“Out of complete liquidity assist of over ₹3.68-lakh crore, NPAs reported are round ₹22,000 crore or 6 per cent on loans assured,” an official mentioned. The definition of NPA below ECLGS is identical as outlined by RBI. In line with RBI, with impact from March 31, 2004, a non-performing asset shall be a mortgage or an advance the place Curiosity and/or instalment of principal stay overdue for greater than 90 days in respect of a time period Mortgage.

- Additionally learn: With low NPAs and sturdy earnings, banks are nicely capitalised: RBI Monetary Stability Report

Tendencies in unhealthy money owed below ECLGS seem like in step with general system knowledge. In line with the most recent Monetary Stability Report by RBI, scheduled business banks’ gross non-performing property (GNPA) ratio fell to a multi-year low of two.8 per cent and the online non-performing property (NNPA) ratio to 0.6 per cent at end-March 2024. Equally, for non-banking monetary corporations (NBFCs), GNPA ratio at 4 per cent at end-March 2024.

ECLGS was launched in Could 2020, as a particular initiative to allow liquidity assist to companies adversely impacted by lockdown attributable to Covid-19 pandemic. The scheme covers all loans sanctioned below ‘Assured Emergency Credit score Line’ as much as March 31, 2023 or until ensures for an quantity of ₹5-lakh crore are issued, whichever is earlier. It supplies for 100 per cent assure protection to banks & NBFCs on credit score prolonged to enterprise enterprises/MSMEs on their mortgage excellent as on February 29, 2020, to satisfy their extra time period mortgage/extra working capital necessities. Initially, it was primarily for MSMEs, however later, it was expanded to debtors from 26 harassed sectors recognized by Kamath Committee apart from healthcare and hospitality sectors

- Additionally learn: ‘The NPA market isn’t static’

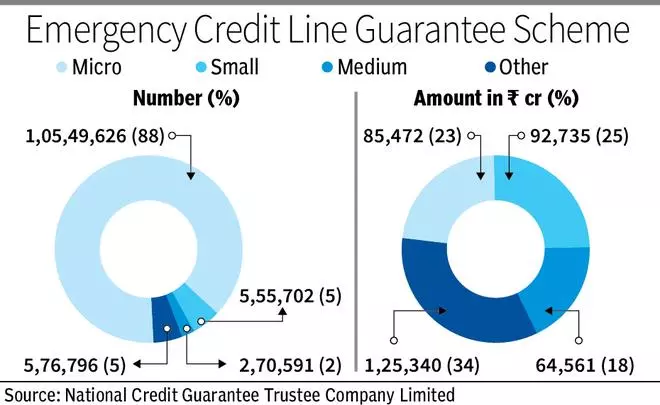

Share of MSMEs

Officers highlighted that out of liquidity assist of ₹3.68-lakh crore to 1.19 crore companies, the share of MSMEs is 95 per cent when it comes to variety of ensures and about 65 per cent when it comes to quantity of ensures issued. By way of variety of debtors supported, 88 per cent are micro debtors, 78 per cent are MUDRA debtors and 68 per cent are girls debtors. Round 6.25 crore workers have been benefitted below this scheme, they added.

The scheme received talked about within the World Growth Report 2022 by the World Financial institution. It was mentioned that the true price of those ensures to the federal government will solely grow to be clear in the long run. Though India’s financial restoration from the primary waves of the pandemic has been remarkably sturdy and the speedy fiscal affect of credit score assure schemes is low, credit score ensures at all times carry the danger of turning right into a legal responsibility for the federal government if an financial downturn causes mortgage defaults to rise.

A report by SBI launched final yr confirmed that at the very least 14.6 lakh MSMEs accounts had been saved attributable to ECLGS. In absolute phrases, MSME mortgage accounts value ₹2.2-lakh crore improved since inception of ECLGS for total banking business. Which means round 12 per cent of the excellent MSME credit score has been saved from slipping into NPA due to the ECLG scheme and thus saving livelihood of 6.6 crore.

#complete #3.68lakh #crore #loans #ECLGS #unhealthy #money owed