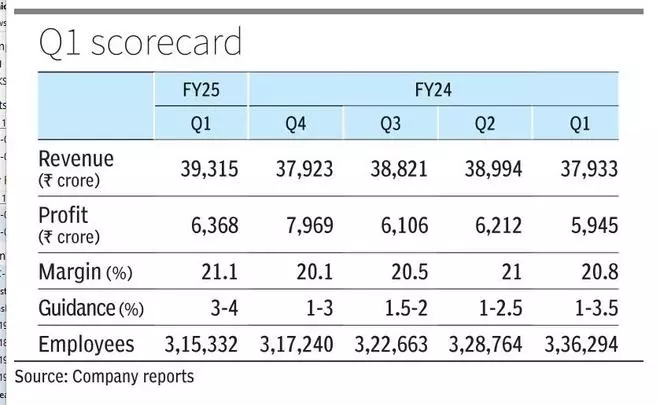

In Q1FY25, income stood at ₹39,315 crore, a rise from Q4FY24’s income of ₹37,923 crore. In the identical quarter final fiscal, the corporate’s income was ₹37,933 crore, a development of two.5 per cent YoY in CC phrases.

One-time curiosity

The online revenue for the quarter stood at ₹6,368 crore, a decline of 20.1 per cent from This fall’s ₹7,969 crore. The decline in web revenue was as a consequence of a one-time curiosity on an revenue tax refund included in ‘Different revenue’ within the fourth quarter of the earlier monetary yr, amounting to ₹1,916 crore. Nevertheless, revenue after tax (PAT) rose by 7.1 per cent from ₹5,945 crore in Q1 of the final fiscal.

“Sturdy deal pipeline, enchancment in key markets, and up to date acquisition are constructing the arrogance for us to up the steering. Our efficiency in Q1 was robust on volumes, and monetary companies within the US are seeing early indicators of enchancment. Sturdy efficiency on the massive offers entrance within the first quarter offers extra visibility into this monetary yr; the in-tech acquisition additionally helps us on this steering,” stated Salil Parekh, CEO and MD of Infosys. “With our targeted method for generative AI for enterprises working with their knowledge units on a cloud basis, now we have robust traction with our purchasers. That is constructing on our Topaz and Cobalt capabilities.”

The corporate claimed that the variety of massive deal wins this quarter was its highest ever at 34 with the entire contract worth (TCV) being $4.1 billion. Nevertheless, TCV for the final quarter stood at $4.5 billion.

Working margins for the quarter stood at 21.1 %, with a development of 0.3 % yoy and 1 % q-o-q. Working margin steering, even for FY25, has been retained at 20-22 %.

Jayesh Sanghrajka, CFO, stated, “We had 80 bps coming from challenge Maximus – a margin enlargement program, on the again of higher pricing, value-based promoting, and higher advantages from effectivity. 40 bps was from a one-off profit from one of many purchasers.”

Hiring plan

Infosys’ complete headcount fell by 1,908 workers to three,15,332, from 3,17,240 final quarter. Within the first quarter of FY24, the headcount was 3,36,294, a discount of 20,962 workers since. Voluntary attrition through the quarter rose to 12.7 per cent from 12.6 per cent in This fall. “Our utilisation is already at 85 per cent, and now we have somewhat headroom left, in order we begin seeing development, we are going to take a look at hiring. We’re hiring 15,000-20,000 freshers this yr relying on the expansion,” the CFO stated.

About 58.9 per cent of Infosys’ income got here from North America, with a contribution of three.1 per cent from India, a rise from final quarter’s 2.2 per cent. So far as verticals are involved, Infosys has proven development within the BFSI sector. The retail and communication sectors observe behind when it comes to income share.

Biswajit Maity, senior principal analyst at Gartner, stated, “Regardless of varied microeconomic challenges and discretionary spending from purchasers, Infosys’s total outlook stays optimistic as its deal pipeline stays good. A 3.6 per cent improve QoQ is a robust indicator of its efficiency. We’ve constantly highlighted that this yr will deliver development. IT service patrons might be cautious with spending and concentrate on robust enterprise outcomes. Organisations will fastidiously method new initiatives within the first half of 2024, anticipating a greater setting later.” He added that over the previous few years, Infosys has efficiently attracted an growing variety of massive offers by an efficient large-deal pursuit technique. Important deal wins in FY24 are anticipated to drive income development in FY25.

Commenting in regards to the outcomes, Shaji Nair, Analysis Analyst at Sharekhan by BNP Paribas stated, “Infosys 3.6 per cent quarter-on-quarter income development in fixed forex, surpassing estimates led by broad-based development throughout verticals, whereas the EBIT margin expanded by 100 foundation factors aided by Challenge Maximus, additionally beating expectations. Notably, the corporate is experiencing early indicators of enchancment in monetary companies within the US which augurs properly for the inventory. The robust Q1 numbers and upward steering revision is prone to result in an upward revision in earnings estimates.”

in-tech purchase

In the meantime, the corporate stated it had additionally accomplished the acquisition of in-tech, a number one engineering R&D companies supplier targeted on the German automotive trade which it had introduced in April of this yr.

Shares of the corporate have been up 2.2 per cent larger through the day and closed at ₹ 1,764.05 per share on BSE, regardless that outcomes have been introduced post-market closure.

#Infosys #beats #expectations #robust #efficiency #ups #development #steering