- Additionally learn: Repo fee: Any hasty motion will trigger extra hurt than good, says RBI Guv Das

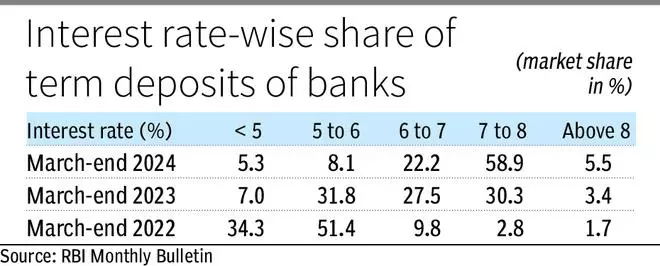

A drill down of RBI information present that as at March-end 2024, 58.9 per cent of the time period deposits (TDs) of banks’ carried rate of interest between 7 per cent and eight per cent (in opposition to 30.3 per cent of TDs as at March-end 2023) and 5.5 per cent of the TDs carried rate of interest above 8 per cent (in opposition to 3.4 per cent of TDs as at March-end 2023).

Charges supplied

For instance, the very best rate of interest that State Financial institution of India (nation’s largest financial institution) is presently providing is 7 per cent on a TD of “2 years to lower than 3 years” length.

The very best rate of interest that HDFC Financial institution (largest non-public sector financial institution) is presently providing is 7.25 per cent on a TD of “18 months to lower than 21 months” length.

The very best rate of interest that AU Small Finance Financial institution (largest small finance financial institution/SFB) is presently providing is 8 per cent on a TD of “18 months” length.

- Additionally learn: MPC meet noticed decided push for fee minimize to propel development

Small finance banks similar to Ujjivan and Suryoday are providing 8 per cent plus rate of interest on sure maturity buckets.

The very best rate of interest that Ujjivan SFB and Suryoday SFB are presently providing is 8.50 per cent (on a TD of “15 months” length) and eight.65 per cent (on a TD of “2 years & 2 days” length)

Deposit mobilisation

Banks are discovering deposit mobilisation difficult as different funding avenues similar to equities, mutual funds and non-convertible debentures are fetching comparatively increased returns. This comes whilst credit score development is outpacing deposit development.

Financial institution credit score and deposits registered a year-on-year development of 19.3 per cent and 13.5 per cent, respectively, as at March-end 2024.

CARE Rankings, in a report, mentioned banks are anticipated to make additional efforts in FY25 to shore up their legal responsibility franchise and be certain that lagging deposit development doesn’t constrain credit score offtake.

In his newest bi-monthly financial coverage assertion, RBI Governor Shaktikanta Das mentioned, “The persisting hole between credit score and deposit development charges warrants a rethink by the Boards of banks to re-strategise their enterprise plans. A prudent stability between property and liabilities must be maintained.”

#Share #time period #deposits #providing #curiosity #fee #jumps #banks #complete #TDs