But when we glance past the benchmarks, many broader indices have outperformed the Sensex and Nifty to this point this 12 months. As an example, the Nifty Subsequent 50 index has surged 29 per cent. Nifty 500 and Nifty 100 index are up about 10 per cent every to this point this 12 months. If you’re trying to take part within the broader market exterior the bellwethers by index funds and ETFs, right here’s our view on key indices primarily based on technical evaluation.

The indices that now we have lined listed here are Nifty 100, Nifty Subsequent 50, Nifty 500, Nifty Smallcap 250 and Nifty Midcap 150. We now have achieved a long-term technical evaluation on these indices. The degrees at which buyers can enter the indices and the targets for a similar are additionally given right here. Relying on the energy on the charts and after giving weightage on likelihood of transfer from present ranges, now we have cut up the quantum of cash to be chosen for every of the entry ranges.

Nifty 100: Bullish. Purchase now and on dips

After surging 20 per cent final 12 months, the Nifty 100 index has continued to maneuver up this 12 months as effectively. Though the momentum appears to have slowed down barely this 12 months, the uptrend stays intact. The index had surged to a brand new excessive of 24,060.75 final week. It’s at present at 23,980.10, up 9.4 per cent for the 12 months to this point.

Outlook

The uptrend is undamaged and powerful. There’s a direct resistance at 24,270. Even when that holds on its first take a look at, there are good helps to restrict the draw back, preserve the uptrend intact. Help is within the 22,800-22,600 area. Under that, 21,000-20,600 is a a lot decrease assist zone.

Nifty 100 index can goal 28,000 by the tip of this 12 months if it continues to maintain above 22,800. In case there’s a correction within the second half of this 12 months, which takes the index beneath 22,600, then the rise to twenty-eight,000 would possibly get delayed.

On this case a fall to 21,000-20,600 is feasible in a worst-case situation. Thereafter the index can start a contemporary leg of long-term uptrend. This rally could have the potential to take the index previous 28,000. If that occurs, Nifty 100 index can goal 30,000 someday within the first or second quarter subsequent 12 months.

The uptrend will come underneath risk provided that the Nifty 100 index declines beneath 20,600. Such a break, although much less probably, can drag the index all the way down to 19,500.

Technique

Lengthy-term buyers can get into this index in three tranches. Purchase now at present ranges for about 20 per cent of the meant quantity. Accumulate one other 60 per cent on dips at 23,000 The steadiness 20 per cent could be purchased at 21,300.

Nifty Subsequent 50: Ripe for a correction?

Nifty Subsequent 50 has made a pointy rise this 12 months. The index was up 26.45 per cent final 12 months. It has crushed this return in simply 5 months this 12 months. Nifty Subsequent 50 index, at present at 69,033.25, is up 29.41 per cent to this point this 12 months. The index has been making new highs each month this 12 months. Final week, it touched a brand new excessive of 69,458.95.

Outlook

The rally this 12 months has been so sharp and really quick. Essential resistances are forward for the Nifty Subsequent 50 index. The resistance at 68,900 was simply damaged final week. Above that, 69,500, 70,500 71,300 are the subsequent essential resistances.

The rally appears to be nearing an interim prime. So, a corrective fall is extra prone to occur from wherever between 70,500 and 71,300. Contemplating the sharp and swift rise this 12 months, the corrective fall can be barely steeper.

Helps: 63,800, 61,800, 58,000

Resistances: 69,500, 70,500, 71,300

Targets: 78,000 and 80,000

On the charts, the helps are additionally out there at a lot decrease ranges. The necessary helps are at 63,000 and 61,800. Under that, 58,000 and 57,000 are the a lot decrease assist that may be examined in a worst-case situation. This corrective fall can unfold by the second half of this 12 months. A contemporary rally after this corrective fall could have the potential to take the Nifty Subsequent 50 index as much as 78,000 and 80,000 by the tip of subsequent 12 months or in early 2026.

Technique

Because the possibilities of a corrective fall look excessive, buyers can enter with a minimal amount at first. It’s because the opposite indices have room to rise from right here. To cash-in on that chance we recommend that buyers deploy 10 per cent of the cash first at present ranges. Accumulate one other 60 per cent at 62,500. The steadiness 30 per cent could be deployed at 58,800.

Nifty 500: Purchase now and accumulate on dips

Nifty 500 has been in a robust uptrend since April final 12 months. After surging 25 per cent final 12 months, the index is up over 10.57 per cent to this point this 12 months. It’s at present buying and selling at 21,483.75.

Outlook

The value motion on the month-to-month chart signifies that the index is getting good consumers within the 20,000-19,500 area. That’s prone to preserve the uptrend intact. Nifty 500 index has room to rise farther from right here as much as 22,500 and 23,000. This 22,500-23,000 could be a good resistance that may halt the present rally. A corrective fall from this resistance zone can take the index all the way down to 21,000 first. An extra break beneath 21,000 will see the autumn extending as much as 20,000 and even 19,000 in a worst-case situation. Thereafter a contemporary leg of uptrend can start.

