But, the Funds did not make a big-bang. Ideally, it ought to have been gift-wrapped with some tax goodies for the vociferous middle-class, which has felt omitted with real causes. A small improve in the usual deduction and different measures that add as much as a saving of ₹17,500 each year in tax doesn’t qualify as a present. Nor do reforms within the evaluation course of.

What’s extra, Sitharaman took on traders along with her proposal to extend the capital positive aspects tax on equities and the securities transaction tax (STT) on derivatives buying and selling. Little surprise that the markets nose-dived within the speedy aftermath of the Funds presentation earlier than recovering later within the day. The STT transfer is well-intentioned, although by itself it can’t rein in speculators.

Fiscally tight

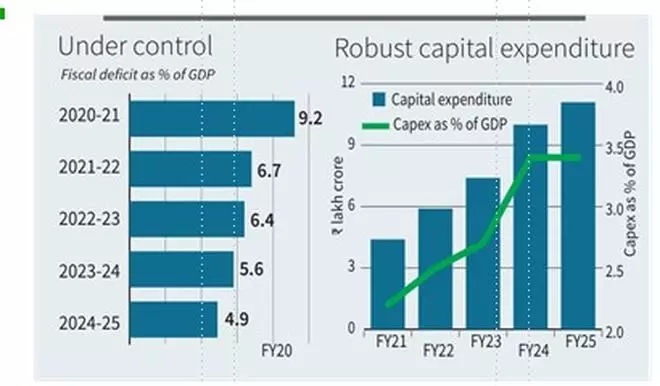

The most effective factor about this Funds is its fiscal conservatism. At 4.9 per cent of GDP, the projected FY25 fiscal deficit shall be virtually half of what it was simply 4 years in the past — 9.2 per cent in FY21. This can be a huge pull-back and the hassle that went into this can’t be overestimated. Fiscal consolidation has grow to be second nature to this authorities, but that doesn’t fetch it the brownie factors as a result of the stance is taken without any consideration.

Whether or not it’s the 10.83 per cent rise assumed in gross tax revenues or the ten.5 per cent nominal GDP development assumption, they’re conservative and plausible. The trouble to rein in expenditure has been helped by decrease subsidies for urea, meals and petroleum, all on the again of decrease costs.

And, in fact, the good-looking ₹2.11 lakh crore dividend from the RBI got here in helpful, too. Part of it could have been used to cut back borrowings — gross borrowings are projected down by ₹1.42 lakh crore in comparison with the Revised Estimates of FY24 — whereas the steadiness could fund income expenditure. It’s now over to the rankings companies which were doing a poor job on India until now.

Even supposing we’re already 4 months into the fiscal yr, the Finance Minister has caught to the capital expenditure of ₹11.11-lakh crore proposed within the Interim Funds.

To Spur jobs

To incentivise job creation, the Funds proposes three novel employment-based incentives. Probably the most attention-grabbing of those is a direct switch of 1 month’s wage as much as ₹15,000 in three instalments to first-time staff incomes as much as ₹1 lakh month-to-month wage and registered with the EPFO. By one other proposal, the federal government will reimburse employers as much as ₹3,000 monthly for two years for the EPFO contribution of each extra worker they recruit. After which there may be the scheme for offering a 12-month internship within the high 500 firms to 1 crore youth in 5 years. These are novel concepts and their success will depend on whether or not firms chunk.

Leg-up for MSMEs

Sitharaman has proposed a credit score assure scheme for MSMEs that may allow them purchase plant and equipment with out collateral.

Working on the mechanism of pooled threat, the scheme will supply assure cowl of as much as ₹100 crore for borrowings, from a self-financing assure fund. Whereas the mechanics of the scheme seem good, its working will must be watched.

Key beneficiaries

Bihar and Andhra Pradesh (AP), as anticipated, got here in for particular consideration within the Funds with a slew of proposals benefiting them. Whereas AP obtained important help for its capital metropolis and Polavaram initiatives, Bihar has been showered with funds for varied actions starting from flood mitigation to highways building and spiritual tourism.

In the end, Sitharaman’s seventh Funds shall be remembered for this and the capital positive aspects tax rationalisation.

#Sitharaman #presents #BAP #Budgets