The inventory worth of IEX is now buying and selling at a reduction of 44 per cent in comparison with its life-time excessive of ₹318.7. It remained underneath strain because of competitors and measures comparable to market coupling. Nonetheless, year-to-date in 2024, IEX has appreciated 5.4 per cent and up to now in FY25, it has rallied practically 32 per cent.

Whereas the latest appreciation seems to be a aid rally because of the potential delay in implementation of market coupling, it stays a major danger to the corporate as it could possibly impression the corporate’s place as market chief within the enterprise. Additionally, the trailing PE, at 45, seems costly.

That mentioned, there are different regulatory developments which can be conducive for the facility alternate enterprise, which may help the corporate’s development over the long run. So, contemplating the above, buyers who personal the inventory can maintain on to it. However individuals in search of contemporary alternatives can steer clear of this inventory till we get readability on how and when the Central Electrical energy Regulatory Fee (CERC) will implement market coupling.

- Additionally learn: Ganesh Housing Company: What ought to buyers do

A look on the enterprise

IEX allows buying and selling of electrical energy, renewables and certificates via its automated platform. The corporate collects the bids and asks and matches the orders of patrons and sellers of electrical energy, facilitating the bodily supply of the identical.

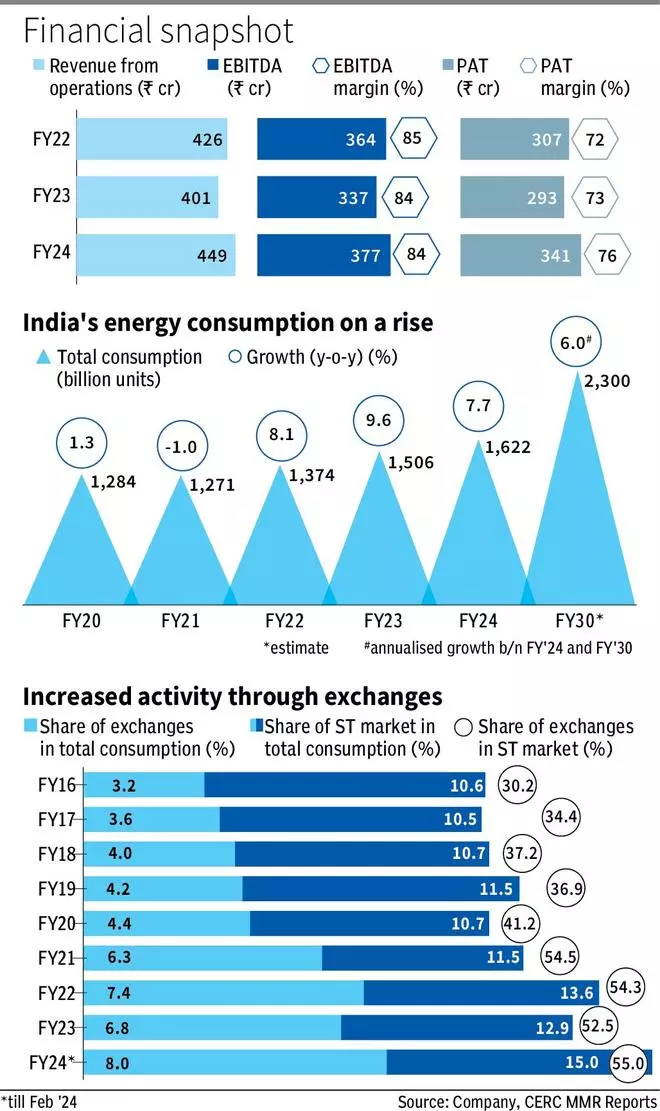

The majority of India’s electrical energy market i.e., 85 per cent, is thru long-term Energy Buy Agreements (PPA). The Brief Time period (ST) energy market, the place IEX operates, includes contracts lower than one 12 months and constitutes the remaining 15 per cent. In FY24, 55 per cent of the ST market occurred via exchanges through which IEX’s share stood at 84 per cent.

The completely different segments of the ST energy market are primarily DAM (Day-Forward Market), RTM (Actual Time Market) and TAM (Time period Forward Market). IEX additionally offers with ESCert (Power Saving Certificates) and REC (Renewable Power Certificates).

