The corporate derives advantages from regulatory-based earnings from a portion of its era, transmission, and distribution (T&D) segments whereas the earnings from the renewable era portfolio are based mostly on fastened tariff. Its steadiness sheet has seen substantial strengthening as elevated energy era has led to greater operational money flows, leading to a internet debt/EBITDA ratio of two.75 occasions, from 5.19 occasions 5 years in the past.

Additional, the corporate’s Mundra thermal plant (tariff-based) in Gujarat has benefitted extensively from the Part 11 invoked by the Authorities, which mandates imported-coal based mostly (ICB) energy crops to maintain full-capacity operations, thereby permitting the plant to promote energy on a full value pass-through foundation. Nonetheless, uncertainty nonetheless looms over its Mundra plant tariff because it has not but secured any energy buy agreements (PPAs).

General on the enterprise entrance there have been many positives in recent times. Nonetheless that is additionally effectively mirrored in inventory which has surged over 100 per cent up to now yr and round 600 per cent within the final 5 years. It’s at present buying and selling at 30 occasions its FY25 earnings, a premium of greater than 50 per cent in comparison with its five-year common valuation of round 19 occasions. Therefore, given the present valuation, we suggest that traders ebook partial income to lock within the positive aspects. Given positives talked about above and Tata Energy being levered to the long run India development story, we’re not recommending a full ebook revenue.

Enterprise

The corporate being a complete energy utility working throughout energy enterprise verticals, its enterprise segments embody era from hydroelectric and thermal sources (55 per cent of income in FY24), renewables resembling wind and photo voltaic (15 per cent), transmission and distribution (30 per cent).

As of March 2024, the corporate has an put in capability of 14.7 GW, together with 8.86 GW from thermal and 0.88 GW from hydro sources. A good portion of this capability is secured by means of long-term PPAs, guaranteeing income stability. The Mundra plant (4.2 GW) operates on imported coal from Indonesia and has confronted challenges resulting from adjustments in Indonesian coal pricing legal guidelines below which all contracts had been compulsorily linked to a benchmark market-determined coal worth, thus nullifying all fixed-price agreements beforehand entered into by the corporate. The scenario has improved with authorities interventions extending Part 11 rules, most lately till October 15, 2024.

Tata Energy’s transmission community spans 4,626 ckms, and its distribution community serves over 12.5 million prospects throughout areas resembling Mumbai, Delhi, Ajmer, and Odisha. The corporate has efficiently diminished combination technical and industrial (AT&C) losses by means of technological investments, resembling sensible metering.

In 2022, Tata Energy restructured its renewable enterprise right into a wholly-owned subsidiary, Tata Energy Renewable Vitality Ltd. This section consists of utility-scale initiatives, rooftop installations, photo voltaic EPC and manufacturing, photo voltaic pumps, and electrical automobile charging. The corporate has put in renewable capability of 4.5 GW. Key shoppers for its photo voltaic EPC companies embrace NTPC, NHPC, and SJVN. Just lately, the corporate gained Agency and Dispatchable Renewable Vitality (FDRE) tenders for 460 MW and 200 MW PPA capability from SJVN and NTPC, respectively. These FDRE tenders command greater tariffs than plain vanilla photo voltaic and wind sources and are most well-liked by distribution firms resulting from their capacity to retailer and launch energy as wanted, addressing intermittency points.

Efficiency

The Plant Availability Issue (PAF) and Plant Load Issue (PLF) of Tata Energy’s Mundra plant greater than doubled from 29 per cent and 25 per cent in FY22 to 70 per cent and 56 per cent in FY24, respectively, aiding it to interrupt even on the PAT degree. Whereas the captive coal mine profitability acts as a hedge for Mundra’s profitability, any unfavourable regulatory adjustments in Indonesia might enhance the danger of the mixed portfolio, in keeping with India Scores and Company.

Within the photo voltaic EPC enterprise, Tata Energy’s massive utility-scale order ebook stands at 2.6 GW, valued at ₹13,400 crore. Within the rooftop photo voltaic and group captive area, the order ebook quantities to ₹2,867 crore as of March 2024. Moreover, within the transmission sector, the corporate has secured two orders totaling practically ₹2,300 crore, permitting it to supply transmission companies for 35 years.

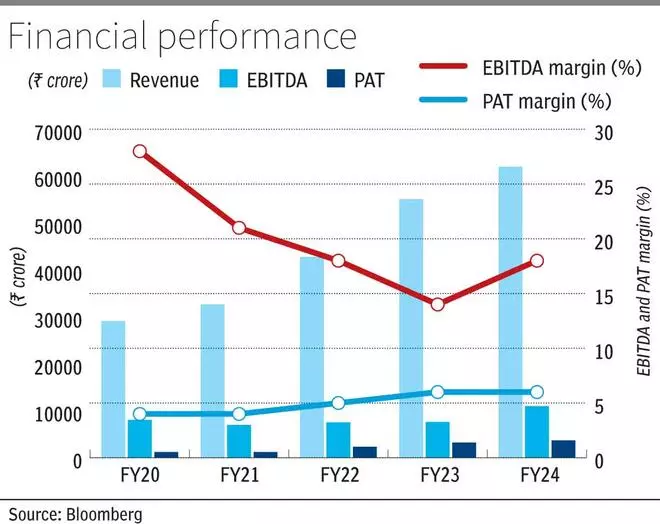

Income elevated by 12.5 per cent YoY to ₹61,994 crore in FY24, pushed by greater execution of photo voltaic EPC initiatives, elevated era on the Mundra plant, and better gross sales throughout Odisha discoms. The EBITDA margin expanded by over 400 foundation factors to round 18 per cent. The corporate reported a 14 per cent YoY development in internet income to ₹3,701 crore, with the PAT margin remaining steady at round 6 per cent. The RoE has considerably improved from 6.2 per cent in FY20 to 11.3 per cent in FY24. Throughout the yr, internet debt/EBITDA elevated to 2.75 from 2.66 final yr, resulting from greater capital expenditure (capex), which was partially offset by robust operational money movement and the discharge of working capital.

Outlook

In March 2024, Tata Energy’s renewable power arm commenced industrial manufacturing of roughly 130 MW of photo voltaic modules, with peak capability anticipated to achieve 4.3 GW within the coming quarters. Initially, the domestically produced modules shall be used to fulfill the corporate’s captive necessities, facilitating operational synergies.

Tata Energy has fulfilled its FY24 capex dedication of ₹12,000 crore. The corporate is at present endeavor two brownfield pumped storage initiatives (PSPs) with a complete capability of two,800 MW. These initiatives, requiring capex of ₹4,700 crore and ₹7,850 crore respectively, are anticipated to be accomplished by 2027 and 2028, and can generate 6,000 MWh and 10,800 MWh each day with the minimal annual income of ₹2,500 crore as soon as operational, as per estimates given by JM Monetary.

Wanting forward, the administration has offered a capex steerage of ₹60,000 crore by means of FY27, with 42 per cent allotted to incremental renewable capability, round 35 per cent to T&D initiatives, and 18 per cent to pumped hydro storage facility.. The corporate goals so as to add 1.5-2 GW of renewable power yearly to attain 70 per cent of its put in capability from renewables by FY30.

Over the past 5 years (FY2020-2024), Tata Energy has greater than doubled its earnings in absolute phrases, whereas its inventory has surged by over 600 per cent. Regardless of the stable fundamentals, given the substantial appreciation within the firm’s valuation and the risk-reward being unfavourable, we suggest that traders take into account reserving partial income to safe positive aspects.

#Tata #Energy #Traders