OFSS is one inventory that bl.portfolio had maintained a optimistic stance on, amid our total cautious stance within the Indian IT house during the last 2-3 years. This stance has largely performed out now, with OFSS outperforming the sector considerably. The inventory is up 150 per cent within the final one yr as in comparison with Nifty IT up 22 per cent. Since our purchase suggestion on OFSS (‘Play the ready recreation’ in bl.portfolio version dated October 2, 2022), OFSS has given complete returns together with dividends of 260 per cent (vs Nifty IT’s complete returns of 35 per cent).

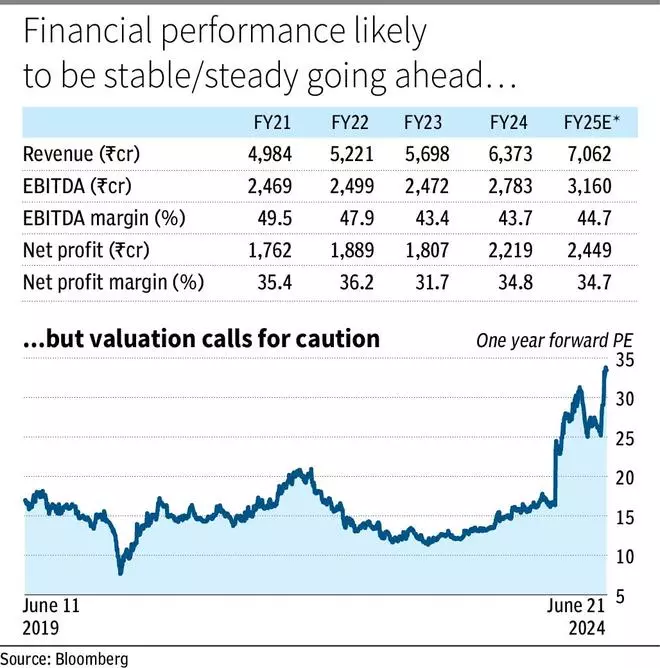

Is it time to take inventory? We imagine it’s. Via this era of serious outperformance, the valuation of OFSS has expanded from an ultra-attractive one-year ahead PE of 11.5 instances to fairly an costly one-year ahead PE of 33.5 instances (greater than double the five-year common of 16 instances). In October 2021, OFSS represented the quintessential instance of a deep worth inventory. With some rerating taking part in out within the early a part of the yr when its PE moved as much as 23 instances, we had really helpful that buyers proceed to carry the inventory, in our replace printed in bl.portfolio version dated February 4, 2024 (‘Ample positives to financial institution on for now’). Nevertheless, now the valuation seems stretched with, in our view, not a lot room additional for any rerating. We suggest that buyers e book earnings within the inventory and lock in on the positive aspects.

Submit uptick in its enterprise reported in January 2024 on the time of its Q3 earnings launch, which triggered the rerating within the inventory, the expansion prospects at the moment are mirrored in ahead estimates. Expectations now are for FY24-26 income/EBITDA/EPS to development at a CAGR of 11, 13 and 12 per cent respectively. One-year ahead PE at 33.5 instances greater than adequately components this. In our view, the dangers are extra to the draw back than upside from right here, making it unfavorable to carry the inventory anymore. Many IT shares peaking out between mid 2021 and an early 2022 after reaching excessive valuation relative to development prospects is a transparent indication that valuation issues. OFSS is unlikely to be an exception.

Enterprise

OFSS is a worldwide chief in offering IT options to the monetary providers business. It presents complete banking functions throughout the spectrum of retail, company and funding banking to monetary establishments. Its expertise options embody core banking expertise and canopy end-to-end necessities (entrance to again workplace) within the monetary providers business and likewise embody danger administration, analytics and forensic finance.

It’s a software program merchandise firm and earns income by means of licensing, consulting and upkeep charges linked to the product. Its flagship product is Oracle Flexcube. The corporate additionally earns some income from allied providers and BPO. Nevertheless, these presently kind a small half, with merchandise income accounting for 90 per cent of complete income. Inside its merchandise enterprise, the corporate has been adapting effectively to the altering dynamics within the business with the shift in the direction of SaaS (software program as a service). It has been making investments on this house and a big portion of its banking product portfolio is now out there as a cloud service.

OFSS is geographically well-diversified with round 25 per cent of revenues from the US, 15 per cent from Europe, 25 per cent from APAC, 16-17 per cent from West Asia and Africa, round 11 per cent from India and stability from remainder of the world. Usually within the Indian IT house, the US and Europe account for 80-90 per cent of revenues for a lot of corporations. OFSS’ a lot decrease publicity to those geographies and wholesome diversified geographic combine enabled it to buck the pattern versus different IT gamers in FY24, whereby it reported higher income and earnings.

Current efficiency

FY24 income elevated 12 per cent to ₹6,372 crore and internet revenue elevated 23 per cent to ₹2,219 crore. The stronger development in internet revenue relative to income is unlikely to repeat, going ahead, because it benefited from a margin rebound, submit decline in FY23, because of which earnings had declined by 4 per cent in FY23.

Additional, submit a strong 3Q, when income and licence wins elevated 26 and 80 per cent Y-o-Y respectively, This fall noticed some reversion, with income rising 12 per cent and licence wins declining 31 per cent.

Quarterly volatility aside, the corporate is prone to proceed secure/regular efficiency over the following few years. That is absolutely factored at present ranges. Our thesis on the inventory has absolutely performed and therefore buyers can e book earnings.

#Oracle #Monetary #Companies #Software program #time #e book #earnings #returns #purchase #suggestion