Earnings image

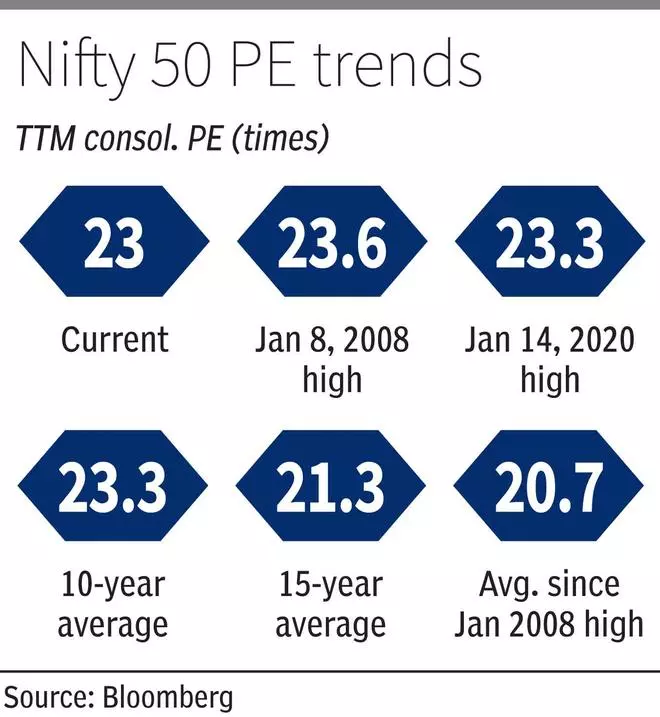

Provided that over the long run, inventory costs meet up with earnings, what might lie forward for the markets must be seen within the gentle of the earnings expectation for FY25. As per Bloomberg consensus, earnings per share (EPS) estimates for the Nifty stand at ₹1,100, a 11.1 per cent development over ₹990 recorded for FY24. Nevertheless, buyers ought to observe that 11 per cent development in earnings anticipated for FY25 is way decrease than the 20 per cent development recorded for FY24. For a perspective, Kotak Institutional Equities, in its current ‘Technique’ report launched in Might, too estimates solely a 9.1 per cent development in FY25 earnings over FY24.

Regardless of lacklustre demand, low enter prices aided bottom-line development for India Inc for a part of FY24. However with base impact catching up, a revival in demand will probably be a key monitorable for the markets in FY25. As an example, measures by the brand new authorities to place extra money within the palms of the agricultural shopper in misery, as extensively anticipated, might present a lift to earnings.

That mentioned, buyers can strategy the market right this moment within the following methods:

