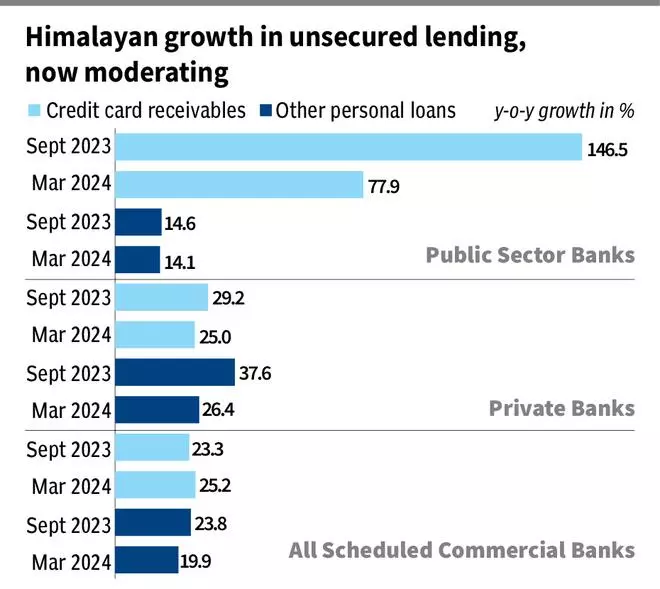

Earlier, in its FSR for the half-year ended September 2023, the RBI flagged indicators of threat build-up in shopper credit score, particularly the unsecured form. The bank card receivables of Public Sector Banks (PSBs) noticed a year-on-year (YoY) development of a whopping 146.5 per cent as of September 2023 (See chart). Non-public Banks (PVBs) recorded a 29.2 per cent development in bank card receivables and 37.6 per cent development in different private loans. All of the Scheduled Business Banks (SCBs) collectively marked a 23.3 per cent and 23.8 per cent YoY development in bank card receivables and different private loans respectively.

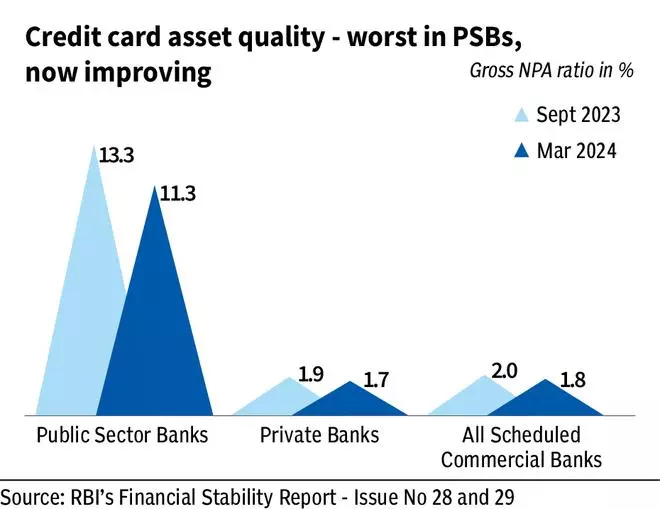

Not all loans superior have been high quality ones and so, classic delinquency of private loans reached 8.2 per cent, indicating a decline in credit score underwriting requirements. Classic delinquency is the share of accounts which have turn into delinquent (90+ days overdue) inside twelve months of origination. As regards asset high quality of bank card receivables, the gross NPA ratio on the system stage stood at 2 per cent as of September 2023. Not one thing that may ring alarms bells. Nevertheless, so far as PSBs are involved, the GNPA ratio stood at 13.3 per cent (See chart).

The state of affairs was so intense that 42.7 per cent of shoppers availing of consumption loans already had three stay loans on the time of origination; 30.4 per cent of shoppers had availed greater than three loans within the final six months, and seven.3 per cent of shoppers availing a private mortgage beneath ₹50,000 had at the least one overdue private mortgage.

Additional, financial institution lending to NBFCs elevated at a CAGR of 26.3 per cent between June 2021 and June 2023, which is properly above the 14.8 per cent CAGR recorded by total financial institution credit score. That is vital as a result of the share of unsecured loans within the AUM of NBFCs was properly north of 30 per cent, with bank card receivables of NBFCs posting 22.6 per cent development and different retail loans 33.6 per cent YoY as of September ‘23.

The state of affairs made the RBI spring into motion in November 2023, when it hiked the chance weights for unsecured lending by banks and financial institution credit score to sure NBFCs by 25 per cent. The transfer caused a slew of measures by banks — akin to ICICI Financial institution refining credit score parameters for private loans, SBI and Axis Financial institution passing on the incremental price of capital because of the larger threat weights to NBFCs and prospects of private mortgage merchandise.

As a consequence, YoY development in bank card receivables of PSBs fell sharply to 77.9 per cent as of March 2024, from monumental ranges of 146.5 per cent (See chart). Different private loans of PVBs have slowed right down to 26.4 per cent YoY as of March 2024, from 37.6 per cent. On the system stage, development in different private loans has moderated to 19.9 per cent from 23.8 per cent. On the asset high quality entrance, the GNPA ratio with respect to bank card receivables has fallen by 200 bps for PSBs and 20 bps every for PVBs and on the system stage (See chart).

Financial institution lending to NBFCs has declined to 9.4 per cent of whole financial institution credit score as of April 2024, down from its peak of 10 per cent in June 2023. Furthermore, YoY development in financial institution lending to NBFCs has additionally moderated, from 18.9 per cent in November 2023 to 14.6 per cent in April 2024. Additionally, NBFCs have significantly diminished their publicity to unsecured loans from a peak of 32.2 per cent to 29 per cent in November 2023, to 22 per cent in March 2024.

The RBI’s well timed corrective measures actually appear to be working, having introduced bank cards GNPA to 1.8 per cent. Whole GNPA on the system stage has additionally declined to comfortably low ranges. System-level CRAR, too, is at a wholesome 16.8 per cent. Total, RBI’s proactive measures show to be a constructive for the long-term monetary well being of India’s banks and their buyers.

#Actuality #Verify #Riskweight #Capsule #Working