We advocate that buyers accumulate JSW Metal, given the upcoming spurt in output, its execution potential and powerful home presence. The inventory often trades at a premium, and presently at 10.7 instances trailing EV/EBITDA, the valuation is at a 25 per cent premium to historic vary. Traders can accumulate the inventory on dips for accommodating a margin of error in valuations.

Rising home demand

Indian metal consumption elevated to 136 mt (million tonnes) from 120 mt final 12 months, which is a 13 per cent YoY development. Demand from infrastructure, dwelling, auto, client home equipment, power storage and energy infrastructure has spelt tailwinds, aside from broader financial development. The outlook for many of the end-user industries is anticipated to maintain domestically. The administration expects metal demand development to match 1.5x GDP development charge within the ‘nationwide constructing’ part, which ought to indicate not less than 8-10 per cent demand development per 12 months or within the vary of 10-12 mt extra metal demand yearly.

The headwind is from imports into India, which elevated 37 per cent final 12 months to account for 7 per cent of home consumption. China, the most important producer, going through a weak property market domestically, has elevated exports by 32 per cent in CY23. As selective stimulus in China and demand restoration globally take form, imports into India and pricing strain are anticipated to subside from the presently excessive depth.

Heavy capex outlay

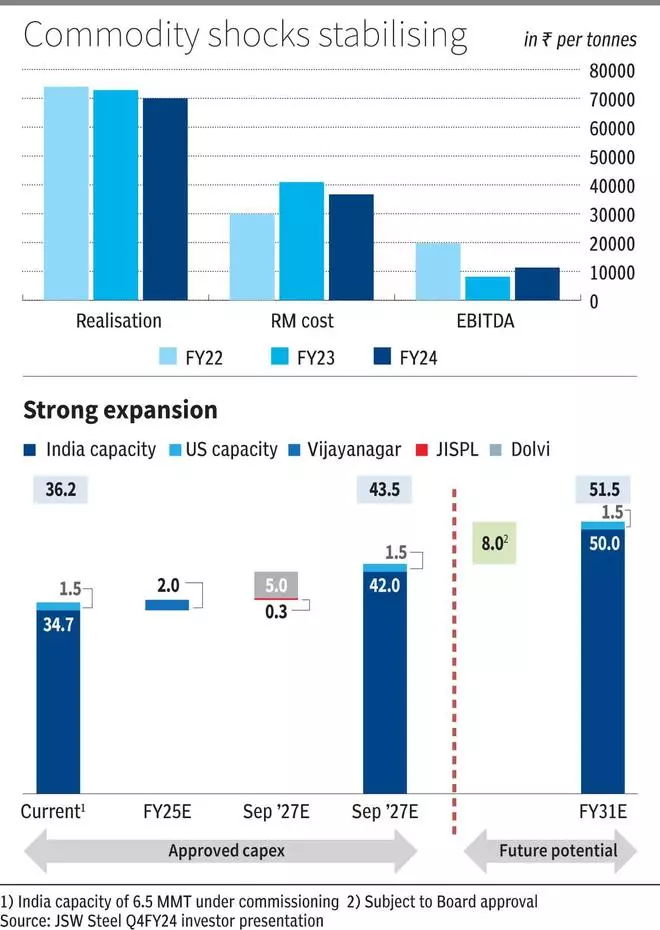

JSW Metal goals to extend capability at 10 per cent CAGR for the following seven years, with complete capex outlay of ₹65,000 crore within the subsequent three years alone. This represents round 30 per cent of the present market cap. The corporate has guided for 8 per cent YoY quantity development in FY25 gross sales, which needs to be considered as a conservative estimate, given the enlargement.

The general enlargement is phased in three broad levels. The primary is at commercialisation juncture as development is accomplished in Q4FY24. The corporate had a acknowledged capability of 28.2 mt until Q3FY24. Within the present fiscal it ought to begin business manufacturing from 5 mt in Vijayanagar and a couple of mt within the subsequent part. The Bhushan Energy and Metal (BPSL) acquisition, finished in 2021, has been expanded from 3 to 4.5 mt and is anticipated to ramp up within the 12 months. The BPSL capability will come on-line the earliest by Q2FY25, adopted by Vijayanagar facility, however the full scope might bear fruit solely in FY26.

Past this, the corporate plans to do brownfield expansions in Dolvi, Vijayanagar and Jharsuguda to succeed in 42 mt by FY28 and additional improve it to 51.5 mt by FY31. This features a 4-mt Inexperienced Metal manufacturing plant in two phases, which is beneath proposal for the board. Total, the enlargement is basically brownfield, finished at present places, which ought to indicate a decrease value.

Traders should be aware that the highest three home metal gamers (Tata Metal, JSW Metal and Jindal Metal and Energy) have enlargement plans of comparable magnitude. The sturdy demand domestically is anticipated to soak up such capacities however everybody increasing may be an overhang to pay attention to.

Commodity costs

JSW Metal noticed web realisations decline by 4 per cent in FY24 however with uncooked materials prices, together with coal, iron ore and energy prices, declining considerably, the unfold or EBITDA margins improved 450 bps in FY24 to fifteen per cent.

Metal costs are anticipated to have bottomed out within the final two quarters. Any development from right here relies on Chinese language and world financial restoration and rates of interest taking an accommodative stance. In a probable state of affairs of that not occurring, metal costs might maintain fort on the present ranges. In any case the unfold is unlikely to vary. Coking coal, iron ore and energy prices have additionally declined in FY24. The worldwide restoration is prone to affect metal realisations and uncooked materials prices equally with a lag favoring metal costs within the brief time period, however evenly in the long run.

The opposite components impacting JSW Metal’s unfold outlook positively (consensus expects 200 bps EBITDA margin enchancment in FY25) are working leverage/effectivity, uncooked materials linkages and value-added product combine. These can solely be a mushy cushion to the unfold within the brief time period. JSW Metal has acquired a coal mine in Mozambique with entry to greater than 800 tonnes of premium laborious coking coal reserves. The extra iron ores in Karnataka, Odisha and Goa are anticipated to complement its backward integration. However the firm has a 3rd of iron ore from captive mines and the profit could be gradual incremental addition to the unfold on operationalising the mines.

Valuation and financials

JSW Metal has a web debt to EBITDA of two.62 instances as of March 2024 and a web debt of ₹74,000 crore. The enlargement is prone to be financed from inside accruals, whereas debt discount could also be slower and proceed to stay on the present mildly elevated ranges.

In comparison with final eight-year common of 8.5 instances EV/EBITDA, the inventory trades at 10.7 instances. Contemplating the tailwinds in demand development and capability enlargement, tempered by overhang of imports and world financial restoration and scope for margin enlargement, we advocate that buyers accumulate the inventory on dips.

#JSW #Metal #accumulate #inventory