We advocate that traders accumulate the inventory after being attentive to features comparable to dilution, debt compensation targets, synergy advantages and consolidated earnings development prospects, publish the acquisition. The inventory is buying and selling at 31 instances FY26 earnings, driving on its branded formulations development momentum, which may maintain if the acquisition advantages play out as anticipated.

Base enterprise

Mankind operates three segments, Home (84 per cent of revenues in Q1FY25), Client Well being (7 per cent) and Exports, primarily to the US (9 per cent). Development prospects within the three segments are robust.

Persistent prescriptions’ share in home gross sales has elevated to 37 per cent, from 35 per cent final 12 months. This improves profitability, income stickiness and general development, in comparison with acute therapies. The product combine change has supported a big a part of the 200 bps QoQ gross margin enchancment to 71.9 per cent in Q1FY25. Within the final 5 years, the diabetes, cardiology, urology, neurology and respiratory segments have ramped up, owing to the power focus of Mankind.

The Panacea Biotec acquisition (₹1,800 crore) in FY23 opened the transplant section, and the corporate has been in-licensing priceless therapies, together with Symbicort from Astra Zeneca, and now Inclisiran, Vonoprazan, Neptaz within the final 12 months, which can assist an extra improve in power share. The section reported 14 per cent YoY development in FY24.

The Client Healthcare division was revamped in FY24, which held again development to 2 per cent YoY. The revamped construction is anticipated to generate 12-15 per cent development in FY25. Exports recorded 175 per cent development in FY24, which can have a portion of one-time demand from product shortages within the US. However given the nascent stage, the section needs to be anticipated to ship excessive development.

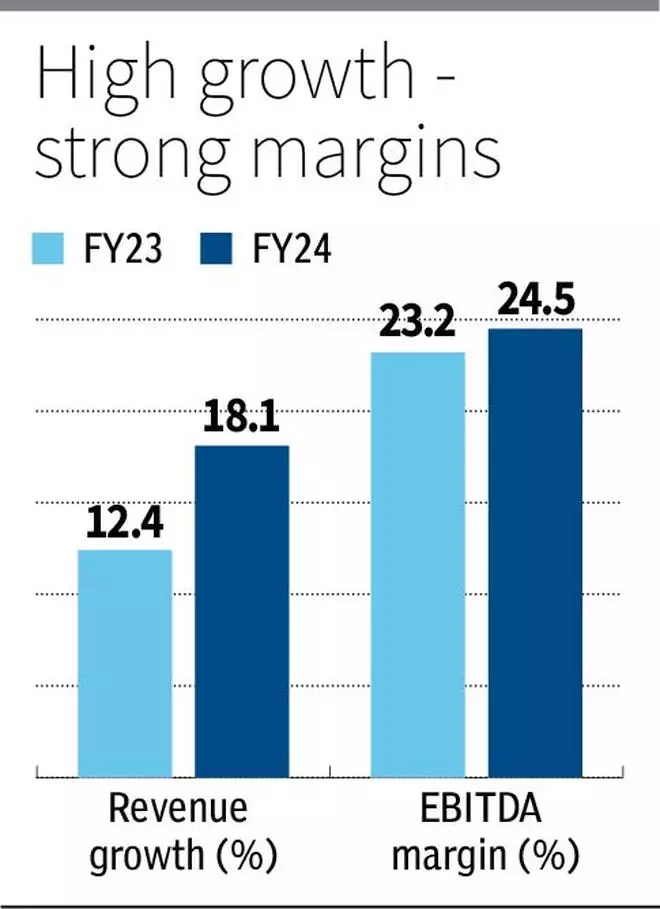

General, the income development in FY24/Q1FY25 has been 18/12 per cent YoY. The branded formulation-focused portfolio in home markets, with robust worth development potential, together with new product introduction and quantity development, can maintain Mankind’s income momentum. The corporate has a robust subject pressure of 16,000 within the nation, however with a per thirty days productiveness of round 6.5 lakh, in comparison with Torrent Pharma’s greater than 8 lakh productiveness. A bigger power portfolio, together with physician and hospital entry, would additional enhance Mankind’s productiveness, which it’s striving for.

