- Additionally learn: Adani Ports & SEZ to interchange Wipro in Sensex

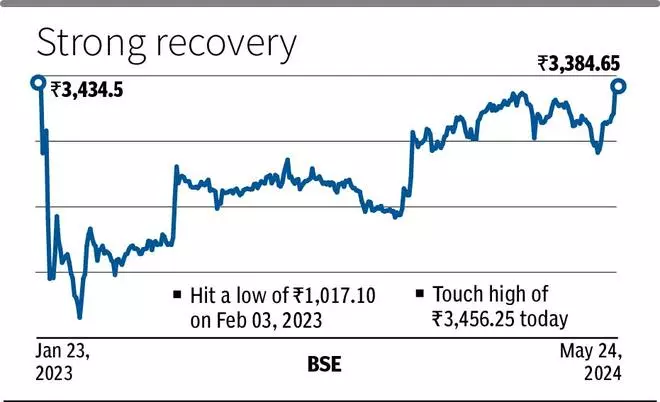

On Friday, Adani Enterprises inventory rose 2.1 per cent to an intra-day excessive of ₹3,457.85 on the NSE, overhauling the closing value of ₹3,442 on January 24, 2023, a day earlier than the Hindenburg report got here out. It fell to a low of ₹1,194.20 on February 27. Since then, the inventory has practically trebled.

Although the shares ended flat with a damaging bias at ₹3381, the inventory has appreciated over 22 per cent within the final 11 buying and selling periods, with an unbroken 5-day rally in between until Thursday, when it rose 8.3 per cent. Sentiment within the inventory obtained a lift with the prospect of it being included within the BSE’s Sensex which is anticipated to fetch inflows of $118 million within the inventory from passive index funds.

Shares of Adani Ports, Adani Complete Fuel and Adani Energy have already crossed their pre-Hindenburg ranges, however these of Adani Inexperienced Vitality, Adani Vitality Options and Adani Wilmar nonetheless should get again to these ranges. On Thursday, the whole market capitalisation of the group was at ₹17.23 trillion ($207.6 billion), however nonetheless about $22 billion in need of what it was earlier than the Hindenburg report.

Alongside the way in which, the corporate and others within the group have been helped by periodic infusions of funds by Rajiv Jain’s boutique funding agency GQG Companions, supplemented by contributions from sovereign funds of UAE and Qatar.

GQG Companions’ investments within the Adani group have appreciated round 150 per cent in little greater than a yr.

Adani Enterprises, the Gautam Adani flagship, is the chief incubator of recent enterprises within the conglomerate. Its board is scheduled to satisfy on Might 27 to think about a proposal to boost funds by means of the difficulty of fairness or different eligible securities. In February 2023, a follow-on public provide to boost ₹20,000 crore needed to be deserted within the aftermath of the allegations.

In keeping with media stories, the corporate is planning to boost round $1 billion to fund its airports and new vitality companies.

#Adani #Enterprises #inventory #value #Breaches #preHindenburg #ranges