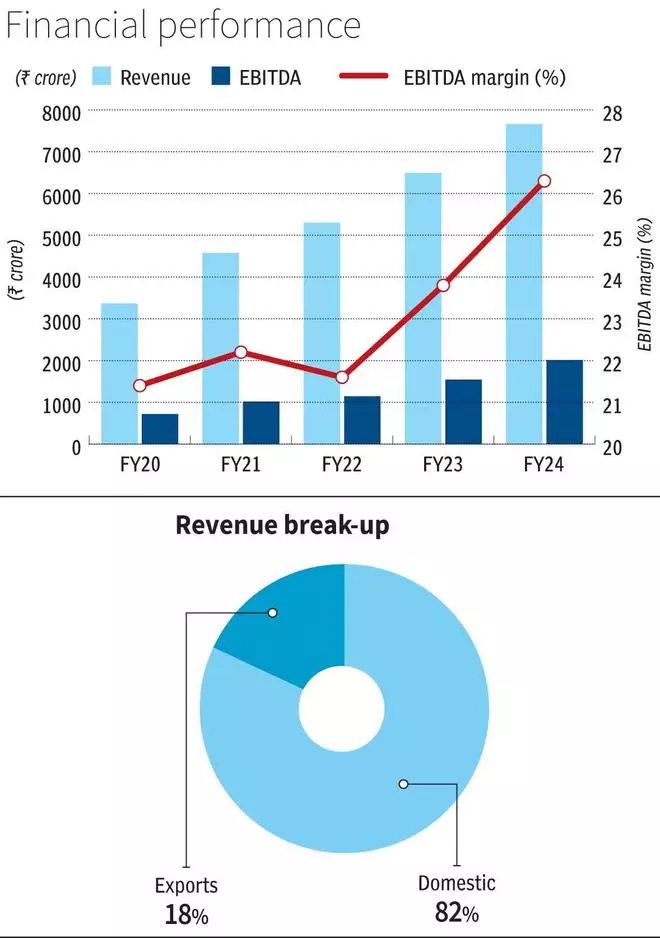

On the present value of ₹3,646, the inventory trades 32.8x its trailing 12-month earnings, implying a big low cost to friends comparable to Bharat Rasayan (40 per cent) and Sumitomo Chemical (50 per cent). Curiously that is regardless of PI Industries’ best-in-class working revenue margin (26 per cent in FY24) and return ratios (Return on Capital Employed of 24 per cent).

PI Industries is among the many nation’s main exporters of crop safety chemical substances – each lively elements and formulations. Exports represent over 80 per cent of the corporate’s complete gross sales, with home accounting for the steadiness. The corporate can also be a significant participant within the customized synthesis enterprise, whereby it really works intently with innovators in growth and manufacturing of modern merchandise.

Development levers

The expansion levers for PI Industries are three-fold. First, the corporate’s exports have witnessed wholesome development over the previous couple of quarters, whilst corporations globally have been impacted by the problem of excessive channel stock and the unfinished destocking cycle. This has been a world phenomenon with retailers and distributors slicing down on their stock primarily on account of increased carrying value, in mild of the prevailing excessive rate of interest regime. Moderation within the fee cycle over the following few quarters and completion of the destocking will present a lift to agrochemical gross sales.

PI Industries has managed to climate this nicely, due to its differentiated product basket — that enjoys higher margins within the export enterprise. Additionally, in its customized synthesis enterprise, because the molecules mature and progress to the following stage within the discovery life cycle, the income scale-up might be increased. Additionally, this may have a constructive rub-off on the corporate’s consolidated margins as these are modern merchandise and revel in very excessive gross margins.

Based on the administration, the present order e book for exports is pegged at $1 billion, equal to its FY24 total gross sales. In FY24, the income development was pushed by a 15 per cent leap in exports, which greater than compensated for the de-growth within the residence market. Additionally, in FY24, over 70 per cent of the expansion got here from new merchandise. A wholesome pipeline of about 20 merchandise lined up for launch within the close to time period, along with development from present basket, ought to assist the corporate outpace its modest steerage of 15 per cent income development.

As already said, channel de-stocking and total sentiment enchancment will additional assist profitability and income development for PI Industries. In addition to, the export enterprise additionally has a small proportion of non-agrochem merchandise (pharma firm PI Well being Sciences and group corporations) which, although at present small at 6 per cent, can get to a significant dimension in future.

In FY24, the corporate launched six new merchandise and these have seen wholesome development. Within the present 12 months too, the corporate plans to launch 4-5 merchandise. The sturdy development in FY24, fuelled largely by the acquisition of Archimica S.p.A (headquartered n Lodi, Italy) by PI Well being Sciences entity in April final 12 months, will proceed to drive the non-agrochem development.

Second, within the residence market too, the corporate has shifted focus in direction of in-licensed molecules, which get pleasure from a lot increased margins. In FY24, the corporate launched seven such merchandise and has a growth pipeline of over 20 merchandise in varied phases of growth.

The opposite main macro tailwind for the present 12 months is the expectation of regular rainfall through the South West monsoon season. This could assist the home market development in FY25. Additionally, the biologics portfolio in India is witnessing wholesome development. Merchandise comparable to Jivagro, Claret, Eketsu and Kadett, to call just a few, have aided development.

Lastly, the pharma enterprise, which incorporates an built-in contract analysis and manufacturing enterprise, is preparing for a take-off. Whilst the corporate aspires to construct world-class manufacturing and analysis infrastructure, additionally it is seeing good curiosity from world giants, which is able to drive development within the medium to long run.

What differentiates PI Industries, in addition to product innovation and market dominance, is the corporate’s means to construct a powerful enterprise mannequin, which is able to proceed to generate wholesome returns for its buyers. As an example, the corporate already has to its credit score over 165 patents until date and engages with over 700 farmers.

Financials

On the financials entrance, PI Industries enjoys the best-in-class margins (upwards of 26 per cent) totally on account of differentiated, restricted competitors alternatives. Additionally, its Return on Capital Employed is among the many highest within the business. One other constructive for the corporate is its means to keep up tight management over working capital. Consequently, the money move from operations (CFO) has grown by over 10.5x within the final 9 years.

The present a number of of CFO to the corporate’s working revenue is over 1x, as in comparison with 0.6 per cent in years previous Covid and likewise early half of the present monetary 12 months. Money conversion cycle has halved within the final two years, from about 122 days in 2022 to about 59 days now. In FY24, the corporate grew income by over 18 per cent regardless of large stock being current within the system. Working revenue for the interval grew by a powerful 30 per cent. That is due to the higher product combine, increased margins.

We imagine that the corporate, regardless of being in a management place, is obtainable at an inexpensive valuation for buyers with a medium-term horizon and therefore we now have upgraded the inventory from accumulate to purchase. Nonetheless, the one key threat and monitorable on this case can be the monsoon onset and development as any antagonistic growth on that entrance can impression agrochemical gross sales within the present 12 months, with a potential spill-over impact on the following 12 months too.

#Industries #buyers