BSV acquisition

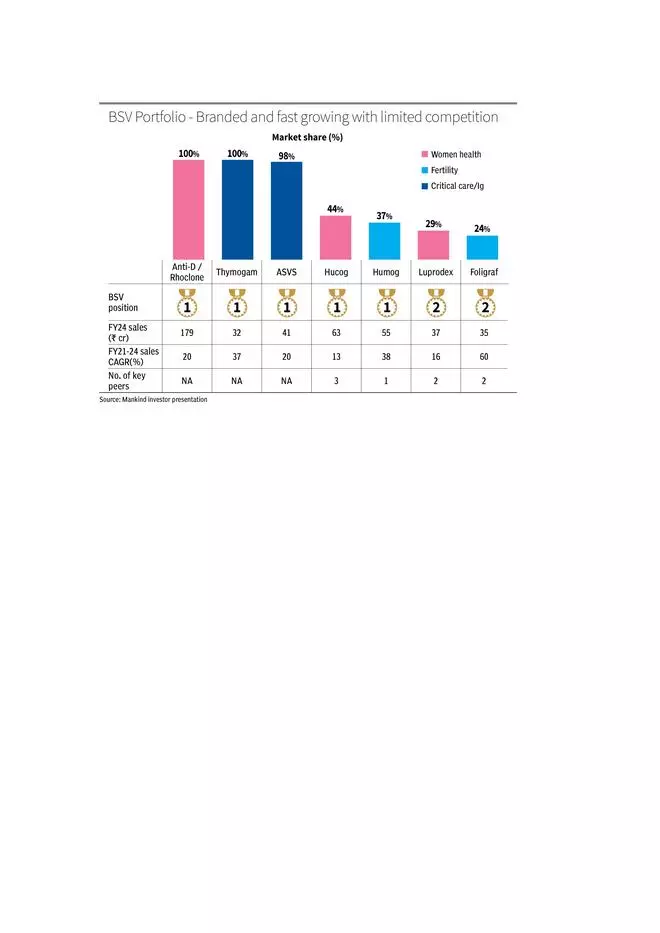

BSV operates within the ladies and infertility care segments with a distinct segment portfolio of merchandise, together with a patented product (patented until 2028). The goal firm provides R&D capabilities in recombinant expertise, area of interest biologics, immunoglobins, and sophisticated supply techniques. This opens the gynaecology section to Mankind, and propels it to main standing within the remedy.

The merchandise even have a excessive entry barrier, with just one or two opponents, in comparison with 40-50 in different therapies. BSV additionally has 46 per cent revenues from worldwide markets (the Philippines, Malaysia and 15 different international locations), that are ramping up gross sales. BSV reported 20 per cent YoY development in FY24, as a lot of the merchandise are within the ramping-up stage, with 15-60 per cent CAGR within the final three years..

BSV’s excessive growth-niche portfolio is a win-win proposition. Mankind can leverage its large gross sales pressure to speed up development. The super-specialty space of gynaecology, infertility medical doctors and hospitals serviced by BSV might be cross-leveraged for Mankind’s base enterprise portfolio. The pipeline for BSV additionally contains 12 extra merchandise which might be a part of the acquisition, together with dossiers filed and to be filed in BSV’s worldwide enterprise.

Monetary implications

The acquisition is at a premium, which can restrict EPS accretion from the deal within the subsequent two years. BSV Pharma reported FY24 income of ₹1,723 crore and adjusted EBITDA of ₹489 crore or 28.4 per cent EBITDA margin. This means an EV/EBITDA of 27 instances, which is analogous to Mankind’s present valuation. That is itself at a premium-to-industry common of 25 instances for the large-caps. The premium paid will restrict EPS accretion by curiosity prices, dilution in fairness, and amortisation of intangible property (non-cash).

Of the ₹13,630 crore, ₹4,000 crore is anticipated from inside accruals, ₹6,700 crore from debt, and ₹2,900 crore from fairness elevate, in response to preliminary expectations. The curiosity part (₹500-700 crore each year), the three per cent fairness dilution, and ₹400-₹600 crore of amortisation per 12 months will greater than offset the positive aspects, initially.

On a tough calculation, the pre-deal anticipated FY26 EPS of ₹63 for Mankind could, at greatest, be matched by post-deal adjusted EPS (adjusted for amortisation). However traders ought to look to future synergies from the deal. The margin growth from the patented/ branded/ excessive entry barrier portfolio, together with under-development merchandise and cross-leveraging portfolio throughout therapies (acute/power) and worldwide market attain, can propel Mankind’s present strengths in the long run.

#Mankind #Pharma #Inventory #Submit #Bharat #Serums #Vaccines #Acquisition