As of Could 28, the 10-year authorities safety (G-Sec) — the long-term debt benchmark — yielded about 7 per cent. The 364-day treasury invoice (T-Invoice) yielded a barely higher 7.02 per cent.

This presents a troublesome alternative for buyers. In the event that they spend money on solely short-term debt, they’ll discover their returns dipping if and when charges are minimize. In the event that they go for long-term debt, they’ll should bear the brunt of no returns or losses if charges stay on maintain.

After weighing each sorts of dangers, we consider that buyers can be higher off with a barbell technique right now. Simply as you’d load each side of your barbell on the health club, your bond portfolio ought to have exposures to each long-term and short-term debt.

Why long-term bonds?

If you happen to can look past near-term uncertainties, the outlook for long-term bonds in India is sort of optimistic. The primary driver for 10-year bond yields is the anticipated demand versus provide of G-Secs. Three elements level to a fall within the provide of G-Secs in FY25 whereas demand is prone to broaden.

One, with impact from this June, Indian G-Secs are set to be included within the international JP Morgan GBI EM Index. Indian G-Secs will bag a 1 per cent weight in June 2024, with the burden climbing to 10 per cent by March 2025. With this inclusion, international passive gilt funds will discover it crucial so as to add to Indian G-Secs to their portfolio. Ballpark estimates counsel that this might create demand for about ₹2 lakh crore price of G-Secs this 12 months, primarily in G-Secs below the Freely Accessible Route — 5-year, 10-year, 15-year, 20-year. The latest S&P improve to India’s outlook additionally provides to the funding case for Indian G-Secs.

Two, the ₹2.11 lakh crore dividend payout by RBI at twice the budgeted sum will assist fiscal deficit discount, probably decreasing G-Sec provide. Three, as a part of its fiscal consolidation plans, the Authorities hopes to cut back the fiscal deficit from 5.8 per cent in FY24 to five.1 per cent in FY25 and additional to 4.5 per cent by FY26. That is additionally optimistic for G-Sec costs. This glidepath is extra prone to be attained if the NDA returns to the Centre slightly than the UPA.

The above elements make a bull case for long-term G-Secs to rally, with or with out charge cuts. Lengthy-term debt buyers can, nonetheless, face dangers to the bullish outlook from an hostile election final result or volatility unleashed by larger overseas participation in bonds. This argues for investments in funds holding publicity to long-term gilts and company bonds.

Why short-term?

Debt funds that spend money on treasury payments, tri-party repos and short-term company paper or certificates of deposit current an equally compelling case right now, for 2 causes. The RBI is sustaining a decent liquidity place within the monetary system. So, yields on T-Payments, certificates of deposit, industrial paper and short-to-medium time period company bonds are very engaging right now, ruling at effectively over 7 per cent.

Usually, the short-term debt devices can defend your portfolio from uncertainty concerning the election final result, MPC, Fed charge cuts, and many others. Charge cuts by the MPC, even when they occur, look probably solely after end-2024 when there might be readability concerning the monsoon and its affect on meals costs and the resultant inflation. This makes a case for funds with publicity to T-Payments and short-term company paper.

One-year CP trades at a yield of seven.7 per cent, whereas the one-year CD offers 7.5 per cent, and a one-year AAA-rated bond trades at 7.91 per cent yield. Three-month CPs and CDs additionally give yields of seven.16 per cent and seven.35 per cent, respectively, in keeping with information from Refinitiv and CCIL (compiled by Kotak Mutual Fund).

With charge cuts a way away and liquidity nonetheless tight, it could be prudent for buyers to take a position on the shorter finish of the curve.

On this evaluation, we cherry decide two good fund choices for buyers to wager on each the lengthy and quick finish of the yield curve.

