As an illustration, MSIL reported home wholesales of over 1.4 lakh items in August, a year-on-year (YoY) decline of 8.35 per cent as in contrast with over 1.4 lakh items in the identical month final yr.

To handle sellers’ inventory ranges, the corporate mentioned it was lowering dispatches to regulate stock. This strategy can even present a clearer image of retail gross sales on the premise of the dispatches by the businesses.

We’re adjusting our dispatches barely and have diminished them by 13,000 automobiles this month, mentioned Partho Banerjee, Senior Government Officer – Advertising and marketing and Gross sales at MSIL.

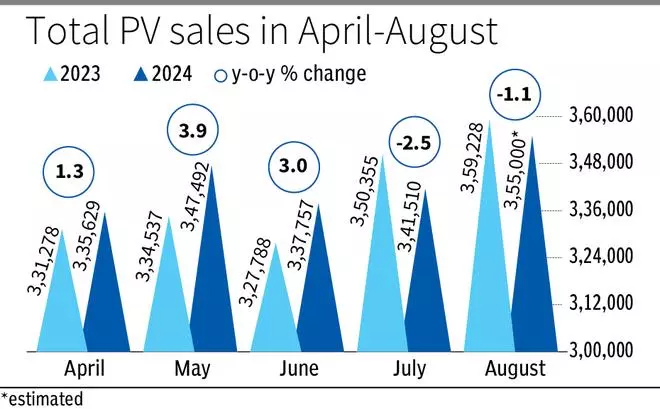

We estimate that the business whole must be round 3.50-3.55 lakh automobiles, in comparison with 3.60 lakh in August 2023, he added.

He mentioned the corporate’s retail gross sales was consistent with the wholesale figures and even barely exceeded them. Because of this, the corporate’s community inventory, which was 38 days in the beginning of August, had come all the way down to 36 days by the tip of the month.

The second largest PV maker, HMIL, too reported a decline of 8per cent YoY in its home gross sales to 49,525 items as in contrast with 53,830 items in August final yr.

‘Nexon’ maker Tata Motors additionally reported a decline of three per cent YoY in its home wholesales of 44,142 items in August as in contrast with 45,513 items in August 2023.

In response to sources, HMIL and Tata Motors have been managing their vendor networks’ inventory ranges in accordance with buyer demand.

“Within the present scenario, the provision chain is managed primarily based on the demand cycle and there’s no want for pointless inventory. However, sure because the festive season kicks in, certain quantity of shares must be there in order that the shoppers don’t have to attend for lengthy and miss their auspicious days to gather the vehicles,” a Delhi-based vendor instructed businessline.

In the meantime, Banerjee highlighted that evaluating August of final yr to this yr isn’t completely correct, because the festive season started in August final yr. This yr, the primary festivals are ranging from September.

“Final yr, Onam was on August 27-28-29. This yr, Onam is on September 16-17-18 and subsequently, it isn’t a like-to-like comparability. However, simply to share that in Kerala, if we examine the entire month this yr, we’re seeing a progress of seven per cent by way of bookings. Even the retail has been kind of identical because the final yr’s August,” he added.

Different firms are additionally hoping for a greater month by way of gross sales in September as the primary festive season kicks off with Ganesh Chaturthi and Onam.

“As we strategy the festive season, demand for our merchandise stays buoyant, and we’re already witnessing elevated shopper curiosity and better footfall throughout all our dealerships. Sports activities utility automobiles (SUVs) and multi-purpose automobiles (MPVs) proceed to considerably contribute to our gross sales numbers, reflecting a rising choice for these phase automobiles,” Sabari Manohar, Vice President, Gross sales-Service-Used Automobile Enterprise, Toyota Kirloskar Motor, mentioned.

The corporate reported a home wholesales of 28,589 items in August, a progress of 25 per cent YoY as in contrast with 22,910 items in August final yr.

Equally, Kia India and JSW MG Motor India additionally reported a progress of 19 per cent and 9 per cent of their gross sales respectively.

#clear #shares #automobile #majors #calibrate #dispatches #August