1. Backside-up inventory selecting

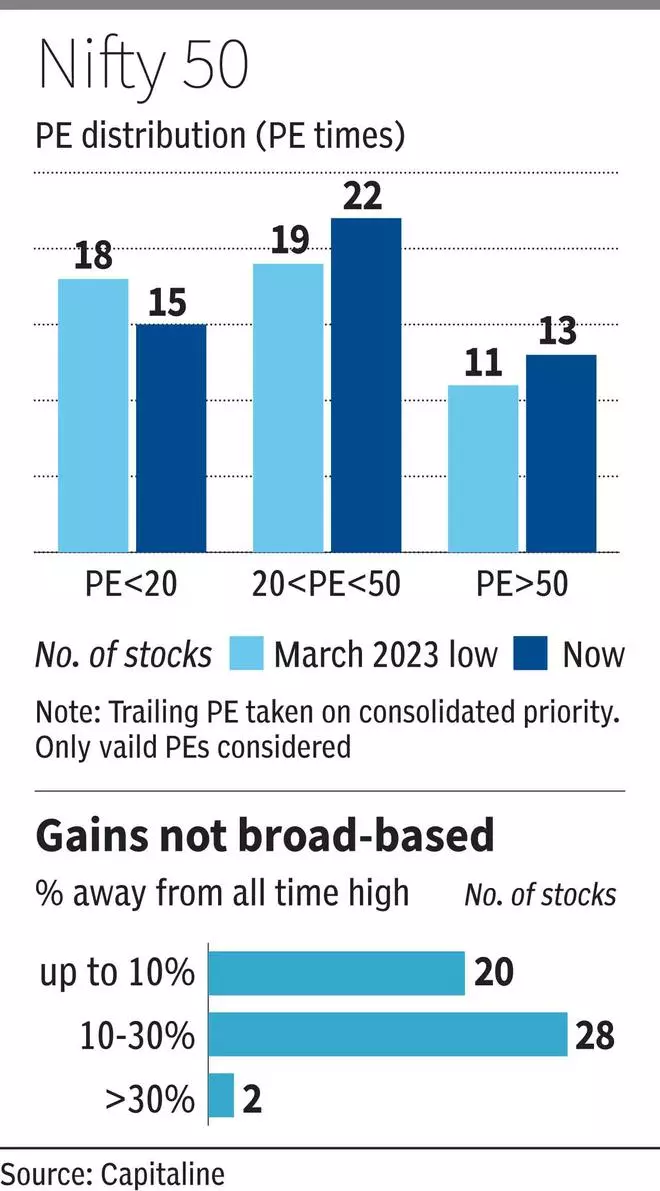

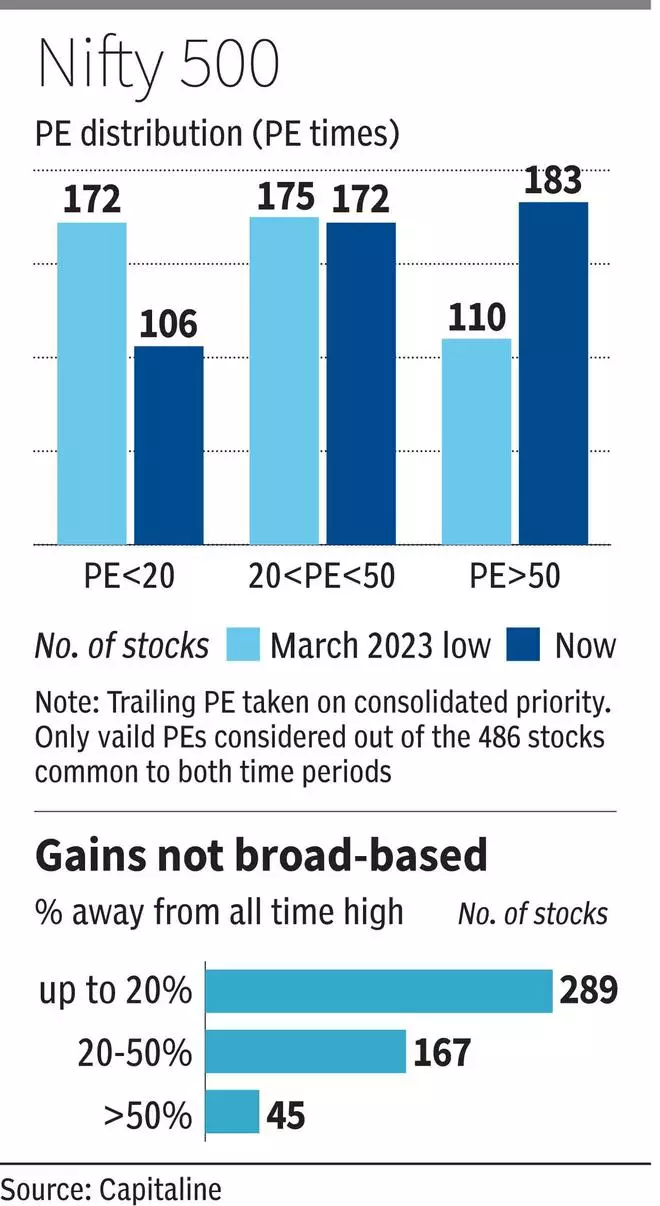

Whereas the bellwether indices appear to be reaching new highs each few days, it is very important observe that the breadth of the participation within the current rally has been slender. Be it the Nifty 50 or the Nifty 500, the accompanying charts present that lots of the constituents nonetheless commerce a lot beneath their all-time highs. Equally, whereas valuations have expanded throughout the board, pushing extra shares into the 20<PE<50 and >50 PE zones (see charts), buyers can search for worth amongst shares with first rate fundaments, which haven’t participated a lot within the rally and/or out there at affordable valuations. UTI AMC, KNR Constructions, IndusInd Financial institution are some shares which bl.portfolio advisable in current months from this basket. Different names embrace banks akin to HDFC and Kotak, NTPC, Energy Grid, metropolis fuel distributors Indraprastha and Mahanagar Gasoline, Solar TV, Apollo Tyres, Ceat and PNC Infratech.