4 funds for buyers: Lengthy-term choices

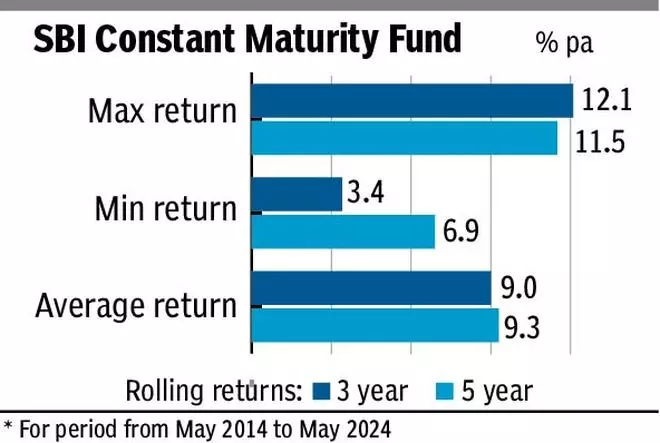

SBI Fixed Maturity Gilt Fund

As extra overseas buyers discover Indian bonds due to international index inclusion, the extra liquid G-Secs are prone to be their most popular bets. The ten-year G-Sec is the benchmark for the Indian bond market and in addition its most actively traded bond. Fixed maturity gilt funds are an environment friendly low-cost car for buyers to purchase and maintain the 10-year G-Sec so long as they need.

SBI Fixed Maturity Gilt Fund is an effective possibility for buyers to contemplate due to three attributes. One, with a observe file of over 20 years (launch date December 2000) the fund has navigated many charge cycles efficiently, to ship a CAGR of seven.8 per cent since launch. Two, a rolling return evaluation during the last 10 years exhibits that the fund has contained draw back higher than friends in hostile phases. The fund has delivered losses lower than 2 per cent of the time for one-year durations, whereas it managed 10-20 per cent returns 44 per cent of the time. Its one-year returns common out to eight.9 per cent within the final 10 years.

Three, as a fund that primarily buys and holds G-Secs, its annual bills are low, at 0.31 per cent for the direct plan and 0.64 per cent for the common plan. Expense ratios for actively managed gilt funds common 0.41 per cent for direct plans and 0.94 per cent for normal plans.

This fund is appropriate just for buyers with a excessive threat urge for food, not in search of common revenue. Whereas it affords potential for top returns if charges fall, it’s also prone to topic buyers to larger day-to-day volatility as its returns rely extra on charge actions than curiosity accruals.

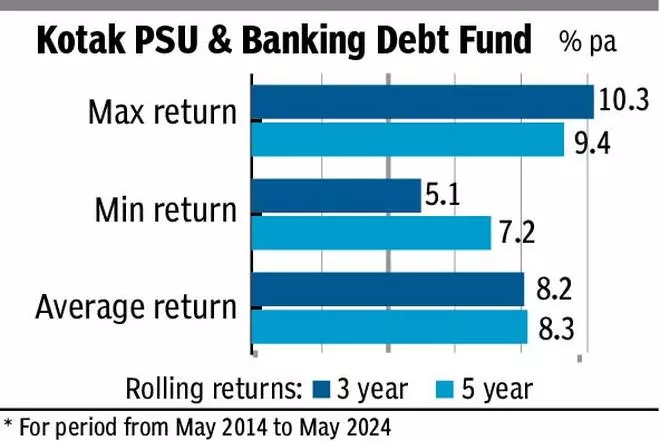

Kotak Banking and PSU Debt Fund

With robust credit score offtake and a scramble for funds, PSUs and banks have been elevating long-term debt at good spreads over G-Secs. Ought to market rates of interest fall, these AAA-rated bonds will take part within the rally alongside G-Secs. Banking and PSU debt funds, subsequently, supply buyers a shot at incomes larger yields than G-Secs, with attainable positive factors if charges fall.

Kotak Banking and PSU Debt Fund is an effective alternative for 2 causes. One, the fund’s common portfolio maturity of 8.3 years and Macaulay Period of 4.16 years are excessive, relative to the class. Other than a 24 per cent publicity to 10-11 12 months G-Secs, the fund has holdings in 10-year bonds from Powergrid, REC and LIC Housing Finance and 10-15 12 months bonds from SBI, PNB, Indian Financial institution and so forth, which make up about 20 per cent of its portfolio. All these bonds can acquire sharply from charge declines.