DAM is for subsequent day deliveries of electrical energy whereas RTM is for energy deliveries in a single hour. In each these markets, IEX holds about 99 per cent market share. TAM is for electrical energy deliveries as much as 90 days. IEX has petitioned CERC to increase the time period of TAM contracts from 90 days to 11 months, which is pending approval. Market share of IEX in TAM is 55 per cent. The corporate additionally facilitates buying and selling in ESCert and REC, through which its contribution is 70 per cent.

The corporate additionally gives GDAM (Inexperienced Day-Forward Market) and GTAM (Inexperienced Time period Forward Market), enabling trades in renewable power.

The main supply of revenue is the transaction charges, accounting for 78 per cent of complete revenue in FY24, which the corporate collects in electrical energy trades that it facilitates.

Altering dynamics

IEX, since 2022, has been tormented by elevated competitors, notably submit the entry of HPX. Competitors has led to a drop in market share of IEX, from about 95 per cent in FY22 to 84 per cent in FY24.

As well as, the CERC introduced ‘market coupling’ again into the highlight not too long ago. Market coupling is the idea of aggregating all of the purchase and promote bids throughout the exchanges and discovering a uniform Market Clearing Worth (MCP). If that is carried out, a purchaser within the IEX can discover a vendor from different exchanges, which may be PXI or HPX. Thus, IEX can lose its benefit of being probably the most liquid alternate because the clearing of trades from all three exchanges can be executed in frequent by a separate physique.

As a brief aid for IEX, CERC, in its February order, famous that “merely coupling bids of all energy exchanges is not going to yield substantial enchancment in market final result” in DAM and RTM market. Nonetheless, CERC will go forward with pilot runs to search out financial advantages of coupling the RTM market with the SCED (Safety Constrained Financial Dispatch) market. SCED is an influence dispatch approach to fulfill the load in probably the most cost-effective method by contemplating constraints comparable to transmission capability, system stability, and many others.

Nonetheless, IEX’s administration thinks it could possibly take appreciable time for completion of such research and implementation of market coupling. So, whereas the danger has not gone away, it could not weigh on the inventory within the brief time period.

- Additionally learn: Actuality test: Threat-weight capsule working nicely

That mentioned, there have been regulatory tailwinds for the facility alternate enterprise. Implementation of Indian Electrical energy Grid Code, amendments relating to GNA (Normal Community Entry) and Inter-State Transmission prices rules are anticipated to enhance the methods through which electrical energy can be traded. Additionally, the Ministry of Energy has amended guidelines to make URS (Un-Requisitioned Surplus) energy out there to the market via energy exchanges, which earlier remained as unused surplus energy by producing corporations.

Efficiency measurement

IEX, which noticed a dip in income in FY23 because of decrease demand for ST energy, a serious marketplace for the alternate, noticed a restoration in FY24. The highest line expanded 12 per cent year-on-year to ₹449 crore within the monetary 12 months 2023-24. EBITDA, too, improved 12 per cent to just about ₹377 crore.

Thus, the corporate was capable of keep an EBITDA margin of 84 per cent in FY24, the identical as in FY23. The web revenue within the final fiscal went up 16 per cent to ₹341 crore. Because the firm primarily is dependent upon transaction prices for revenues, extra shopping for and promoting of electrical energy via alternate routes is vital.

India’s complete electrical energy consumption stood at 1,622 BU (Billion Items) in FY24. Inside this, the share of ST market and share of exchanges in complete consumption has been bettering (refer chart).

The nation’s complete consumption is forecast to develop at 6 per cent annualised fee to 2,300 BU in 2030, paving the best way for a possible enhance in electrical energy traded via exchanges. IEX additionally operates IGX (Indian Gasoline Alternate), which is at a nascent stage, and ICX (Indian Carbon Alternate), which is but to take off.

Total, the corporate faces danger within the type of market coupling and the valuation of 45 occasions seems costly for an organization whose internet revenue rose 16 per cent. Nonetheless, there are long-term structural advantages because of regulatory measures that IEX can reap. So, buyers can maintain on to this inventory.

- Additionally learn: The Buffett Indicator and why you need to view long-term Sensex targets with warning

#Indian #Power #Alternate #Traders