Helps: 20,000, 19,500, 19,000

Resistances: 23,000, 25,000, 28,000

Targets: 25,000 and 28,000

The rise from the 20,000-19,000 assist zone can take the Nifty 500 index as much as 25,000 within the first quarter subsequent 12 months. From a multi-year perspective, the Nifty 500 index has potential to focus on 28,000 and better ranges.

Technique

Buyers should buy round 20 per cent of the meant quantity at present ranges. Look forward to a corrective fall. Purchase one other 60 per cent at 20,500 and the steadiness 20 per cent at 19,800.

Nifty Smallcap 250: Bullish. Purchase now and on dips

After making a stellar rally of 48 per cent in 2023, the Nifty Smallcap 250 index witnessed a 14 per cent correction earlier this 12 months. The index fell from a excessive of 15,489 (February) to a low of 13,284 (March). However thereafter it has made a robust restoration and is up 13 per cent this 12 months. The index is at present at 15,865.65

Outlook

The uptrend is undamaged. Rapid resistance is at 16,000. A break above it may possibly take the Nifty Smallcap index upto 16,800 or 17,100. Thereafter we are able to count on a corrective fall to fifteen,000 or 14,800. If the sell-off intensifies, then a break beneath 14,800 can see a steeper correction to 13,600. Although this fall to 13,600 can’t be fully dominated out, it seems much less possible as seen from the charts.

Helps: 15,000, 14,800, 13,600

Resistances: 16,000, 17,100, 18,500

Targets: 18,500 and 19,000

As such, a reversal both from 14,800 or 13,600 can set off a contemporary leg of upmove. That rally could have the potential to take the Nifty Smallcap 250 index as much as 18,500-19,000.

Technique

Buyers can get into this index at present ranges. Purchase 40 per cent of the meant quantity now. One other 50 per cent could be purchased at 14,900. The steadiness 10 per cent could be deployed at 13,800.

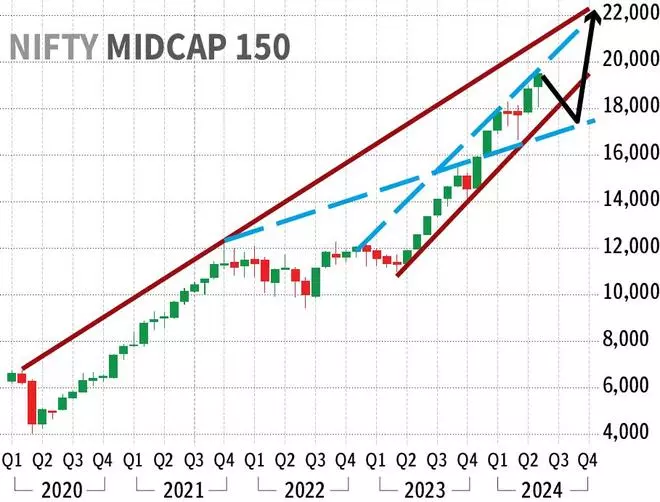

Nifty Midcap 150

Much like the Nifty Smallcap 250, the Nifty Midcap 150 index additionally witnessed a corrective fall within the month of February and March this 12 months. However not like the Nifty Smallcap 250 index which tumbled about 14 per cent, the correction was restricted to 9 per cent in Nifty Midcap 150. The index fell from the excessive of 18,345 (in February) to a low of 16,718 (March). Nonetheless, it has risen again sharply from there and is at present buying and selling at 19,553.15, up 14.5 per cent for the 12 months.

Outlook

The development is up and intact. Rapid resistances are at 19,700 and 20,150. If the index turns downwards from any of those two resistances, then there could be a corrective fall. In that case the Nifty Midcap 150 can fall to 18,750 and 18,200. A break beneath 18,200 although much less probably, can set off an an prolonged fall to 17,200-17,000. A contemporary rally both from round 18,200 or from 17,000 can take the Nifty Midcap 150 index as much as 21,000 and 22,000.

Helps: 18,750, 18,200, 17,000

Resistances: 19,700, 20,150, 21,000

Targets: 21,000 and 22,000

One other chance is the index rising previous 20,150 from right here itself. If that occurs, then 21,000 could be seen right away. On this case, the corrective fall to 19,000 can occur from round 21,000. If the sell-off worsens, then the draw back can prolong as much as 18,000. Thereafter a contemporary rally can take the Nifty Midcap 150 index as much as 22,000.

Technique

Buyers should buy 60 per cent of the meant quantity at present ranges. Purchase one other 30 per cent at 18,800 and the steadiness 10 per cent at 18,200.

Motion Plan

Based mostly on the above technical evaluation on the indices and the degrees, buyers can strategise on their very own to enter into the index funds or ETFs. However be sure to do your due diligence in selecting the right index fund or ETF primarily based on the liquidity, expense ratio, monitoring error and, final however not the least, your threat urge for food.

#Alternatives #Benchmarks #Hindu #BusinessLine