- Additionally learn:Majority of Vodafone Concept’s AGR dues could possibly be cancelled: UBS report

Issues are easy when variables are fewer. For instance, take the case of selecting shares primarily based on PE-based valuation. If a inventory A has an EPS of ₹10/ share and is buying and selling at ₹100, then it implies the PE ratio is 10 occasions. The variables figuring out the value listed below are EPS and PE ratio. In case you enhance one variable PE ratio to twenty occasions believing it to be the honest a number of, the inventory is value ₹200, nicely above the present value of ₹100. That is assuming the EPS will keep at 10 and never fall to, say, ₹5 or zero in future. Lacking the scope for change in any of the variables can entice you. If so in a product with two variables, what are the chances in a product with extra variables?

Valuing the enterprise

This brings us to Enterprise Worth or EV-based method to selecting shares. Enterprise worth refers to complete worth of an organization/enterprise. This complete worth as perceived by the market is represented by the sum of its market cap and web debt.

Usually, EV-based multiples which are used to worth shares are EV/EBITDA, EV/EBIT, EV/Tonne, EV/Gross sales, EV/subscriber, and so forth. The commonest amongst these is EV/EBITDA, which is typically most popular over PE to worth companies that sometimes require debt and common capex — telecom, cement, metal, and so forth. In such instances, the worth of inventory or its market cap is arrived at by giving the enterprise a a number of linked to EBITDA after which adjusting that for web debt within the stability sheet – ie Market cap = EV minus web debt or Share value = EV/share minus web debt/share. Right here EV = EBITDA *a number of (occasions)

In order you modify your valuation method from value to enterprise worth, the variety of variables adjustments — EBITDA, Debt and EV/EBITDA ratio on this case. However the attention-grabbing factor to notice right here is that, even when two out of those three variables don’t change a lot, the implications to the inventory value can change extensively.

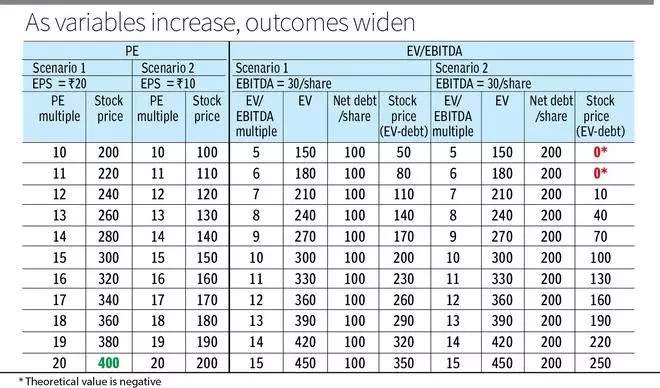

Utilizing the identical instance of firm A above, allow us to add one other component to it. Allow us to assume two situations – State of affairs 1: Inventory A has debt of ₹100/share, whereby EBITDA is 30/share; State of affairs 2: Inventory A has debt of 200/share, whereby EBITDA is ₹30/ share. You will need to notice right here that whereas PE of a inventory can change primarily based on debt and corresponding curiosity paid, EBITDA will stay the identical. For simplicity’s sake, allow us to assume the speed of curiosity is 10 per cent and tax and depreciation are zero. On this case, below situation 1, the EPS will likely be 20 per share, whereas it is going to be 10 per share below situation 2. Allow us to have a look at the vary of outcomes which are attainable in arriving on the share value.

The illustration under explains how the worth of a inventory can change as only one variable adjustments.

Relying on assumptions you make, the inventory of A will be valued from zero to ₹400. You possibly can additional enhance the multiples and make the valuation vary even wider.

What if extra variables can change in keeping with completely different situations? What if debt will be transformed into fairness? What if promoting value is elevated or decreased, which might have outsized impression in growing or decreasing EBITDA versus present ranges? The outcomes will even increase wildly on both route.

There are occasions when elementary valuation train, which entails assessing completely different variables with completely different prospects, will contain some ranges of hypothesis. As Benjamin Graham says, – ‘ some hypothesis is critical and unavoidable, for in lots of frequent inventory conditions there are substantial prospects of each revenue and loss, and the dangers therein have to be assumed by somebody.’

However he goes on to caveat that with, ‘However there are lots of methods by which hypothesis could also be unintelligent. Of those the foremost are: (1) speculating whenever you assume you’re investing; (2) speculating significantly as an alternative of as a pastime, whenever you lack correct data and talent for it; and (3) risking more cash in hypothesis than you’ll be able to afford to lose’

Because the variables enhance, like whenever you transfer from PE ratio to EV/EBITDA after which to EV/Gross sales, whereas buyers can diligently stay throughout the boundaries of core elementary evaluation, the dangers of straying away from pure elementary evaluation into unintelligent hypothesis will increase. Traders must take cognisance of this.

Why this matter now?

It’s because of the latest buzz round Vodafone thought, and the extraordinarily broad vary of value targets on the inventory from promote facet analysts following the FPO, primarily based on varied assumptions and adjustments to variables. There was a variety of assumptions from EV/EBITDA multiples, estimated EBITDA, debt conversion into fairness (and at what value), scope for cancellation of AGR dues partially, and so forth. Some assumptions are required, however have they been affordable?

- Additionally learn:Vodafone Concept This autumn FY24 outcomes: Losses widen by 19.5% at ₹7,674 crore

Therefore we wished to spotlight components that buyers want to think about whereas utilizing the EV/EBITDA a number of normally, and prospects that one can stray into unintelligent hypothesis unknowingly relating to valuing Vodafone Concept.

#Valuing #Vodafone #Concept #Clever #hypothesis #unintelligent #hypothesis