Are you confused as to who is correct? Give the whole lot that you just see and listen to a cross. The issue with the examples which have been shared is that, normally, solely particular cases are proven. However every of our conditions could also be distinctive. Completely different individuals would have purchased properties at completely different closing dates and had completely different ranges of appreciation on their property. Some would have held property just for years, some for many years and a few would have inherited properties purchased one or two generations earlier than. The one factor widespread is the speed of inflation or indexation.

- Additionally learn: Price range 2024: The way to go about your fairness, debt and gold investments submit tax modifications

Do the maths your self

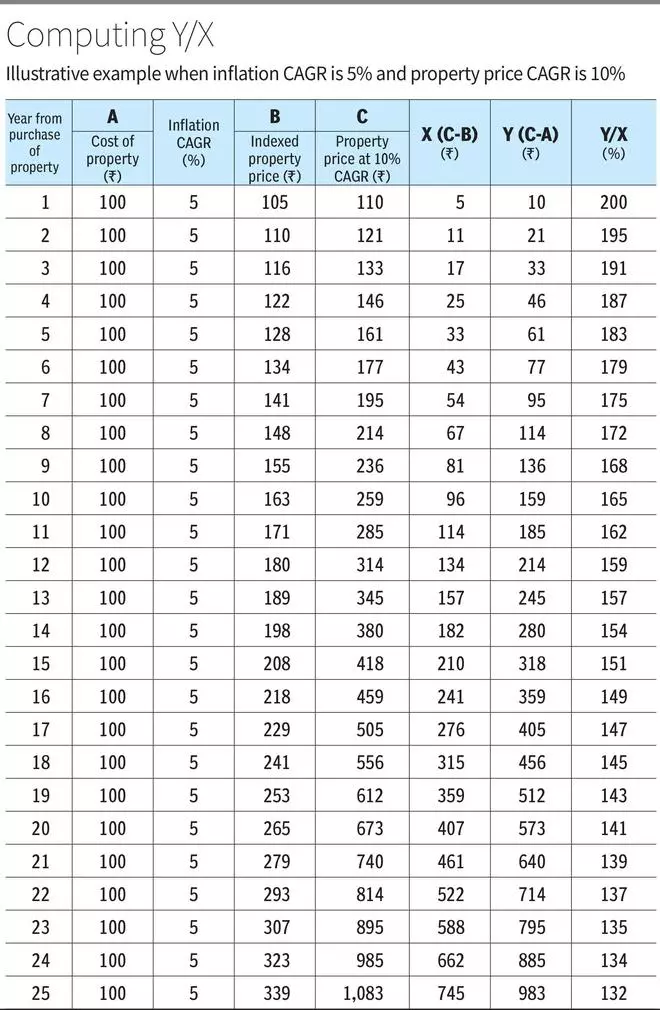

So, to maintain it easy, do the maths your self, utilizing two easy variables X and Y.

Let X right here symbolize the capital positive aspects submit indexation. The tax on capital positive aspects submit indexation was 20 per cent.

Let Y symbolize the capital positive aspects with out indexation. The Authorities has now proposed capital positive aspects tax on this at 12.5 per cent.

Whether or not this new tax is nice for a taxpayer could be confirmed from a easy equation, which is:

When 12.5Y < 20X, ie if 12.5 per cent upon Y is lesser than 20 per cent upon X, then this new tax proposal is helpful to you. You’ll now pay much less tax in these cases.

The above equation could be additional simplified to Y/X <20/12.5 or Y/X < 160 per cent

What does this imply in easy English? So long as capital positive aspects with out indexation is lesser than 160 per cent of capital positive aspects with indexation, you’ll pay much less taxes now. It’s the similar property bought on the similar worth. So solely distinction between X and Y will depend on the extent of inflation.

Observe the three vital components right here – one, the decrease the X, the upper the probabilities that Y/X will have a tendency to extend above 160 per cent; two, the upper the inflation relative to progress in property costs, the decrease X can be; three, if X is damaging, ie if cumulative inflation is increased than capital positive aspects, then this equation doesn’t apply.

