Novelis: Capital outlay and IPO

Novelis is the world’s largest aluminium producer primarily based within the US that Hindalco acquired for $6 billion in 2007. The backward built-in producer makes use of 63 per cent recycled content material to produce to beverage cans (47 per cent in FY24), cars (24 per cent) and speciality (25 per cent). The section reported 12 per cent income decline in FY24 owing to excessive stock at purchasers and decrease realisations (9 per cent decrease YoY).

However Novelis reported a 3 per cent EBITDA development as EBITDA per tonne improved 7 per cent YoY. This, owing to the next recycled content material (200 bps enchancment), decrease price of manufacturing and working effectivity.

Novelis goals to increase amenities with $4.9-billion value tasks below development. The central mission is a $4.1-billion greenfield totally built-in plant in Bay Minette, US, that’s anticipated so as to add 600 kt capability (16 per cent addition) by FY27. Moreover, a $365-million automotive recycling centre within the US and $350-million debottlenecking tasks within the US, Brazil and Asia are additionally deliberate.

The corporate administration sees scope for development in US markets. Based on US official knowledge, the US imported 5.5 million tonnes of aluminium (largely unwrought) in 2023, of which Canada accounts for half the quantity, withChina, India and Russia additionally contributing considerably. In April, the US banned Russian-origin aluminium, which has pushed costs of aluminium to $2,500 pertonne from $2,200 per tonne in early 2024. Contemplating the home import substitution, ESG-compliant standing of Novelis’s new facility and a excessive recyclable sourcing, the incremental provide ought to discover demand for Novelis.

China has ended 2023 with a deficit in aluminium provide regardless of weak point in development and cars owing to extreme energy prices. The remainder of the world has witnessed weak demand and three per cent extra provide owing to gradual restoration in world development. Going through FMCG, auto and customers, aluminium demand will choose up following any restoration in development or any motion in rate of interest softening.

Novelis IPO has been introduced with a worth band of $18-21 within the US, which values this Hindalco subsidiary at an enterprise worth of $16.3 billion on the larger finish. Hindalco, by divesting 8.6 per cent of shareholding (together with doable oversubscription), ought to collect $9,000 crore from the IPO. On the present IPO worth, Novelis’s current enterprise and enlargement plans are valued at 8.72 instances EV/EBITDA.

India enterprise

Hindalco’s India enterprise consists of aluminium (upstream and downstream) and copper segments. The aluminium enterprise confronted income decline of two.5 per cent YoY in FY24 as realisations declined by 5 per cent however shipments elevated by 2.5 per cent YoY. Much like Novelis, EBITDA elevated by 7.8 per cent YoY regardless of decrease revenues owing to decrease price of manufacturing. The copper section, pushed by larger shipments (up 12 per cent YoY) and realisations (up 4 per cent YoY), is within the midst of demand revival.

Hindalco capital outlay for India targets a brand new alumina facility, energy linkages and downstream value-added portfolio. In Section-I, ₹6,000 crore might be invested in a 1,000 kt (50 per cent incremental capability) in Odisha with settlement with State authorities for long-term provide of the requisite bauxite. A 150 MW energy plant can be deliberate in the identical facility.

Aluminium demand in India is predicted to develop at a CAGR of 6-7 per cent within the subsequent decade. Hindalco has a powerful stability sheet with consolidated internet debt to EBITDA at 1.2 instances and India enterprise at internet money place of ₹3,500 crore in March 2024. With IPO fund flows to Hindalco, the stability sheet is ready to get even stronger to seize the rising demand. On the power entrance, Chakla coal mine and Meenakshi coal mine, that are being developed, will add to the power safety of Hindalco’s India enterprise. The corporate has reiterated that with rising power safety, together with renewable power, Hindalco will goal extra value-added downstream tasks in the long term.

Sum of the components

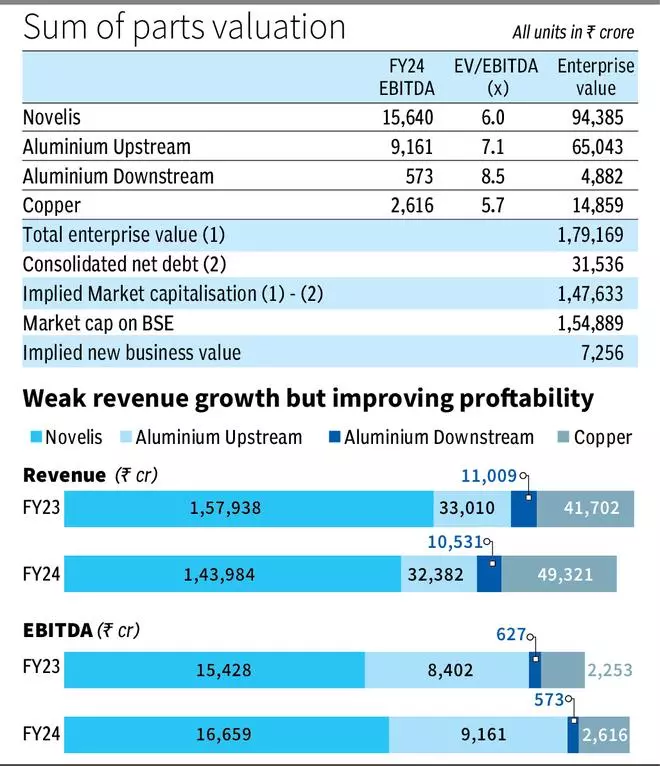

Hindalco (consolidated) is at present valued at ₹1.55 lakh crore. SOTP signifies that worth of working companies is effectively captured within the present market capitalisation (see desk). So any incremental worth creation for Hindalco shareholders lies in potential for worth creation from the continued $5 billion enlargement plans for Novelis and in India enterprise. Profitable execution of those funding plans can add to shareholder worth, which doesn’t seem like adequately captured within the present market cap.

Within the final decade, and thru financial cycles, Hindalco traded at a mean 7.1 instances EV/EBITDA. Novelis valued at 6 instances EV/EBITDA (adjusted for 15 per cent Holdco low cost), aluminium downstream at 20 per cent premium for future development, copper at 20 per cent low cost for peak cycle low cost and aluminium upstream in line — implies an EV of ₹1.8 lakh crore. Adjusted for internet debt of ₹31,500 crore implies a market cap of ₹1.47 lakh crore with the distinction being assigned to worth of recent ventures to the tune of ₹7,200 crore or lower than $1 billion.

Because the Bay Minnette tasks close to completion and world macros enhance, the incremental worth is prone to replicate within the inventory worth. Contemplating the scope for volatility associated to elections in India and even within the US, and world commerce wars, buyers can construct a margin of security and accumulate the inventory on dips.

#Hindalco #Traders