- Additionally learn: RBI’s well timed motion helped curb potential dangers in unsecured client credit score: Das

On the MPC assembly, which was held from June 5–7, 2024, a majority of 4 to 2 voted to take care of the coverage repo charge at 6.50 per cent.

Goyal, Emeritus Professor, Indira Gandhi Institute of Growth Analysis (IGIDR), Mumbai, and Varma, Professor, Indian Institute of Administration, Ahmedabad, voted for a reduce within the repo charge from 6.50 per cent to six.25 per cent.

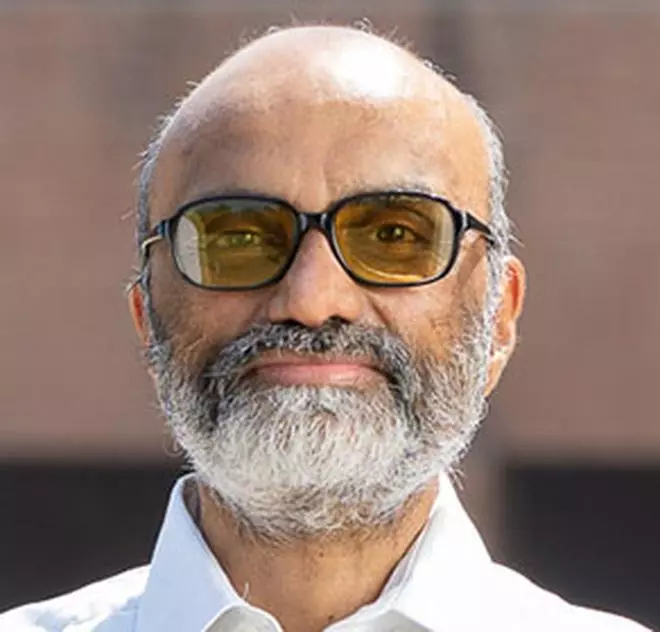

Jayant Varma

| Photograph Credit score: RAVI MISTRY

The decision “to stay centered on the withdrawal of lodging to make sure that inflation progressively aligns with the goal whereas supporting progress” was additionally determined by a majority of 4 to 2. Goyal and Varma voted for a change in stance to impartial.

Whereas Varma was the one member to bat for a charge reduce within the final three MPC conferences (February 2024, April 2024, and June 2024), now Goyal voted with him within the June assembly.

- Additionally learn: RBI to rationalise the variety of agenda gadgets financial institution administration locations earlier than its board: Guv Das

Actual coverage charges can safely fall

The IGIDR professor mentioned the headline inflation projection of 4.5 per cent for FY25 offers a median actual repo charge of two per cent, implying that this charge will likely be above impartial for too lengthy if the repo charge stays unchanged (at 6.50 per cent).

She cautioned that, “Falling inflation has raised actual repo above unity. This can cut back actual progress charge with a lag. Anticipated progress is round 7 per cent in FY25 beneath the 8 per cent achieved in FY24.

“Standing quoism is praised as being cautious. But when doing nothing distorts actual variables, it aggravates shocks as a substitute of smoothing them and raises danger.”

Goyal noticed that if headline inflation is approaching the goal and core inflation is beneath goal, and incoming knowledge helps this, it implies progress is beneath potential and NIR (impartial actual coverage charge) is above impartial, so actual coverage charges can safely fall.

“At current, solely small steps are required to align the repo with the autumn in inflation, so this shouldn’t be seen as the beginning of a rate-cut cycle.

“Communication ought to make it clear that there is no such thing as a softening path and ahead steerage stays data-determined. A impartial stance is suitable because the charge can then transfer in both route as required,” she mentioned.

Unacceptably excessive progress sacrifice

Referring to his assertion within the final assembly (April 2024), whereby he expressed concern concerning the progress sacrifice in FY25 induced by restrictive financial coverage, Varma mentioned: “It now seems that the upkeep of restrictive coverage for an unwarrantedly lengthy will result in a progress sacrifice in FY26 as nicely.”

The IIM Professor famous that skilled forecasters surveyed by the RBI are projecting progress each in FY26 and FY25 to be decrease than in FY24 by greater than 0.75 per cent, and decrease than the potential progress charge (of say 8 per cent) by greater than 1 per cent.

“That is an unacceptably excessive progress sacrifice contemplating that headline inflation is projected to be solely about 0.5 per cent above goal and core inflation is extraordinarily benign.

“The present actual coverage charge of round 2 per cent (primarily based on projected inflation) is nicely above the extent wanted to glide inflation to its goal,” Varma mentioned.

#MPC #Minutes #slicing #charge #influence #progress #Varma #Goyal