Anil Kewalramani

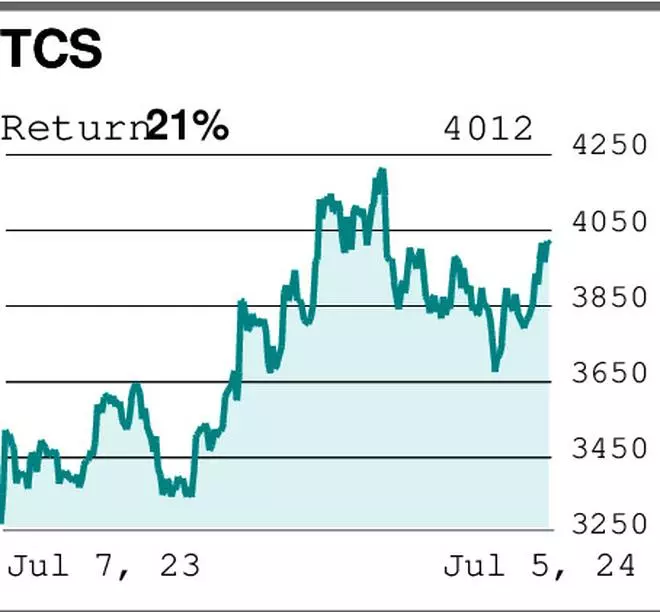

Tata Consultancy Companies (₹4,011.8): The inventory of TCS (Tata Consultancy Companies) has been in an uptrend since early June, after discovering assist at ₹3,600. However in the previous couple of periods, it has been flat. Nonetheless, the broader development is up, and we count on it to understand, probably to ₹4,250 within the close to future. That mentioned, there’s a probability that TCS would possibly see a dip to ₹3,950 earlier than the following leg of upswing.

So, we propose shopping for 4100-strike name now at ₹51 and accumulate when the inventory worth drops to ₹3,950. The anticipated worth of 4100-CE then might be between ₹30 and ₹32. Subsequently, your common worth would come round ₹42.

Exit half of your possibility holding on the prevailing worth when the inventory worth rallies to ₹4,150. For the remaining half, hold stop-loss on the entry worth. Exit the leftover when TCS’s inventory worth rises to ₹4,225.

As a substitute of appreciating if the inventory declines and slips beneath ₹3,900, liquidate the choices place. As a result of the breach of ₹3,900 can result in a contemporary leg of downswing.

I’ve a brief place on Coforge July futures. I bought at ₹5,689.70. Ought to I exit or wait?

Palani S

Coforge (₹5,870.15): The inventory of Coforge has been on an uptrend since Could. Final week, it closed above a resistance at ₹5,800, opening the door for additional rally. Subsequently, Coforge July futures (₹5,859.45) is more likely to go up from right here.

However there’s a slim probability for the contract to see a minor correction in worth, probably to ₹5,750 or to ₹5,650. Given the prevailing situations, a decline beneath ₹5,650 is much less possible.

Our advice can be to carry the place with a stop-loss at ₹5,900. However exit the quick place at both ₹5,750 or ₹5,650, relying on how far the corrective transfer can stretch.

It is crucial so that you can strictly adhere to the stop-loss talked about above. For the reason that development is up, a breakout of ₹5,900 may end up in a fast rally to ₹6,300.

You would possibly contemplate going lengthy as soon as the stop-loss of quick futures is hit. Goal and stop-loss might be at ₹6,300 and ₹5,750.

Ship your queries to derivatives@thehindu.co.in

#Question #Purchase #Promote #Inventory #Derivatives