Two, with a 68 per cent publicity to AAA PSUs and banks, its portfolio YTM was 7.79 per cent as of April-end, about 19 foundation factors larger than class. Three, a 10-year rolling return evaluation exhibits that the fund managed a most one-year return of 12.8 per cent and a minimal of two.7 per cent whereas averaging 8.15 per cent for one-year durations. The fund’s expense ratio (0.39 per cent for direct, 0.76 per cent common) is larger than friends’ within the PSU and Banking class.

Because it carries length threat, the fund is appropriate just for buyers who’ve the urge for food for volatility in returns and should not common revenue seekers.

Quick-term choices

On the different finish of the spectrum are cash market and extremely quick length funds to play the short-term recreation, on condition that yields are engaging there.

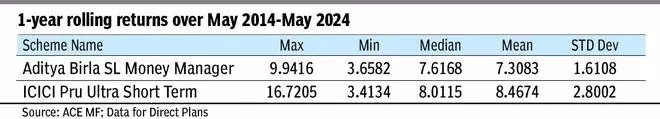

Aditya Birla Solar Life Cash Supervisor Fund is without doubt one of the finest schemes within the class, in view of the wholesome stability it strikes with excessive security and sturdy returns.

For buyers seeking to park a lump-sum quantity that’s both earmarked for emergencies or to be moved later to fairness funds or shares, the fund is a high-quality alternative.

Cash market funds spend money on fastened revenue securities that mature inside a 12 months. Most funds limit maturities to lower than a 12 months.

ABSL Cash Supervisor invests principally in certificates of deposits of banks and monetary establishments. It additionally takes publicity to 364-day RBI Treasury Payments and state improvement loans (SDLs) that may mature in lower than a 12 months. Business papers (CPs) additionally determine within the portfolio, however in small proportions.

On a one-year rolling foundation from Could 2014 to Could 2024, the fund has delivered 7.2 per cent on a median. Over this timeframe, it has by no means given detrimental returns. The scheme has delivered greater than 7 per cent over 68 per cent of the time and over 8 per cent in practically a fourth of the instances, indicating constant above-average returns.

CDs of Punjab Nationwide Financial institution, SIDBI, HDFC Financial institution, Financial institution of Baroda and NABARD determine prominently within the portfolio. RBI’s 364-day and 91-day T-Payments and SDLs of Maharashtra and Madhya Pradesh are additionally key holdings.

The fund has a median maturity of simply 0.76 years, modified length is 0.75 years. Yield to maturity of the portfolio (as of April 30) is wholesome at 7.73 per cent.

ICICI Prudential Extremely Quick Time period Fund is a scheme that’s forward of most friends by way of delivering constant returns.

Now, extremely quick length funds spend money on debt securities that mature in 3-6 months’ timeframe.

These funds, too, spend money on CPs, CDs and T-Payments, aside from NCDs (non-convertible debentures) and debentures.

ICICI Prudential Extremely Quick Time period holds CDs of NABARD, HDFC Financial institution, SIDBI and IndusInd Financial institution amongst a couple of others. Treasury Payments additionally determine prominently within the portfolio. Business papers of Sharekhan, SIDBI and Motilal Oswal Monetary Providers discover a place. Debentures of Bharti Telecom and Mahindra Rural Housing Finance are different essential holdings. CPs and debentures of Embassy Workplace Parks REIT are additionally key holdings.

Since virtually the complete portfolio contains sovereign securities or devices with the best short-term scores, there’s minimal scope for any credit score threat.

On a one-year rolling foundation from Could 2014 to Could 2024, the fund has delivered practically 8.5 per cent on a median. Over this timeframe, it has by no means given detrimental returns. The scheme has delivered greater than 7 per cent practically 71 per cent of the time and over 8 per cent over half the instances. It has given greater than 10 per cent returns practically 28 per cent of the time, thus guaranteeing constant above-average returns for buyers.

The fund has a median maturity of simply 0.49 years. Macaulay length is 0.48 years. Yield to maturity of the portfolio (as of April 30) is wholesome at 7.7 per cent.

#Debt #Funds #Experience #Charge #Reduce #Uncertainties