Ambuja capability targets

Ambuja goals for a consolidated capability of 140 mtpa by FY28, from the present 77 mtpa. The present deal can add 10 MTPA which is operational and one other 4 mtpa is beneath building anticipated to be commercialised in subsequent one 12 months. This can take Adani Cement operational capability to 89 mtpa, together with the two mtpa acquisition in April 2024. Ambuja has lowest presence in South India, with North and Jap areas accounting for 27 per cent of FY24 gross sales and Western, Central and Southern areas accounting for twenty-four, 14 and 9 per cent.

By way of market, its pan-India market share improves by 2 per cent with the deal. South India market share will attain 15 per cent versus 8 per cent earlier. Over and above the 14 mtpa capability, PCIL additionally has a 3 mtpa cement grinding capability in North India, which could be leveraged for additional capability enlargement.

Together with cement amenities, PCIL acquisition also can add sea transportation logistics with 5 bulk cement terminals at Kolkata, Gopalpur, Karaikal, Kochi and Colombo, to serve peninsular India and exports to Sri Lanka for the group.

PCIL operations, alternatively, are dealing with a robust decline and might profit from a strategic overhaul that Ambuja group can present. The revenues have declined at 37 per cent CAGR in final two years to ₹1,241 crore in FY24 in comparison with Ambuja’s income gowing at 2.5 per cent CAGR within the interval. This might clarify the deal at worth decrease than the alternative price.

Valuation comparability

Primarily based on the acquisition EV of ₹10,422 crore and assuming capability at 14 mtpa because the price is included within the EV, PCIL is being acquired at $89 per tonne. Optimistically, if the 3mtpa enlargement fructifies, the deal could be priced at even decrease price. This falls between the valuation paid within the newest two acquisitions within the area. Ambuja Cements acquired Sanghi Cements in August 2023 at $99 per tonne for its 6.1 mtpa. However Dalmia Bharat acquired Jaiprakash’s 9.4 MTPA cement facility in December 2022 at $73 per tonne. The latter was a confused asset, which may clarify the massive hole.

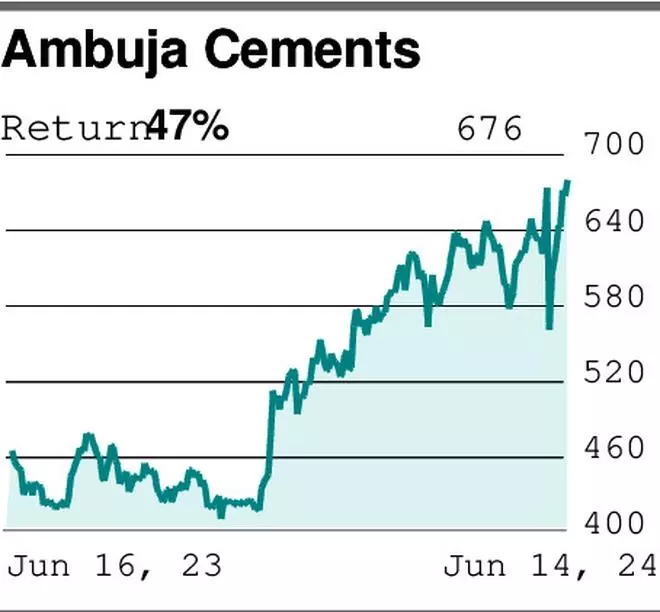

If the deliberate 3 mtpa capability comes on-line as anticipated and extra 3 mtpa capability is leveraged with minimal funding, the PCIL funding could be value-accretive for Ambuja in the long term. The group has efficiently executed such worth addition earlier as properly. Adani acquisition of Ambuja was executed at $157 per tonne and is now valued at $221 per tonne.

On a PE foundation, Ambuja Cements trades at 36 instances one-year ahead earnings, consistent with business chief UltraTech Cements.

#Ambuja #Cements #continues #southward #March