- Additionally learn:RBI MPC Assembly June 2024 Highlights: RBI holds repo fee at 6.50%; forecasts 7.2% GDP progress for FY25

He stated, it’s the central financial institution’s core goal to align the inflation fee with the 4 per cent goal, and added that no motion on charges shall be attainable, until the RBI is assured of it, remaining at or under 4 per cent.

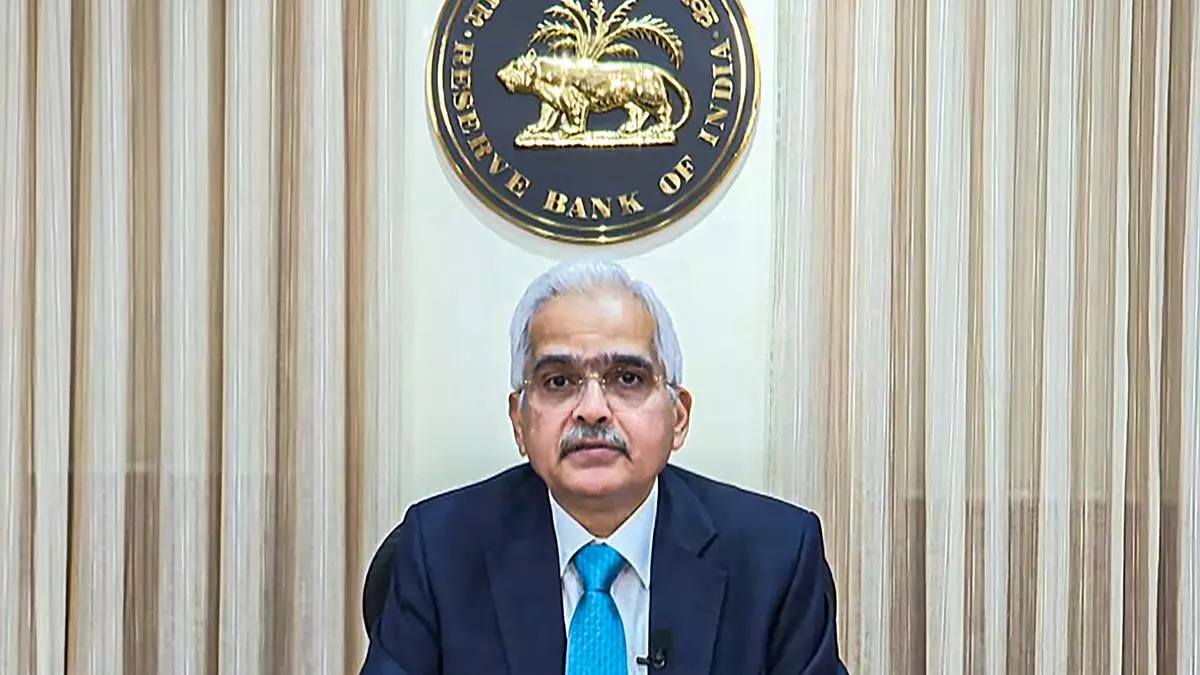

Talking to reporters on the customary interplay after selecting a establishment in charges for the eighth consecutive time, Das stated, as per the RBI’s projections, client value inflation is coming at 3.8 per cent, within the December quarter, however rising once more later to the touch 5 per cent.

“It (inflation), has to align with the goal, and as soon as it reaches 4 per cent, it has to remain there. Once we will get confidence that this may keep at 4 per cent, and won’t go up, then we’ll take into consideration additional financial coverage actions,” Das stated.

He was replying to a selected query on when to anticipate a fee minimize from the central financial institution. In a shift throughout the six-member fee setting panel, two members, voted in opposition to the choice to carry fee as in opposition to just one in earlier situations, which is seen as being indicative of a change in pondering, in favour of the growth-propping fee minimize.

Das stated the growth-inflation journey, is progressing as per expectations, however, added that it’s the final mile of the journey in direction of 4 per cent, which would be the most troublesome or sticky, and reiterated the necessity for the quantity to align with the goal.

On progress, the place the RBI upped its estimate for FY25, actual GDP growth to 7.2 per cent, Deputy Governor, Michael Patra stated, the quantity is decrease, due to the excessive base in FY24, however, added that the expansion momentum within the financial system could be very excessive.

Patra stated the dangers to progress are primarily from world elements like geopolitical developments, whereas home elements like excessive climate occasions also can drag it.

Replying to a query if his insistence on the RBI’s coverage being de-linked from US Fed’s strikes, has a tinge of dovishness, and the central financial institution can transfer with a fee minimize even when the US Fed does not minimize, Das stated, the converse can also be attainable, the place RBI could not minimize fee, even when the US Fed chooses to.

The RBI is able to dealing with the extra fund flows that may are available, due to the nation’s inclusion within the J P Morgan bond indices, Das stated, including that it has accomplished so in comparable situations up to now as properly.

- Additionally learn:Key highlights from RBI’s bi-monthly coverage assertion

To a poser on the newer additions within the toolkit on foreign exchange interventions, being mulled, as acknowledged within the annual report, Das shunned increasing additional.

Das didn’t particularly reply questions, on the expectations from the brand new authorities, its stance on fiscal consolidation, given the exigencies of coalition politics, or his response to the folks’s election verdict.

#Financial #coverage #actions #desk #inflation #stays #put #Das