Trade insiders and shoppers businessline spoke to need the federal government to expedite the establishing of a well being regulator or cut back the GST price from present 18 per cent to curb the surging value of medical health insurance.

Tops retail inflation

In accordance with Srinath Sridharan, an insurance coverage buyer, the rise in well being premiums exceeds the common retail inflation price by 3-4x.

“The sector’s basis seemingly rests on a mistrust of its clients, burdening policyholders with the onus of proof and claims efforts. That is evidenced by the persistently low claims ratio and payouts,” he stated.

Furthermore, shoppers are sometimes left holding exorbitant hospital payments, in what can solely be described as ‘fleecing’, Sridharan stated. “Maybe it’s time to contemplate regulatory measures to revive affordability and bolster client confidence in healthcare providers,” he stated.

Hovering premium

As an illustration, a medical health insurance policyholder, who sought anonymity, stated that the annual premium for a ₹10-lakh cowl has elevated from ₹29,740 for protection interval of April 2018-April 2019 to ₹31,305 for April 2019-20, April 2020-21, April 2021-22) to ₹34,822 (April 2022-April 2023) to ₹42,486 for (April 2023-24) and to about ₹51,000 for April 2024-25.

- Additionally learn: Well being cowl for senior residents: Common insurers gearing up to herald new merchandise

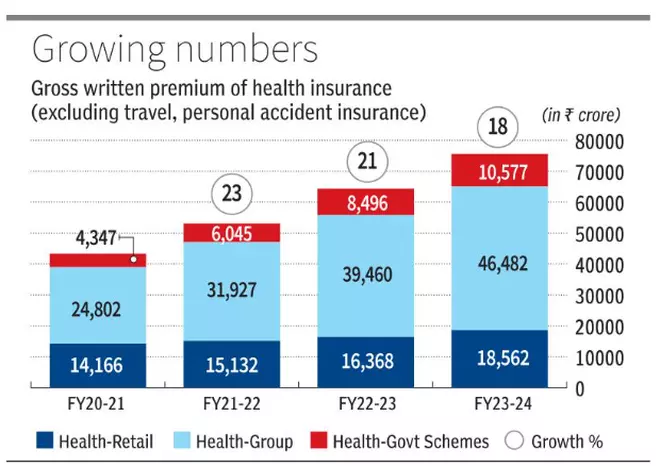

Well being has been the quickest rising insurance coverage phase, clocking premium of near ₹1-lakh crore in 2023-24, reflecting a sturdy compounded annual progress price of 20 p.c, per newest Common Insurance coverage Council knowledge.

Additionally, the well being phase now accounts for 38 per cent of the insurance coverage market with greater than 50 crore folks having some type of cowl. Tapan Singhel, Chairman, Common Insurance coverage Council and Chairman of the CII Nationwide Committee on Insurance coverage and Pensions, stated: “We have now been saying on numerous boards for some time now that GST on medical health insurance ought to be introduced down from the present 18 per cent to the minimal slab of 5 per cent.”

GST have to be minimize

“We must always see insurance coverage as a necessity that everybody ought to afford. Lowering the GST will deal with the difficulty of affordability to a sure extent,” stated Singhel, who can be MD & CEO, Bajaj Allianz Common Insurance coverage.

S.Ok.Sethi, Co-Chairman, BFSI Committee, PHD Chamber of Commerce and Trade (PHDCCI), stated: “Inflation within the nation is within the vary of seven per cent however it’s a undeniable fact that medical healthcare inflation has been 18-20 per cent yr over yr.”

Many points persist

- Additionally learn: Your medical health insurance has many variants: Right here’s what you have to know

The makes an attempt in sure quarters to herald a well being sector regulator has not made any headway. Additionally, the Supreme Courtroom instructions to the Centre to carry consultations with State governments and arrive at a consensus on figuring out therapy charges at hospitals throughout the nation remains to be work in progress.

Standardisation — though a posh train— is seen to be the necessity of the hour as it might herald much-needed transparency within the healthcare sector. It’s anticipated to additionally cut back frauds and any form of extrapolation of undue prices. This will decrease healthcare inflation and thereby decrease insurance coverage premiums.

“The GST just isn’t being let go, value regulation of hospitals just isn’t taking place, premium adjustment to medical inflation can occur solely as soon as in three years. So, what aid can insurance coverage corporations deliver to the desk,” puzzled an trade participant.

#Rising #well being #insurance coverage #premium #leaves #consumers #sore