Right here you will need to notice that since the index is predicated on free-float market cap, the very best performing shares might not essentially have been the drivers of this 5,000 level rally. Index motion is a operate of inventory value change in addition to the load of the inventory within the index. So, we analysed which corporations contributed probably the most to this upside and which didn’t on each these elements.

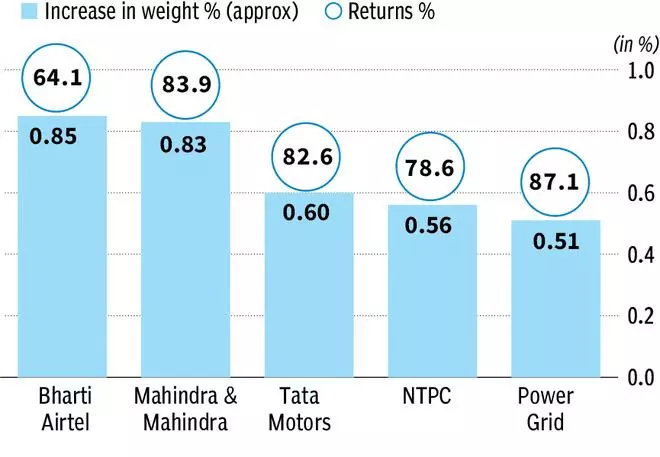

High 5 drivers of the index primarily based on enhance in weights

Bharti Airtel has powered the index probably the most with the best enhance in weight in index on this run up, adopted by Mahindra & Mahindra. When shares outperform the index, their weights will enhance.

Bajaj Auto on prime gear

By way of absolute efficiency, Bajaj Auto was the highest performer, although it was not the most important driver of the index. This is because of its comparatively decrease weightage in index. The respective enhance in weights for the highest 5 gainers had been 40 bps, 23 bps, 36 bps, 51 bps and 41 bps respectively.

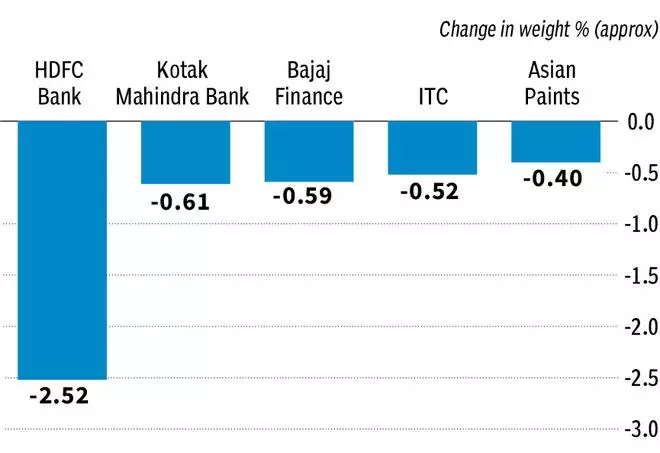

Heavy weight HDFC Financial institution lags the index

HDFC Financial institution led the pack of laggards, despite the fact that it hasn’t given adverse returns throughout this era. It has traded flat whereas Nifty 50 has moved up 25 per cent. Consequently, its weight within the index has taken a success.

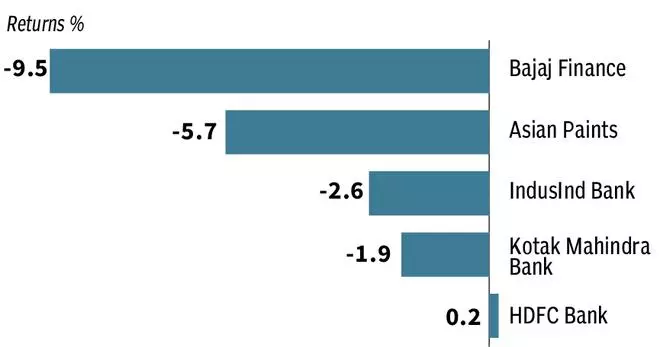

High 5 losers

By way of absolute inventory returns, Bajaj Finance was the worst performer, although it didn’t see the utmost discount in weights.

Observe: For this evaluation, UPL is excluded as it isn’t a part of Nifty 50 now. Change in weights primarily based on constituent weights as of August 2023 and factoring for share value modifications from Nifty at 20,000 to Nifty at 25,000. Value efficiency is for the interval September 13, 2023 – August 1, 2024.

#Mount #Shares #fuelled #Niftys #surge