The 2 tables clarify how this works. Desk 1 provides an illustration of how Y/X will development when annualised inflation is 5 per cent and annualised progress in property costs is 10 per cent. Inflation assumed right here at 5 per cent is the higher finish of the 4-5 per cent generic vary of indexation for inflation as identified by the Revenue Tax Division. That is additionally one per cent above the RBI’s inflation goal of 4 per cent.

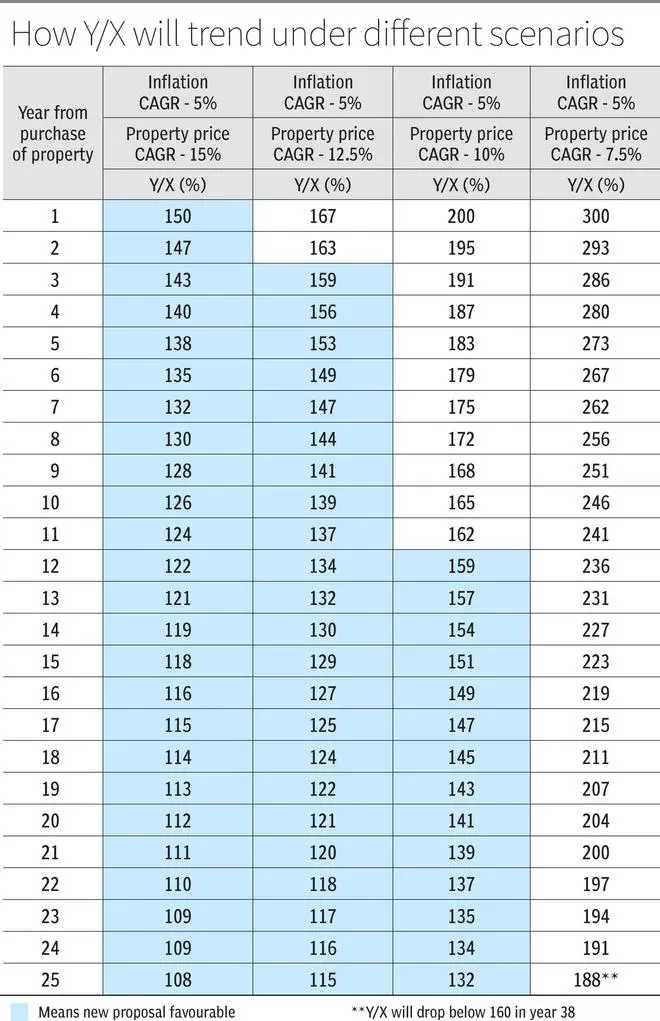

Desk 2 provides an illustration of how Y/X will development underneath completely different eventualities. In any state of affairs, the 12 months wherein Y/X drops beneath 160 per cent, is the 12 months from which the brand new tax proposal will work out higher for you.

Desk 1

Desk 2

Two easy takeaways

1) Larger the property worth appreciation over inflation, decrease can be your taxes now. So in the event you had bought previous to the beginning of the property growth in 2003-04, the brand new proposal can work to your benefit. So will it, if you’re inheriting ancestral property.

2) The longer your holding interval, the extra helpful is the brand new proposal. So long as property worth CAGR is above inflation CAGR, Y/X will are likely to beneath 160 per cent. After all, if the distinction could be very small, then it can take a really very very long time. By which case, the purpose to ponder is why ought to anybody purchase property as an funding if its outperformance over inflation goes to be very marginal?

On the whole, property, being an actual asset with restricted provide, tends to outperform inflation by a great margin in the long term. This makes the brand new actual property capital positive aspects tax proposal a great deal for long-term buyers. If you’re such an investor and never a speculator, you possibly can welcome this new proposal.

3) In circumstances the place the property worth CAGR has underperformed inflation or outperformance is just marginal, and the brand new tax proposal is unfavourable, then the genesis for that drawback lies both in a poor or unfortunate funding choice.

#Idea #Realty #Capital #Features #Tax