Spends in April historically see a fall, on condition that spends usually are typically larger within the final month of a monetary yr. Spends in March 2024 have been at ₹1.64-lakh crore, additionally decrease than the height of ₹1.79-lakh crore seen in October 2023 as a result of pageant season-related spending.

Development in spends slowed from 25.9 per cent y-o-y in April 2023 to 17.9 per cent in April 2024. Nonetheless, the variety of card transactions grew 32.7 per cent on yr to 344-lakh crore, doubtless as a result of linking of bank cards to UPI.

Going south

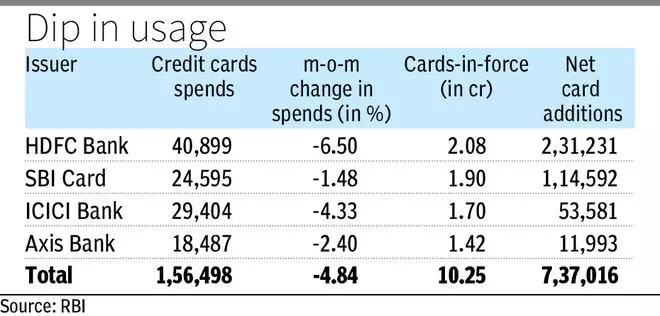

Spends for the highest 4 issuers — HDFC Financial institution, SBI, Axis and ICICI Financial institution — fell 1.5-7 per cent m-o-m. Indian Financial institution, CSB Financial institution, Federal Financial institution, Karur Vysya Financial institution, RBL Financial institution, South Indian Financial institution and DBS Financial institution additionally noticed a big drop in spends over the month. However, IDBI Financial institution and Union Financial institution noticed rise in month-to-month spends.

“HDFC Financial institution misplaced one other 46 bps m-on-m and 246 bps y-o-y, dropping to 26.1 per cent — the bottom since January 2018. Axis Financial institution has been a gainer when it comes to market share with a 30 bps m-o-m market share rise in spends quantity,” Anand Rathi Analysis stated in a notice.

SBI playing cards noticed the very best spends market share, with a 54 bps on month enhance and 15.7 per cent market share, nonetheless decrease than the height of 19.8 per cent in October 2023, it added.

Market share down

The highest 4 bank card issuers noticed a decline of their market share throughout FY24, each when it comes to month-to-month card spends and whole playing cards excellent. Their market share when it comes to spends declined to 71.98 per cent as of March 2024 from 74.79 per cent a yr in the past, each as a result of enlargement within the general spends base and accelerated development seen by mid-sized gamers.

The trade noticed internet additions of seven.4 lakh playing cards in April 2024, taking the whole variety of playing cards excellent to 10.25 crore playing cards — 0.7 per cent larger than March. The online addition was slower than the 12.02 lakh playing cards seen in March, largely owing to a slower tempo of card additions for many prime issuers barring HDFC Financial institution.

“In April 2024, the trade added playing cards on the slowest tempo since December 2022. Playing cards-in-force declined 39 per cent on yr”, the notice stated, including that SBI misplaced 95 bps market share on yr with card additions falling for the second month in a row. HDFC Financial institution’s share rose 8 bps on month, whereas that for ICICI Financial institution fell 7 bps and Axis Financial institution by 9 bps.

HDFC Financial institution internet added 2.3 lakh playing cards in the course of the month, larger than 1.9 lakh playing cards in March. Financial institution of Baroda, IDFC First Financial institution, IndusInd Financial institution, YES Financial institution and AU Small Finance Financial institution have been another lenders to see a big rise of their whole cards-in-force for the month.

Whereas different issuers too noticed a rise, the tempo of latest card issuances was decrease than earlier months. A part of this slowdown is probably going because of the revised norms on co-branded playing cards issued by RBI and the resultant restrictions imposed on lenders resembling South Indian Financial institution and Federal Financial institution.

The highest 4 issuers had a complete of seven.06 crore cards-in-force as of March 2024, up from 6.09 crore within the earlier yr. Nonetheless, their market share fell to 69.40 per cent from 71.37 per cent a yr in the past. The trade noticed internet card additions of 1.6 crore throughout FY24, of which the highest 4 issuers accounted for 97.62 lakh playing cards. Complete variety of playing cards excellent stood at 10.18 crore at finish of FY24.

#Credit score #card #spends #fall #April #tempo #card #additions #slower