Within the final three years, each bulls and bears have been vindicated at completely different deadlines. Whereas the bulls initially received with the blockbuster itemizing, the bears had their time too, when the inventory cratered to only above ₹41 in July 2022, almost 75 per cent under its prior peak (November 2021) and 45 per cent under its IPO value.

Can the stellar returns exceeding 500 per cent within the final two years from the lows of July 22, be taken as a validation that bulls have convincingly received? It’s higher to order the ultimate verdict because the battle remains to be on, and the interplay of the next three components will proceed to maintain it ongoing for some time.

Income development

On this entrance, the decision is decisively in favour of the bulls. Since pre-IPO yr FY21, income (FY21-FY24) of Zomato has grown at a staggering CAGR of 82 per cent. After all, this consists of the good thing about inorganic development that concerned dilution for Zomato shareholders – the acquisition of Blinkit. However two components outscore this level. One, Blinkit has had a lot stronger development as soon as below the fold of Zomato and its contribution to income is predicted to turn into bigger than its meals supply enterprise few years down the road. Additional, the valuation at which Blinkit was acquired by Zomato in a share-swap deal, was round 10 per cent of Zomato’s then enterprise worth. Right now, the valuation for Blinkit enterprise in Zomato’s whole worth is north of fifty per cent. So the deal has labored remarkably in favour of Zomato traders, and in addition in favour of the bulls who had guess on aggressive development assumptions to justify the IPO and quick post-IPO valuation (when the inventory doubled).

Profitability

On this entrance, each the bulls and the bears have a fair proportion of the argument. What has labored for the bulls is that the corporate’s profitability metrics have improved in latest quarters after some disappointment early on after the IPO. The corporate achieved adjusted EBITDA profitability in Q1FY24 and has constantly improved since then. In Q1FY25, adjusted EBITDA profitability was at 6.6 per cent, a big enchancment from the -13 per cent in Q4FY21. It’s fairly clear the corporate is on a path to enhancing profitability.

However the bears, too, maintain some lever in the case of this level. From a long-term shareholder perspective, adjusted profitability shouldn’t be a comforting issue. Solely the earnings left after shifting down from adjusted EBITDA optimistic to normalised EBITDA to the underside line known as PAT belongs to them and displays the positive aspects they will harvest. On that entrance, Zomato reached normalised EBITDA profitability (Adjusted EBITDA – share-based compensation + leases paid pertaining to leases) in Q3FY24. To present a perspective of the distinction between the 2, for Q1F25 whereas adjusted EBITDA was at ₹299 crore, the normalised EBITDA was at ₹177 crore (margin at 3.9 per cent).

On the PAT entrance, whereas the corporate reported web revenue of ₹253 crore, it was fully pushed by different earnings (primarily curiosity/treasury earnings of ₹255 crore). Therefore, the online revenue attributable to its operation at the moment stays miniscule. Wanting forward, consensus estimates point out web revenue attributable to core enterprise will probably be round ₹2400 crore in FY26. That means Zomato is buying and selling at two-year ahead PE of round 95 instances — that’s, if the inventory stays flat for the subsequent two years, it is going to finish FY26 at a PE of 95 instances. Progress shares can commerce at excessive PE, however there’s one danger to issue. Consensus estimates point out web revenue margin will probably be at 9 per cent. That seems excessively optimistic in case you pay attention to the truth that the working margin for the massive and mature North American e-commerce enterprise of Amazon (income of $352 billion) is simply 4 per cent. It may be a tall ask for Zomato to realize the 9 per cent web margin by FY26. If web margin is as an alternative at 4 per cent by FY26, the FY26 PE of Zomato is 190 instances! General, the profitability targets assumed by bulls seem difficult and will disappoint.

Unbelievable parallel with Amazon

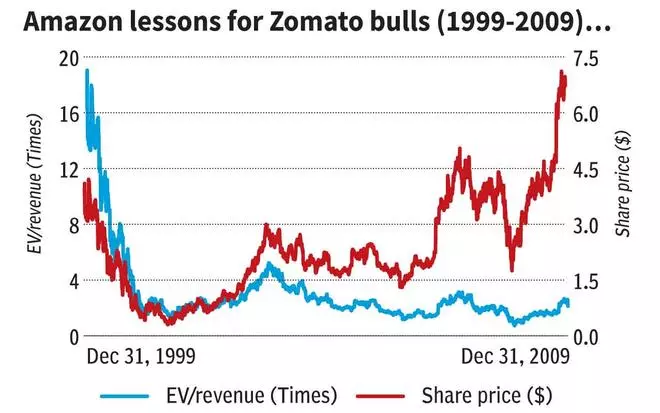

Zomato in a number of facets seems just like Amazon in 1999. Each corporations, early entrants within the e-commerce area, darling of traders, are rising at a staggering tempo in an business with lot of alternatives forward. However there’s another unbelievable similarity – Amazon in 1999 reported income of round $1.65 billion and had an enterprise worth of $27 billion (market cap of $26 billion). Zomato’s final 12-month income too is at $1.65 billion and has an enterprise worth of $26 billion (market cap of $27 billion). The EV/income valuation of Zomato in the present day is strictly just like that of Amazon in 1999.

How a lot Amazon has grown since then, everyone knows (enterprise worth of $2 trillion in the present day). However equally vital to grasp is the way it fared within the subsequent 10 years from 1999 to 2009. Its revenues grew at a staggering CAGR of 31 per cent. From zero web earnings in 1999, web revenue margins improved fairly considerably to three.8 per cent in 2009. But, the inventory CAGR over the identical interval was a mere 6 per cent — whereas income went up 1,385 per cent, the inventory went up solely 76 per cent! EV/income had shrunk from 16 instances in 1999 to 2.1 instances in 2009. And the a number of had shrunk to such low ranges, despite the fact that income was rising at round 30 per cent yr after yr. Wanting again at that 10-year efficiency and in addition the truth that the shares of Amazon crashed 90 per cent when the dotcom bubble burst, it’s fairly clear that the 16 instances EV/income a number of Amazon bought in 1999 was bubble territory valuation. But, traders who purchased at bubble valuations have been validated 20 years later.

So the place from right here for Zomato from its present 16 instances EV/income a number of? We will know 10 and 20 years later, however one can confidently say it is extremely costly and lots has to go proper for the subsequent 20 years for traders to make spectacular returns.

#Zomato #Inventory #Surge #Investor #Hype #Pure #Progress