Additional, the presence of Reliance Industries (through Reliance Retail Ventures) as the most important shareholder within the firm (63.84 per cent) was an incremental constructive when it comes to scope for synergies with Reliance’s long run e-commerce plans.

After the latest upside, a lot of the positives talked about above proceed to stay intact. In truth, valuation is cheaper right now at round 17 instances EV/EBITDA (one-year ahead) versus 22 instances in February 2022. Working efficiency has improved properly within the final two years on the again of excellent execution by administration and the momentum is predicted to maintain.

Whereas synergies with Reliance’s e-commerce enterprise haven’t picked up a lot, the potential stays. Additional, the steadiness sheet stays considerably strong with internet money in its books at 44 per cent of present market cap. The incrementally constructive information with regard to its sturdy money place is that administration in its latest earnings name introduced that they’re having inner discussions together with the board on plans for distributing (dividends/buybacks) to shareholders of no less than 100 per cent of annual income.

If applied, this might be a key catalyst for the inventory. For a perspective, primarily based on trailing twelve-month EPS the yield can be 3 per cent, whereas primarily based on FY25 EPS estimates it really works out to shut to five per cent. Whereas it’s unclear on when a choice can be made, given the uncertainty on how firm plans to make use of surplus money has weighed on valuations, it is a key side to look out for.

General, with most positives intact, traders can proceed to build up on dips. We favor small accumulations over a time frame reasonably than a lumpsum purchase given the uncertainties associated to world markets which will trigger some volatility in Indian shares as effectively, particularly within the case of small-cap shares.

Enterprise

Simply Dial is the most important native search engine in India, with providers spanning over 11,000 Pin Codes in 250+ cities throughout the nation. Its pan-India presence helps join companies and customers throughout India. It gives data associated to localised providers to customers in India by a number of platforms (cell/desktop/phone) and is well-established within the digital ecosystem within the nation.

With a protracted observe document within the native search enterprise, Simply Dial has a big database with almost 45 million listings, consisting primarily of MSMEs (micro, small and medium enterprises).

By way of its core aps JD App (enterprise discovery and opinions), JD Rankings (verified scores of SMEs/MSMEs), JD Enterprise (managing enterprise listings with worth added options), JD Mart (B2B market place), and JD Analytics (insights on buyer engagements and valued added providers), the corporate gives providers encompassing a number of sides which are helpful to MSMEs. A few of these are well-developed, whereas firm is focussing on bettering mining of shoppers with different providers.

At current, bulk of the income of the corporate comes from SME subscription packages, that are pre-paid in nature and therefore with out assortment dangers. Whereas it permits free listings, primarily based on the subscription bundle, SME/MSMEs can profit from options equivalent to precedence placement and better visibility in searches.

Current efficiency

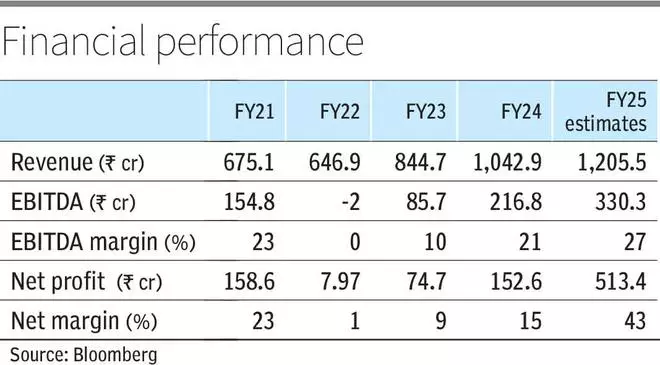

On condition that SME/MSME sector varieties the fulcrum of the corporate’s enterprise, the gradual restoration within the sector submit a success throughout Covid-impacted years, has mirrored in enchancment in its monetary and working efficiency. This, and enchancment in execution and price controls, have been incremental positives boosting profitability.

Person engagement when it comes to distinctive quarterly guests, energetic listings, and scores/opinions has constantly improved in latest quarters (see chart). Monetary efficiency has additionally improved properly in FY23 and FY24 after a success in FY22.

Within the just lately reported June quarter outcomes, income was ₹280.6 crore, up 13.6 per cent Y-o-Y and EBITDA of ₹80.6 crore, up 119.8 per cent Y-o-Y. EBITDA margin at 28.7 per cent was up by a strong 13.8 per cent Y-o-Y. Web revenue at ₹141 crore was up 60 per cent Y-o-Y. The latest quarterly efficiency re-affirmed the development of constant enchancment, quarter after quarter, within the firm’s efficiency.

#Dial #Traders #Keep #Linked