As per the framework, a financially unsound and ill-managed UCB may be introduced below PCA if it breaches the chance thresholds of recognized indicators pertaining to capital and profitability (web revenue).

Presently, there are round 1,500 UCBs within the nation. RBI classifies UCBs as Tier-I (deposits as much as ₹100 crore); Tier-2 (greater than ₹100 crore and as much as ₹1,000 crore); Tier-3 (deposits greater than ₹1,000 crore and as much as ₹10,000 crore); and Tier-4 (above ₹10,000 crore). Tiers 2 to 4 come below the higher Tier.

RBI stated the target of the PCA Framework is to allow supervisory intervention at an applicable time and require the UCBs to provoke and implement remedial measures in a well timed method, to revive their monetary well being.

The provisions of the PCA Framework will likely be efficient from April 1, 2025.

- Additionally learn: RBI doubles UCB gold mortgage restrict to ₹4 lakh

Threat thresholds

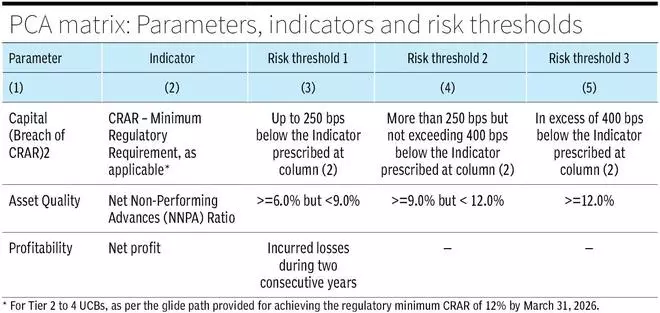

RBI has prescribed three danger thresholds for invoking PCA for breach of CRAR (10 per cent as of March-end 2024, 11 per cent as of March-end 2025 and 12 per cent as of March-end 2026) under the regulatory minimal – as much as 250 foundation factors (bps); greater than 250 bps however not exceeding 400 bps; and greater than 400 bps.

Within the case of NNPAs, too three danger thresholds have been prescribed – larger than or equal to six per cent however under 9 per cent; larger than or equal to 9 per cent however under 12 per cent; and larger than or equal to 12 per cent.

Within the case of profitability, RBI has prescribed just one parameter “incurred losses throughout two consecutive years” for breach. In SAF too this was this parameter was prescribed.

Vinayak Y Tarale, Knowledgeable Director, Maharashtra State Co-operative Banks’ Affiliation, noticed that the RBI’s transfer on PCA is welcome as a number of the UCBs could possibly come out of their financially weak place as a result of rigour of actions anticipated to be taken by them. He stated there are hardly any situations of the SAF making any UCB complete.

Relying on the chance threshold {that a} UCB is categorised below, the actions to be taken by them embody requiring them to boost capital; restriction on declaration/ fee of dividends/donations and applicable restrictions on capital expenditure, apart from for technological upgradation.

Additional, they should prohibit department enlargement and curtail enlargement in whole measurement of deposits.

The Central Financial institution might also require these banks to activate an motion plan accredited by it; undertake an in depth overview of the enterprise mannequin when it comes to sustainability, the profitability of enterprise traces and actions, medium and long-term viability, and so forth.; prohibit enlargement of the scale of the steadiness sheet.

Additional, a UCB might must discover merger choices if steps taken by it don’t seem like yielding the specified outcomes; search a Board-approved proposal for merging the UCB with one other financial institution or changing itself right into a credit score society.

#RBI #introduces #PCA #framework #enhance #monetary #well being #UCBs