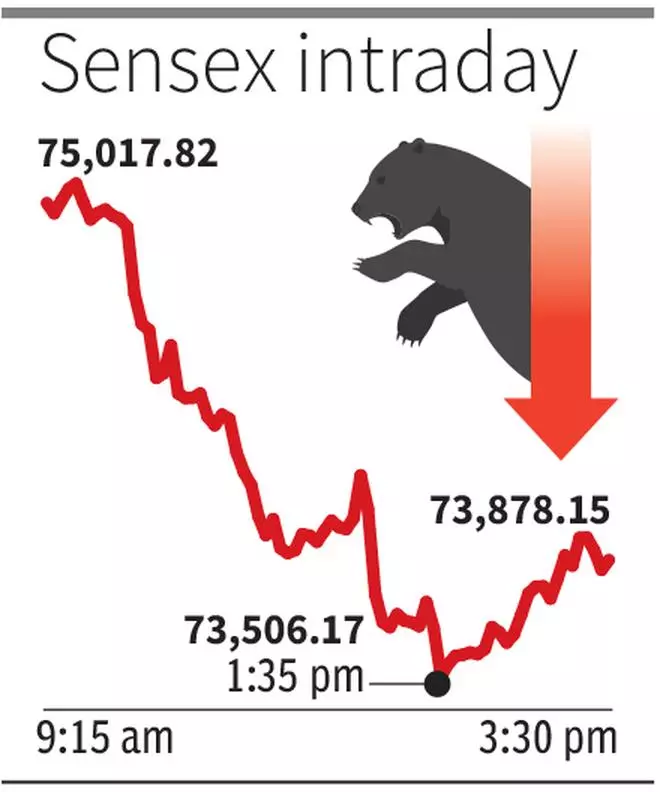

On Friday, the Nifty slid 0.7 per cent to finish at 22,475, whereas the Sensex shed practically a per cent to shut at 73,878, greater than 1,000 factors beneath the day’s excessive.

The Nifty Financial institution closed 0.6 per cent decrease to settle at 48,923. The volatility index, India VIX, rose sharply by 8 per cent to 14.62.

Money market volumes on the NSE remained regular at ₹1.26-lakh crore. Broad market indices fell lower than the Nifty even because the advance decline ratio fell to 0.52:1.

Bharti Airtel, Reliance Industries, and L&T slid over 2 per cent every. Coal India was the highest gainer, up 4.5 per cent. A reduction rally was seen in Bajaj Finance after the RBI lifted restrictions from its eCOM and Insta EMI Card with rapid impact, which was a significant overhang on the corporate. Baring Pharma and Healthcare, all sectors resulted in crimson.

International Outflow

International portfolio buyers continued their promoting spree, offloading shares price ₹2,391 crore, whereas home buyers purchased shares price ₹690 crore, provisional information confirmed.

“We count on a level of consolidation available in the market resulting from costly valuations and any election-led jitters. The FPIs proceed to stay internet sellers available in the market, which has impacted the efficiency of large-cap shares,” mentioned Vinod Nair, Head of Analysis, Geojit Monetary Companies.

He added that the continued outcomes season will likely be a key issue for buyers to align their portfolios. The market may also stay vigilant concerning the BoE coverage and GDP information from the euro zone.

International equities have been principally greater on Friday forward of key US non-farm payroll numbers, helped by reassurance from the US Fed that the following transfer in charges could be down. Asian shares surged to their highest in 15 months on Friday, with the Cling Seng index the highest gainer.

US employers added a seasonally adjusted 175,00 jobs in April because the unemployment price ticked as much as 3.9 per cent.

The IMF upgraded India’s financial development forecast to six.8 per cent for FY25, pushed by strong public funding. In April, India’s GST assortment reached a report of ₹2.1-lakh crore, up 12.4 per cent from ₹1.87-lakh crore the earlier yr, pushed by a strong 13 per cent improve in home transactions, indicating robust native demand.

- Additionally learn:Index Outlook: Sensex, Nifty 50, Nifty Financial institution: Brief-term outlook is combined

The Nifty faces rapid resistance at 22600 ranges, with the following draw back at 22120.

“The short-term Nifty development appears to have reversed down. The upper high of the bullish sample is prone to have accomplished on Friday on the swing excessive of 22794, and the short-term downward correction is anticipated within the coming classes,” mentioned Nagaraj Shetti, Senior Technical Analysis Analyst, HDFC Securities.

#Indices #slide #promoting #heavyweights