- Additionally learn: India Inc seeks a simplified capital good points tax regime

Within the Funds, Finance Minister Nirmala Sitharaman shifted the earnings tax legal responsibility on share buybacks from firms to shareholders.

The Board of 13 firms have met after the Funds announcement and proposed to purchase again shares value ₹4,572 crore.

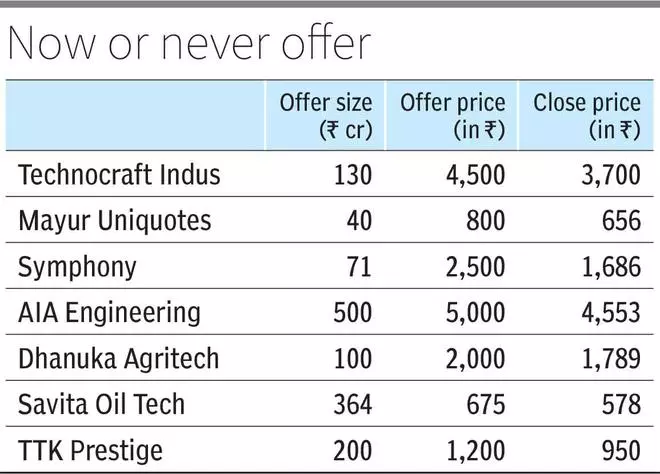

Indus Tower leads the pack with a suggestion of ₹2,640 crore adopted by AIA Engineering and Savita Oil Tech which can buyback shares value ₹500 crore and ₹364 crore, respectively.

Cera Sanitaryware has supplied to buyback shares at a premium of 19 per cent at ₹12,000 a bit towards Friday’s shut of ₹10,108.

- Additionally learn: Take away buyback tax on inventory buys by way of open market: India Inc to FM

Windfall for Govt

Per the present guidelines, firms endeavor share buybacks are topic to a 20 per cent tax and will probably be tax-free within the fingers of shareholders.

Nevertheless, come October, your complete quantity obtained by shareholders from buybacks can be handled as dividend earnings and taxed in keeping with their respective earnings tax slabs. The accountability for withholding tax lies with the corporate.

The transfer can be a windfall for the Authorities because the tax assortment can go as much as 39 per cent. Consultants consider that the brand new buyback tax is disproportionately greater than long-term capital good points tax of 12.5 per cent and short-term capital good points tax of 20 per cent, which apply when shares are bought to different consumers.

Manish Chowdhury, Head of Analysis, StoxBox, mentioned extra cash-rich and low leveraged firms with predictable money flows in future are anticipated to hitch the share repurchase bandwagon.

He added that IT sector firms, given their robust stability sheets and comparatively subdued inventory worth actions, are prime candidates to make the most of the altering taxation state of affairs and are prone to be on the forefront of share buybacks.

Satish Menon, Govt Director, Geojit Monetary Companies, mentioned the brand new guidelines will cut back non-retail traders participation in buybacks because the response will rely upon their particular person tax slabs. Nevertheless, he mentioned traders might reply positively for ongoing presents because it comes at a premium as a result of bullish market sentiments.

Narinder Wadhwa, Managing Director & CEO, SKI Capital Companies, mentioned the markets might even see a wave of buyback exercise in sectors resembling IT, pharma, FMCG, financials and vitality utilities with robust money positions and secure earnings. It’s important for traders to guage every buyback on its deserves, contemplating the corporate’s monetary well being and the potential long-term advantages of the buyback, he added.

#India #buyback #spree #Funds #tax #kickin