In an interview just a few many years again, Warren Buffett famous that the one greatest measure of the place valuations stand at any second was the ratio of market capitalisation of all listed securities as a proportion of GNP. This has subsequently grow to be well-known because the Buffett Indicator. Since in lots of circumstances there is no such thing as a important distinction between GNP and GDP, the market capitalisation by GDP is extra generally used. Consider it like the value/gross sales measure at a rustic degree (though EV/Gross sales is a extra appropriate metric).

This isn’t an ideal metric, as not all corporations are listed and in a rustic like India there’s a massive unorganised sector as nicely; however it has largely confirmed to be very helpful. historic numbers at a country-level in addition to globally throughout nations offers a great way to gauge whether or not markets are costly or low cost.

In response to Buffett, within the context of the US financial system, if the share relationship falls to the 70-80 per cent ranges, it’s time to purchase. If the ratio approaches 200 per cent because it did in 1999-2000 through the dotcom bubble, buyers had been ‘enjoying with fireplace’. To this point this view of his has performed out nicely. The 83 per cent crash within the Nasdaq 100, when the dotcom bubble burst after US market cap/GDP touched 190 per cent, stays one of many worst crashes within the historical past of markets. In current instances, when the US market/GDP reached round 200 per cent by finish 2021, a painful crash performed out in 2022.

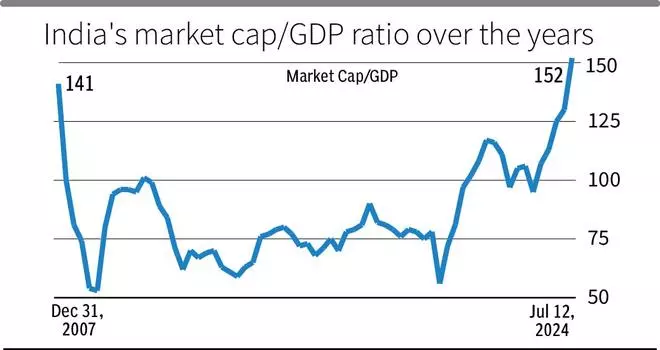

In India, the quantity is at 152 per cent immediately and better than the 141 per cent it touched in end-December 2007. Measured on a quarterly foundation, the ratio has ranged between a low of 53 per cent in March 2009 and a excessive of 152 per cent. The final 15-year common is at 85 per cent.

So, do present ranges suggest that valuations are costly? Trying on the historic pattern in India and for different massive economies the world over, sure. In Germany, the ratio is at 50-60 per cent. Within the UK, it’s round 90 per cent. In Japan, it’s near 150 per cent, and it might be price noting that the final time it reached round this degree in 1989, the crash was so brutal it took an entire 34 years for the Nikkei 225 to claw its manner again to 1989 ranges!

The US is again at near 200 per cent after recovering from the 2022 crash, and now we have to attend and see what occurs from right here.

Why can’t the ratio maintain rising?

Easy. For the ratio to maintain transferring up, progress in investor wealth should exceed the expansion of companies in a rustic. This can not go on eternally.

For instance, let’s see how the ratio has performed out in India, within the final 10 years. Over this era, whereas market capitalisation of all listed shares has grown at a CAGR of 17 per cent, nominal GDP has grown at a CAGR of round 10 per cent. The ratio has already elevated from 76 per cent in July 2014 to 152 per cent now, implying progress in investor wealth has far exceeded progress in companies.

Additional, Buffett notes in his annual newsletters: ‘In a finite world, excessive progress charges should self-destruct. If the bottom from which the expansion is going down is tiny, this legislation might not function for a time. However when the bottom balloons, the get together ends: A excessive progress fee ultimately forges its personal anchor.’

He goes on to elucidate with an instance of how just a few tiny organisms weighing a lot lower than a gram reproduce by dividing each quarter-hour. If this continues uninterrupted, in just a few days these organisms will weigh greater than the Solar! And earlier than lengthy will engulf the complete universe. However this doesn’t occur as a result of some impediment will all the time impede this sort of exponential progress. Utilizing this as a logic, he explains within the yr 1990 why Berkshire wouldn’t be capable of repeat its previous progress efficiency, given its bigger dimension and scale.

Thus, if the identical pattern in market cap progress and GDP progress had been to repeat for the following 10 years in India, by 2034, the market cap to GDP ratio in India might be at 277 per cent! If markets had been to develop at 12 per cent CAGR, the ratio will find yourself at 180 per cent.

That is one cause why it is advisable to get cautious if you hear targets like Sensex at 1,60,000 in 5 years, which requires a 15 per cent CAGR, or Indian market capitalisation at $10 trillion by 2030, which requires a 12 per cent CAGR.

Not that these are inconceivable, however the hurdles to realize these are substantial when the market cap/GDP ratio is the place it’s now. Larger nominal GDP progress fee than in earlier decade or continued progress in company earnings as a proportion of GDP, and the market cap/GDP ratio not declining a lot from present ranges are required to realize these targets.

#Buffett #Indicator #View #Longterm #Sensex #Targets #Warning