2. Enjoying the rotation

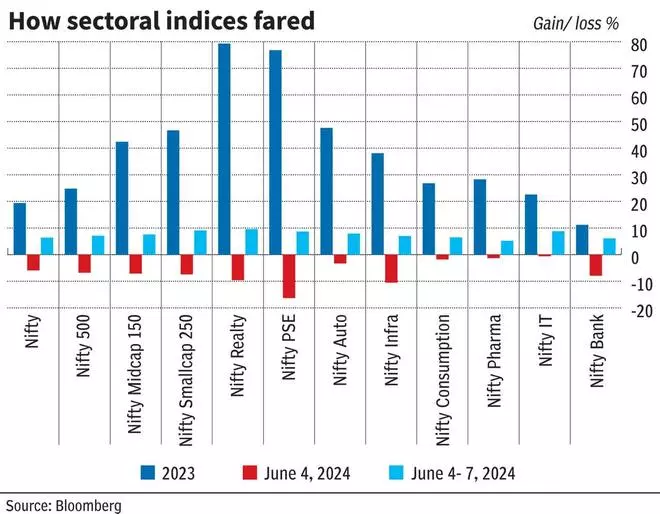

A number of the successful sectors of 2023, akin to PSUs and realty, continued to be within the limelight this 12 months till June 4. Nevertheless, a have a look at the autumn on counting day in addition to the behaviour of key sectoral indices over the previous few days (see chart) suggests {that a} sector rotation may very well be in place. Whereas it’s nonetheless early days, market’s focus now appears to be on the patron items house, on condition that it’s a defensive section in risky/unsure occasions, adopted by pharma and IT, which too exhibit related traits.

Banks too stay in focus, being on a essentially robust patch and fairly valued. Seasoned buyers who need to trip on a few of these themes can think about sectoral funds which we’ve advisable within the associated article right here.

3. Passive investing

Buyers with decrease danger urge for food, beginner buyers, in addition to those that don’t have the time to analysis shares, can go for index funds. Whereas the correction final week won’t have lasted sufficient so that you can act, corrections are endemic to markets and current themselves repeatedly. Hold powder dry to capitalise on such alternatives. Make investments lump sums in index funds-based large-cap or mid-cap indices as elaborated on this linked article.

4. E book earnings in overheated shares

Whilst you establish investible pockets, e book earnings in segments that appear overheated. With sector rotation already at play, some PSU shares might give ample room to take cash off the desk. .bl.portfolio had advisable that buyers e book earnings in RailTel and NHPC earlier this 12 months, which has labored properly to date, with these shares underperforming the broader markets. Whereas we did suggest a ‘e book earnings’ on IRFC, RVNL, Mazagon Docks in September final 12 months itself, the shares have continued to do properly. If you happen to nonetheless contiune to carry these, it might be likelihood to lock-into some features right this moment.

With a brand new coalition authorities taking cost, tapering of order flows, delays in execution, and alter in coverage or path of spending stay dangers to PSU shares. Equally, some within the capital items/industrials house too are buying and selling at wealthy valuations, buoyed by the push to manufacturing.

5. Asset allocation

Lastly, remember the fact that equities ought to solely kind a sure share of your portfolio as per your age, danger urge for food and time horizon, amongst different issues. It’s at all times clever to diversify into debt for stability and gold, which has damaging correlation with equities over the long run. If you happen to discover your portfolio is over-allocated to equities, rebalance and transfer to debt. Whereas shorter time period debt funds are enticing right this moment, choose banks/top- rated NBFCs supply good charges on their FDs too.

#Elections #Coalition #Authorities #Inventory #Markets #Methods #Buyers #Report #Highs